by

Georgi Hristov

on

December 2, 2019 Altcoins, Bitcoin, Cryptocurrency Market Outlook, Ethereum, News, News Digest, Price Analysis, Price pages, Ripple, Stablecoins, Top Coins For The Week

The total crypto market cap added $20.2 billion of its value during the last seven days and now stands at $202.4 billion. The top 10 currencies are all in green for the same time frame with EOS (EOS) and Cardano (ADA) being the best performers with 13.7 and 10.5 percent of gains respectively. By the time of writing bitcoin (BTC) is trading at $7,365 while ether (ETH) stands around $150. Ripple’s XRP is trading at $0.22.

BTC/USD

Bitcoin lost another 6 percent of its value on Sunday, November 24 and stepped down to $6,898. The coin closed the week 19 percent lower compared to the previous seven-day period.

The trading session on Monday, November 25 started positively for bulls as the BTC/USD pair climbed up to 7,133. It successfully regained positions above $7,000 and added 3.4 percent after moving in the wide $7,400 – $6,514 area during intraday.

The most popular cryptocurrency continued to move upwards on Tuesday, November 26 and closed with a small increase of $7,149.

The mid-week session came with a third consecutive green candle on the daily chart. Bitcoin jumped up to $7,526 suggesting a short-term reversal in trend.

The institutional investment platform Bakkt announced it has hit a new record in bitcoin futures trading by reaching 4,443 contracts traded on November 27. The number is 60 percent higher compared to the previous all-time high. As already reported by BTCManager, the company will be looking to launch its very own Bitcoin-based options product on December 9 in a move to expand its services.

On Thursday, November 28, bulls did not have enough to escape from the downtrend channel and were rejected at $7,674, which led to a drop to the newly established support around $7,425. The coin found stability there and avoided further decline.

On Friday, November 29, bitcoin added 4.4 percent to its value and moved all the way up to $7,753. The situation was getting more and more bullish.

Bears, however, had something else in mind. The BTC/USD pair lost momentum on Saturday, November 30 and fell to $7,555 closing the 30-day period with 17 percent worth of losses. The drop was followed by another one on the first day of the new month and we saw bitcoin once again moving down to the support at $7,425. It fell into the downtrend channel and around $7,220 during intraday, but managed to recover its positions in the evening. The coin closed the week 6.3 percent higher.

ETH/USD

The Ethereum Project token ETH continued to slide during the last trading session of the previous week and erased another 7.9 percent of its price. It dropped down to $139 closing up the seven days with 24 percent of a loss.

The ETH/USD pair was extremely volatile on Monday, November 25 and was trading in the $132-$152 zone. Bulls managed to avoid breaking below the $130 mark and successfully pushed the price up to $145, adding 3.5 percent.

On Tuesday, November 26 it climbed up to $147 in its second-straight day of gains.

The third day of the workweek was no different as the major altcoin continued to climb and reached $152 after peaking at $156 during the day.

On Thursday, November 28, we witnessed a slight correction and a fall to $150, right to the middle of the $152-$150 resistance zone we drew on Monday.

On Friday, November 29, the ETH moved North and successfully gained 2.6 percent. It closed at $154.5 after peaking at $158 during the intraday session.

The first day of the weekend started with yet another red candle. We saw the ether dropping back to $151 on Saturday, November 30 as neither bulls nor bears were able to take the lead. The month ended with a 17 percent loss.

On Sunday, December 1, the ETH/USD pair traded in the $146-$152 zone, but closed flat at $151. It was 7.2 percent up on a weekly basis.

XRP/USD

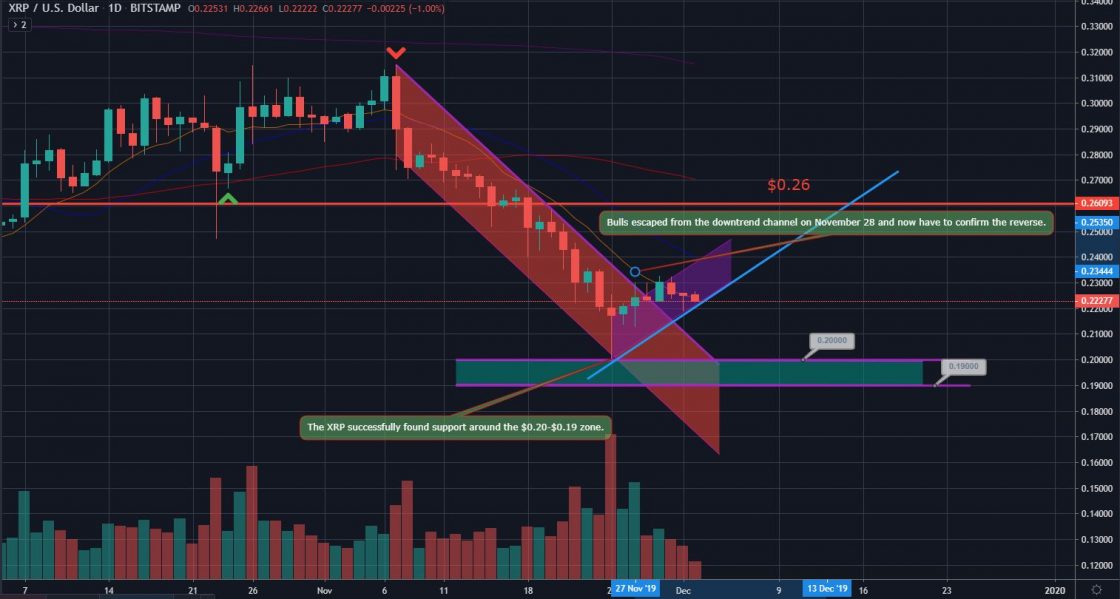

The Ripple company token XRP continued with its bad performance on Sunday, November 24 and fell down to $0.22. It closed that week 16.3 percent lower.

The new trading period started with a highly volatile session on Monday, November 25. We saw the XRP/USD pair dropping all the way down to $0.20 during intraday just to close with a small loss to $0.217 after recovering in the evening.

On Tuesday, November 26, it moved up to $0.221 and formed a green candle on the daily chart. This was followed by another winning session on Wednesday, November 27. The “ripple” reached $0.224 after ranging in the $0.23- $0.212 zone throughout the day.

On Thursday, November 28, it made another step back and corrected its price to $0.223. Bulls, however, were very close to breaking out of the downtrend channel. It happened on the last day of the workweek when the XRP added 3.6 percent to its value and ended the day at $0.23.

The weekend of November 30 – December 1 started badly for buyers as the major altcoin dropped down to $0.225 after suffering a rejection of around $0.233. It’s worth mentioning that this level might turn into a serious resistance if not surpassed in the coming days.

The “ripple” ended the month of November with 23 percent of a loss.

On Sunday, December 1, the XRP/USD pair was trading as low as $0.218 but ended the day with a small loss to $0.224. It remained flat for the 7-day period.

Altcoin of the Week

Our Altcoin of the week is a little-known token by the name Molecular Future (MOF).

The “digital asset investment service platform”, which is described as the future of programmable finance, added 54 percent to its value for the last seven days and moved up to #49 on CoinGecko’s Top 100 chart after peaking at $1.59 during early trading hours on Monday, December 2. It is also 103 percent up for the two-week period and now has a total market capitalization of approximately $97 million.

On November 29, the Hong Kong-based MOF core project team released its latest weekly report outlining the current technical developments, community updates, and future plans.

As of the time of writing, the Molecular Future token is trading at $1.59 against USDT on OKEx exchange.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4