Bitcoin’s correlation to macro factors remains a hot topic as global monetary policies and the asset’s price slumped over the last month

Token Bay Capital founder and managing partner Lucy Gazmararian said in a CNBC interview Wednesday morning that Bitcoin (BTC) can move in tandem with the stock market.

The trend appears more evident as digital assets become entangled with traditional finance, Gazmararian noted. Analysts have marked a correlation between BTC and macroeconomics due to geopolitical uncertainty and global monetary policies like rate hikes or cuts employed by the U.S. Federal Reserve.

Reverse may also be the case in some scenarios since investors have historically treated Bitcoin as a “risk on” asset and a hedge against inflation. Gazmararian said the correlations sometimes break down as BTC fundamentally differs from other asset classes like bonds and equity.

Bitcoin top expected by late 2025

Despite BTC’s 9% drop in the past 30 days and U.S. inflation concerns, Token Bay Capital’s founder believes the Bitcoin bull run is only halfway through at most. Gazmararian pointed to past “four-year boom busts” noticed in crypto markets. In other words, the ongoing market retracement occurred in previous cycles, especially after the halving.

“10%, 15%, to 30% drops are really keeping with past cycles,” said Gazmararian. Data from BiTBO and TradingView showed slumps of as much as 40% following Bitcoin’s quadrennial code change, followed by parabolic runs to new highs.

According to the charts, BTC has never returned to its pre-halving prices after completing the transition. The managing partner from Token Bay Capital predicted that history could repeat itself, and if this pattern plays out, markets may see a Bitcoin top in late 2025.

Conversely, Gazmararian surmised that BTC’s continued bull run may be questioned if the asset value declines by more than 50% in the next few months. A 50% price dip would tumble Bitcoin under $32,000 at current levels.

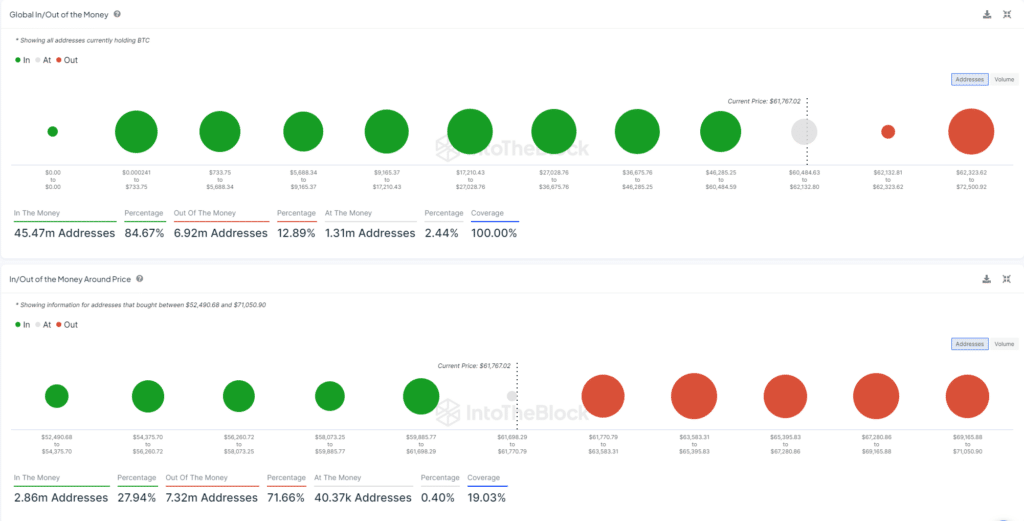

Per IntoTheBlock, over 84% of long-term BTC holders are in profit, but 71% of short-term buyers are “out of the money” or in losses. Investors in the latter category acquired the cryptocurrency between $52,490.68 and $71,050. This means that aggressive declines could spell massive losses for many buyers.