The total crypto market cap is down more than $7 billion for the last seven days as all of the top ten currencies registered double-digit losses.

BTC-USD

Bitcoin lost nine percent on January 10, 2019, and dropped to $3,712 in its fourth consecutive day in the red. The BTC-USD pair did not change in value on January 11 and 12 and closed sessions with almost no change, staying within the $3,670 to $3,770 zone.

On January 13, the price suffered yet another blow and fell below $3,600, to $3,580 ending the week 14 percent lower.

Over the past week, observers reported important news including Bitwise’s initial registration with the SEC for an ETF and the Commission’s Examination Priorities report for 2019.

BTCManager also covered the recent hack of Cryptopia, the first acquisition from Bakkt, and breaking crypto legislation progress in Russia.

On a similar note, China will introduce new blockchain regulations in February 2019 according to a document published January 10 by the China’s internet regulator. The Cyberspace Administration of China (CAC) stated that the rules will “advance the industry’s healthy and orderly development” and will serve as a guideline for blockchain companies to follow. Notably, Chinese blockchain platforms will have to censor content, allow authorities access to stored data and check the identity of users.

China’s neighbors from India also continue to crack down on crypto use. Banks in the country are reportedly forcing customers to sign a declaration that would prevent the use of Bitcoin or digital currencies. The Reserve Bank of India (RBI) prohibited all banks in the country from providing services to crypto-related businesses last April.

In an official press release from January 11, the Financial Services Agency (FSA), Japan’s financial regulator, allowed cryptocurrency exchange Coincheck to continue operating in the country by granting a formal license. Coincheck, Inc., a fully owned subsidiary of Monex Group, Inc., is now registered as a cryptocurrency exchange agency with the Kanto Financial Bureau, the overseeing regulator. The platform was hacked in January 2018, losing approximately $530 million in altcoins.

Bitcoin successfully rebounded on January 14 gaining 4.4 percent in value, to stop at $3,750. The most popular cryptocurrency could not break the important $3,800 level on January 15 and dropped lower to $3,655 instead. This was the fifth consecutive session in the $3,800 to $3,600 zone. On January 16, Satoshi’s project moved up $20, to $3,670.

The Bulgarian Revenue Agency (NAP) will initiate an inspection on all crypto-related companies. According to a local media report, the government agents will closely monitor and inspect companies whose subject-matter is the sale of cryptocurrency, with the objective being to assure compliance with tax and social security regulation.

Individuals’ income earned via cryptocurrency sales must be declared in annual tax returns and is liable to taxation at ten percent.

Tax authorities in Denmark were authorized by the country’s tax council to request information regarding trades, transactions, user names, addresses, and personal tax numbers from three domestic crypto exchanges. Once again, the main goal is to make sure there is no tax evasion on the exchange or user side. At the time of press, BTC is trading at ~$3,631.

ETH-USD

Ethereum broke below the uptrend line on January 10 and lost 15 percent of its value in its fourth day of losses since it peaked at $161. The ETH-USD pair closed the day at $129 and dropped even further to $128 and $127 on January 11 and 12 respectively.

The third biggest cryptocurrency in terms of market cap lost another 7.8 percent on January 13 moving lower to $117 – right below the important $120 level. It was 26 percent down for the seven-day period.

Last time ETH dropped this low ($118) on December 27, it managed to rebound immediately up to $142.

The IT giant Google has once again imposed restrictions on cryptocurrency-related advertising. According to the smart contract auditing startup Decenter, the IT giant blacklisted keywords mentioning Ethereum on their GoogleAds platform. The group reported the issue on Twitter and also reached out to the Ethereum Reddit community and to the official Google Ads account.

The latter replied they should refer to the “Cryptocurrencies’ section of our policy on Financial products and services.”

Google initially banned all crypto-related ads on their platform in June 2018, but later changed the policy allowing some content and changing rules for cryptocurrency exchanges advertisements in the United States and Japan.

The price of ether jumped 12 percent on January 14 jumping back up from the $118 zone for the second time in the last 20 days. Bears already tried once on December 28 to push the price below that level and now it has been confirmed as a solid support. The number three cryptocurrency closed the day at $131 ending a seven-day losing streak.

On January 16, BTCManager reported the delay of the much-anticipated Constantinople fork, which enjoyed a short-lived impact on the market.

The ETH-USD pair reacted by erasing some seven percent of its value to reach $122 on January 15. It was critical for bulls to regain $130 and push the price above that level to initiate short-term recovery and confirm recent defend of $118 to $120. They completed part of the task on January 16 by moving above $124. At the time of press, ETH is trading at ~$121.

XRP-USD

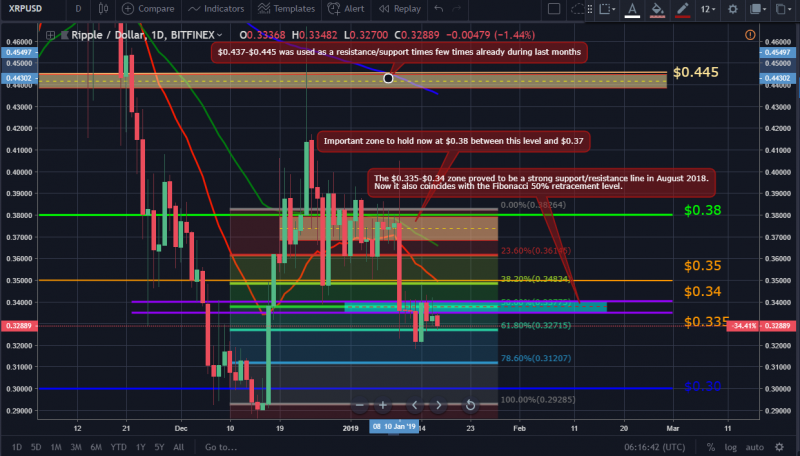

The Ripple company token made a significant correction on January 10 when it lost ten percent of its value to close the session at $0.336. Markets saw no major price movements during the next two days as the XRP-USD pair held the mentioned zone.

It dropped to $0.321 on January 13 and closed the seven-day period with an approximate loss of 14.5 percent.

The $0.335 to $0.34 zone proved to be a strong support/resistance line in August 2018 and it now also coincides with the Fibonacci 50 percent retracement level. It was quickly re-taken by bulls on January 14, but not for long. On January 15 and January 16, observers saw price retreating back to $0.331 then going back to $0.333. Many are expecting more action around this important area in the next few days. At the time press of press, XRP is trading at ~$0.32.

Category: Altcoins, Bitcoin, Cryptocurrency Market Outlook, Ethereum, Exchange, Finance, News, Price Analysis

Tags: bitcoin, BTC, ETH, ether, Ethereum, Market Outlook, market update, price analysis, trading

Hi,

I read your article, you’re describing of expression is excellent and the most valuable thing is, your attracting topic declaration. I really enjoyed and great effort.

Thanks for sharing!