Bitcoin (BTC) fell 5% to retest $11,000 on Sept. 2 as fresh strength in the U.S. dollar currency index appeared to spell trouble.

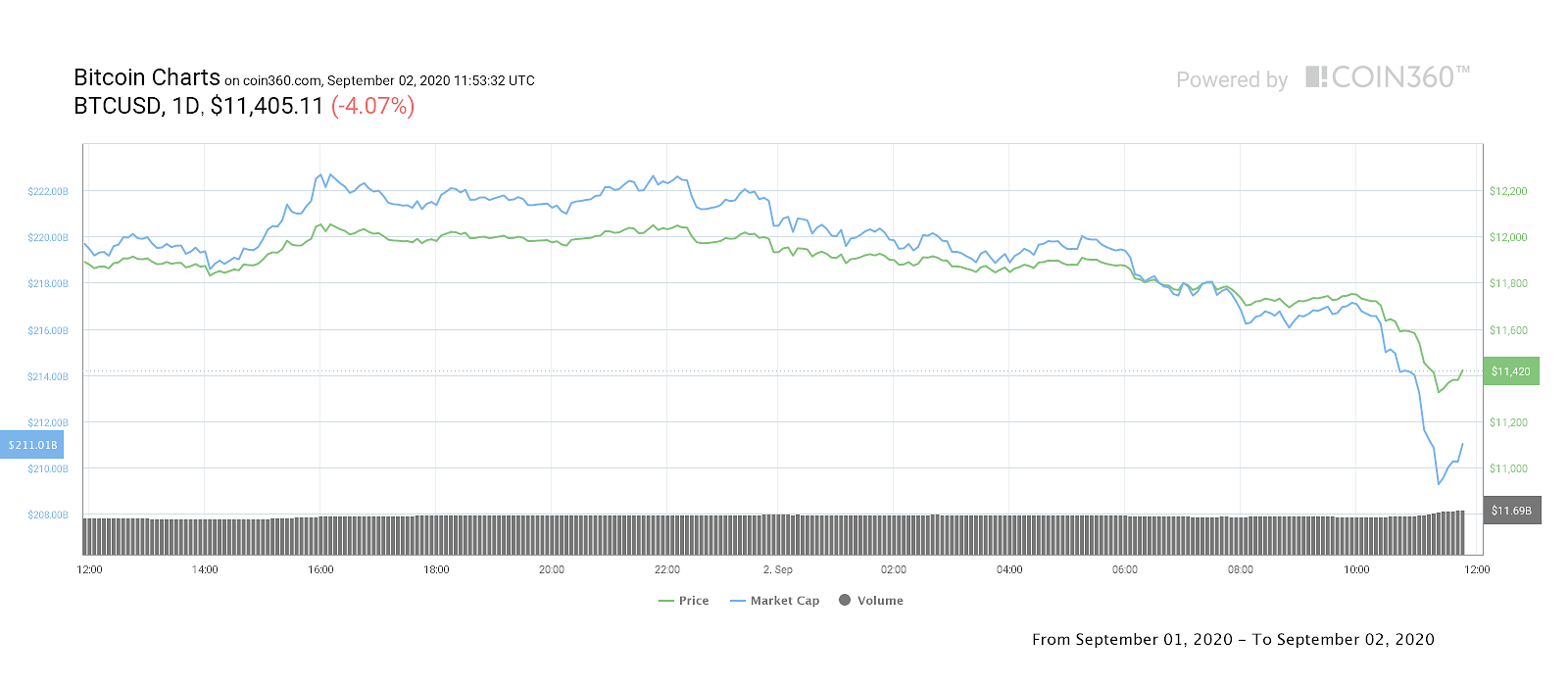

Cryptocurrency market daily snapshot, Sept. 2. Source: Coin360

BTC/USD sees sharp $12,000 rejection

Data from Coin360 and Cointelegraph Markets showed BTC/USD shedding $850 in under 24 hours on Wednesday.

The move follows Bitcoin’s latest brief trip above $12,000 resistance, a level which has so far failed to hold despite multiple attempts this year.

BTC/USD 1-day price chart. Source: Coin360

Analyst warns of “short-term bounce”

Coupled with the bounce off $11,150 was a strong day for the USD currency index, a metric with which Bitcoin has shown strong inverse correlation in recent months.

After hitting its lowest levels since 2018, the index rebounded sharply, pressuring both BTC and gold, the latter shedding 0.6% on the day to hit $1,957.

USD currency index 5-day chart. Source: TradingView

Commenting on the latest movements, Cointelegraph Markets analyst Michaël van de Poppe nonetheless warned that the wider crypto market was in for a correction.

“And that’s why you take some profits on the way up. Significant drop on $BTC here, couldn’t hold the $11,600 area,” he told Twitter followers.

“Could still, very well, be a wick south, but overall I’m expecting short term bounce coming in. Across the field.”

At press time, BTC/USD circled $11,400 after a modest recovery, firmly reclaiming its longer-term trading corridor with $11,000 as support.