The total crypto market cap added $5.7 billion to its value over last seven days and now stands at $327.1 billion. The top 10 currencies are mostly in green for the same time frame with Bitcoin (BTC) and ether (ETH) being the biggest gainers with 4.5 and 3.8 percent of price increase respectively while Cardano (ADA) lost 3.8 percent of its value. By the time of writing bitcoin (BTC) is trading at $11,486 while ether (ETH) stands at $305. Ripple’s XRP is at $0.393.

BTC/USD

Bitcoin closed the previous week 2.6 percent up at $10,750. It added 29.7 percent up for the month of June and started July by breaking below the $10,000 mark during intraday trading on Monday. Bulls, however, rapidly took over control and managed to limit the loses to just $170, by closing at $10,580.

The price of the most popular cryptocurrency remained in the downtrend channel the next day, July 2, when bears once again tried to push below the mentioned level. This time they dragged it down to $9,630, still without being able to close the day with a major selloff. Buyers reversed the direction of the trade and ended up winning back some of their territory as bitcoin closed at $10,820.

On Wednesday, July 3, the coin moved above $11,000 and stopped right below the $12,000 mark, at $11,970. The 10.4 percent increase helped it come out of the downtrend channel at least for the time being.

The BTC/USD pair could not extend gains on July 4 and caused an upset by losing 7.2 percent of its value to $11,135. It stopped around the $11,000 zone on the last day of the workweek, July 5.

The weekend of July 6 to 7, 2019, started with a green candle to $11,250 as bitcoin managed to rebound from the resistance level.

On Sunday, it moved higher to $11,486 and closed the week with 4.5 percent increase

Binance, one of the largest and most popular cryptocurrency exchanges in the world, announced during the Asia Blockchain Summit in Taipei this week that it will soon launch the test version of its futures trading platform. Although there is no exact date for the new service, there are rumors that it will initially offer support for the BTC/USDT pair and will allow trading at a leverage of up to 20x.

At the same time, the most successful crypto derivative platform, BitMEX is preparing to launch a bitcoin zero coupon bonds as confirmed by the company founder and CEO Arthur Hayes in front of Bloomberg. The new product will open the door for a different type of investment opportunities for crypto investors. Unlike traditional bonds, the zero coupon bonds do not offer coupon payments but are issued at a deep discount and repay the par value, at maturity.

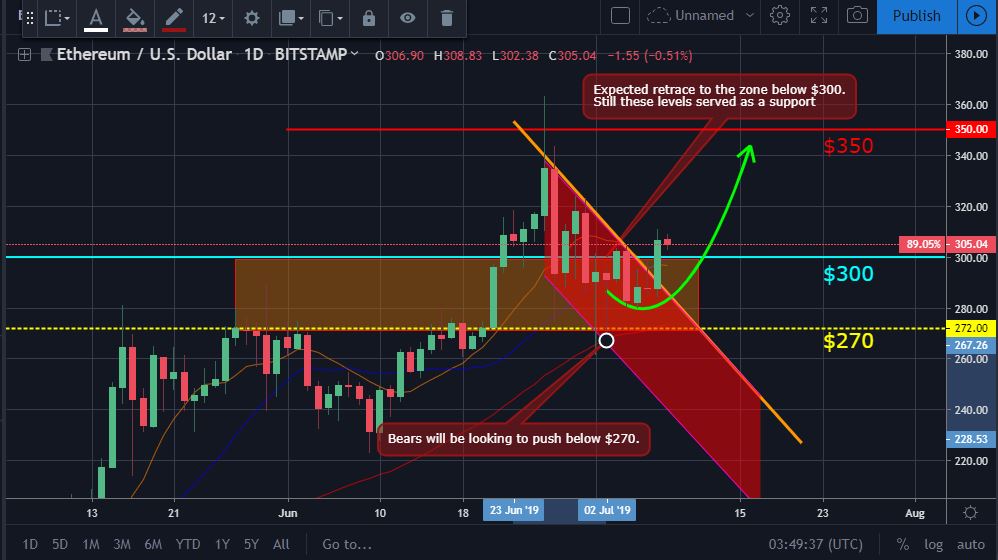

ETH/USD

The Ethereum token ended the last 7-day period at $290 with 1.7 percent of losses. It was, however, 12.7 percent up for the month of June.

On Monday, July 1 the ether temporarily broke above $300, but could not hold to that level and closed the session at $294.

The ETH/USD pair formed an almost identical candle on the next day, July 2, but in the opposite direction, correcting its price to $291. Bears pushed the price as low as $271 during intraday suggesting the ETH is still under immense pressure.

On July 3, it finally stabilized above $300 and closed the session at $302 after adding 3.4 percent to its value. On Thursday, July 4, it followed the market and made a price correction to $282 losing 6.3 percent of its value.

During the trading session on July 5, the ETH jumped back up to $287 but was still caught in the downtrend channel, which started on June 27.

The first day of the weekend came with an almost flat trading session as the coin remained around the mentioned $287 price level. On Sunday, July 7 it gained 6.6 percent to climb up to $306. The ether 3.8 percent up for the last seven days.

XRP/USD

The Ripple company token started July at $0.392 after it was down 11.8 and six percent for the previous week and the month of June respectively.

The trading session on Monday, July 1 came with a positive movement above the $0.40 level as the XRP closed the day at $0.405 or three percent higher. On the next day, July 2, however, it almost erased all of its gains and dropped back down to $0.397.

On Wednesday, July 3, the coin formed an almost identical candle, but in the opposite direction and closed at $0.405. The “ripple” was clearly not able to establish a trend and continued to move sideways.

In the next two days, it registered two consecutive days of losses and declined first to $0.3387 on Thursday, July 4 and then to $0.378 on July 5.

The weekend of July 6 to 7, 2019, was somehow more positive for bull traders as the XRP first climbed to $0.389 on Saturday, after peaking at $0.4115 during the intraday, then added extended gains to $0.398 on Sunday. It was one percent down for the week.

Altcoin of the Week

Our Altcoin of the Week is Tezos (XTZ). The innovative smart contracts and decentralized applications platform is 26 percent for the week and currently stands at $1.18 after peaking at $1.3 on Thursday, July 4.

Additionally, we saw a rapid increase in trading volumes from $11.5 million on July 2 to $24.5 million on July 4.

The coin’s good performance can be attributed to a piece of recent news involving one of the largest financial institutions in the world. BTG Pactual, which is the biggest investment bank in Latin America and the fifth biggest bank in Brazil announced on July 3, it will collaborate with Dalma Capital, a Dubai-based asset management company, to issue $1 billion worth of security tokens on the Tezos blockchain.

At the time of writing, XTZ is trading at $1.187 against the USD on the Bitfinex daily chart.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4