Bitcoin spot trading volumes on centralized exchanges returned to peaks last seen when FTX crashed amid daily sustained demand for ETFs investing in crypto’s top currency.

Trading volumes for spot Bitcoin (BTC) skyrocketed to a 16-month high on Feb. 28, with $34 billion worth of cumulative trades on CEXs, according to Kaiko data. Binance was at the forefront of BTC trading on the day and recorded over $17 billion in Bitcoin trading volume.

Bybit trailed behind at $3.5 billion, while Coinbase reached nearly $3 billion as the platform experienced a traffic surge and technical difficulties. Coinbase CEO Brian Armstrong said the crypto exchange prepared for 10 times its usual traffic. However, this was insufficient to handle a wave of interest in the top cryptocurrency by market cap.

OKX and Kraken saw almost $4 billion in Bitcoin spot trading as BTC surged over 10% beyond $64,000 before retracing to around $62,000 at press time.

Bitcoin derivatives near $200 billion in trading

Per Laevitas data, traders also poured capital into crypto derivative products. BTC derivatives enjoyed $182 billion in trading volume in the past 24 hours. This accounted for 94% of the $358 billion traded across crypto derivatives, including futures, perpetual contracts, and options.

Meanwhile, total notional options open interest hit an all-time high of $26 billion on the crypto exchange Deribit, further confirming massive demand for digital asset derivatives.

Spot BTC ETFs continue daily net inflows

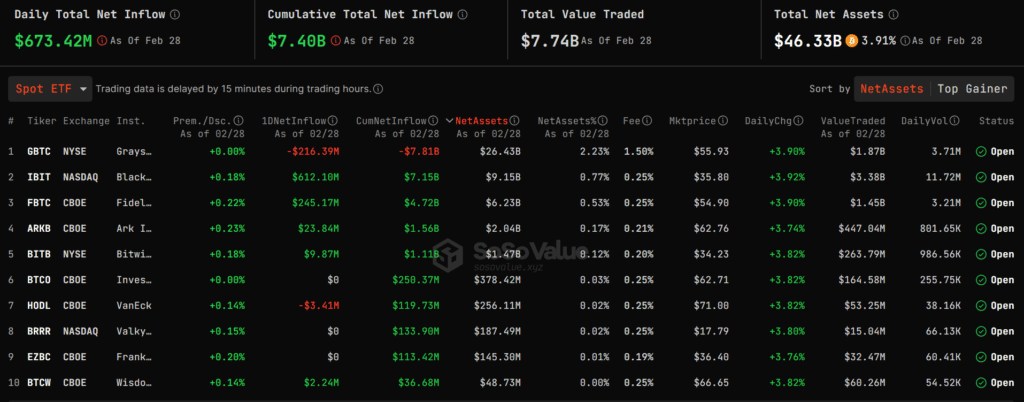

Spot BTC ETFs logged another day of net inflows, with BlackRock leading the charge. Of these products, nine recorded $673 million in total daily net inflows, and BlackRock set a new historical high of $612 million for a single day, SoSoValue reported.

Grayscale saw $216 million in outflows as the firm’s converted GBTC ETF continued to see millions in daily exits. Investors have traded over $7 billion in spot Bitcoin ETFs in less than two months.