The total crypto market cap gained $1 billion for the seven-day period and now stands at $142.4. The top ten cryptocurrencies registered mixed gains with Cardano (ADA) and EOS being the big winners while XRP and Stellar XLM could not escape the red zone. At the time of writing bitcoin (BTC) is trading at $4,072 while ether (ETH) stands at $140. XRP’s Ripple is at $0.3115.

BTC/USD

Bitcoin closed the trading session on March 21, 2019, with a drop to $4,043. The move represented a two percent loss and was the first red candle on the Bitfinex daily chart since March 17. The leading cryptocurrency was ranging in the $4,068 to $4,034 zone on March 22 but did not experience any price changes at the end of the session.

The weekend of March 23 to 24 started with a jump to $4,063 for BTC/USD as buyers tried to keep above the psychological level of $4,000 and maintain bullish momentum. Commentators saw a symmetrical move in the opposite direction on March 24 when the pair dropped back down to $4,040. Bitcoin remained flat for the seven-day period.

The new week began with a solid price correction of 1.7 percent. The pioneer crypto coin broke below $4,000 and stopped at $3,970 as the whole cryptocurrency market was in red.

On March 26, BTC managed to bounce back to $3,992 as bulls were not willing to raise the white flag yet. The coin gained 2.5 percent on March 27 and stormed past $4,000 and $4,050 to erase all losses from the previous three days and close at $4,100.

The social trading platform eToro announced on March 25 it had acquired smart contracts provider company Firmo. According to Yoni Assia, co-founder and CEO of the Israel-based exchange, this will help eToro accelerate the development of tokenized assets offerings, which he sees as the future of blockchain-based trading products. As reported in the press release, Firmo’s contract language called “FirmoLang” can be easily adapted to work with any blockchain making it perfect for creating deploying financial contracts.

At the same time, Tron’s TRX token was added to the eToro platform making it the 15th cryptocurrency available for trading.

On March 24, the company announced the launch of its cryptocurrency trading operations in the United States.

BTCManager continues to follow the Coinbene situation. Yesterday, it was reported that a mysterious maintenance message, which according to some was a cover-up for a security breach on the exchange. In an official post this morning, Coinbene denied the rumors and reassured users that their funds’ safety by explaining that the ongoing wallet upgrade was a preventive measure to enhance security after numerous reports from other exchanges of recent fund thefts.

The independent rating agency Weiss Cryptocurrency Ratings released its March report putting XRP, EOS, and Bitcoin at the top when it comes to adoption levels and underlying technology. The paper, named “Dark Shadows with Bright Future” listed EOS at the number one spot in a second table, which takes into consideration risk and rewards ratio and combines them with the already-mentioned factors.

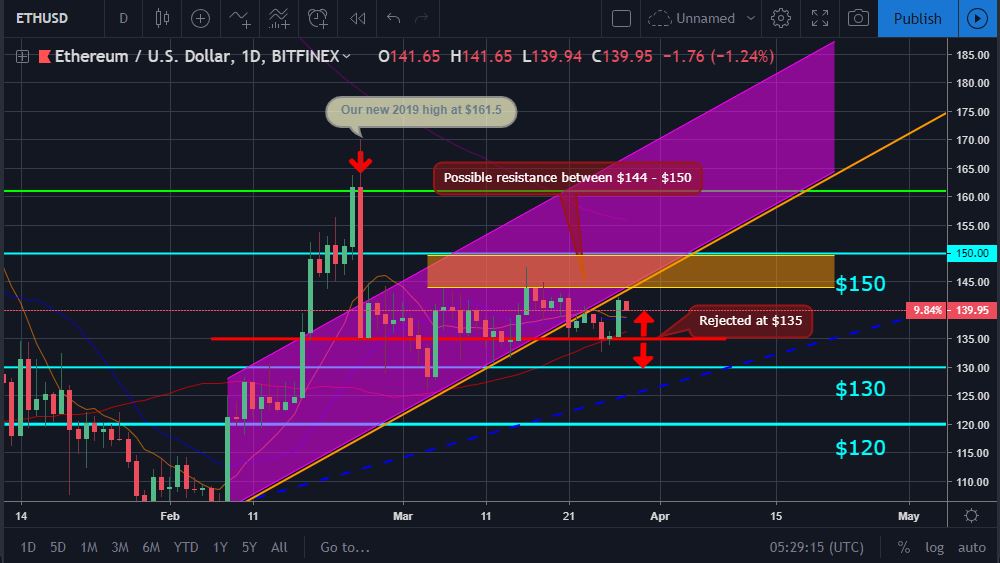

ETH/USD

The Ethereum token lost 4.2 percent of its value on March 21 and moved South to $136, breaking the uptrend channel. It managed to erase some of the losses in the sessions thereafter and formed two consecutive green candles on the daily chart to climb back to $139.4.

The ETH/USD buyers, however, could not hold their ground and started losing positions on March 24 when the pair dropped to $137.5. It was 1.8 percent down for the seven-day period.

This decline continued on March 25 when the coin experienced a 2.1 percent correction at the start of the new week and was once again heading towards the important support level at $130.

On March 26, the ETH successfully bounced back from $135 for the second time in the last two weeks and moved to $135.5. From there bulls were able to follow-up with another solid green candle to $141 on March 27. The ether price went 4.2 percent up in its best day since March 25.

XRP/USD

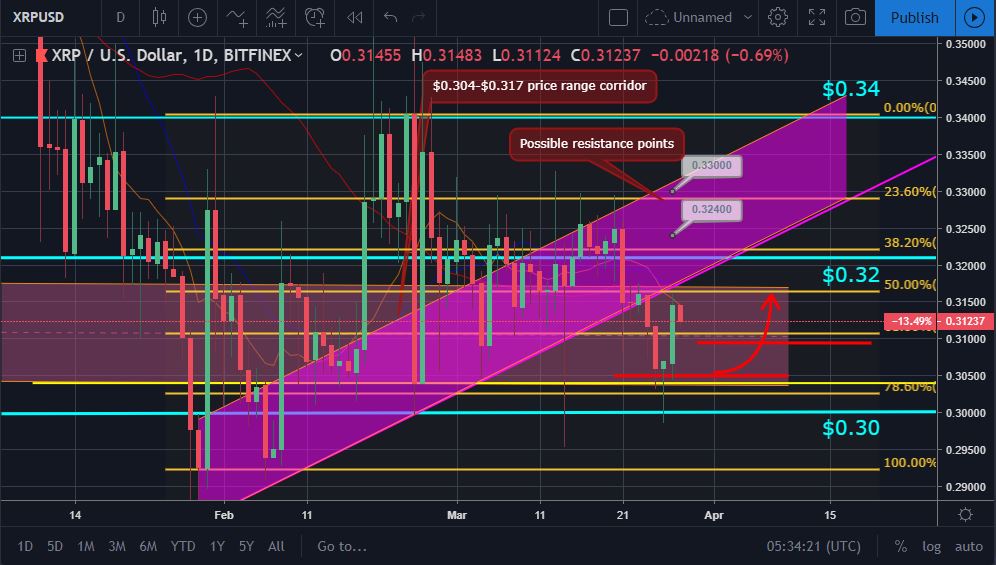

The Ripple company token experienced a significant drop in price on March 21 and moved lower to $0.315. The XRP/USD pair lost three percent of its value and broke below the $0.304 to $0.317 price range corridor. It was trading as low as $0.308 during the day session.

The coin remained flat on March 22 as neither bulls or bears were able to take over control. The weekend of March 23 to 24 started with a green candle to $0.316, but buyers struggled to keep one of the most popular altcoins in the uptrend channel.

On March 24, XRP lost another 1.2 percent and saw its price sliding down to $0.311, closing the week with 2.5 percent of losses.

March 25 brought more problems to buyers as XRP continued its fall, this time to $0.306 and was dangerously close to the important level at $0.30.

As predicted on the March 25 XRP Market report, however, the price almost perfectly rebounded from $0.305 and formed a green candle to $0.307 on March 26.

On March 27, the XRP/USD pair followed the overall market direction and climbed up to $0.314.

Banco Santander, the Spanish multinational commercial bank mistakenly told users it was using XRP tokens to perform international transfers. The bank’s support team replied to a user asking for more details in regards to the popular cryptocurrency but caused a Twitter storm instead. They were quick to correct the message and clarified to its customers it is not using the XRP, but Ripple’s xCurrent product.

For the uninitiated, Banco Santander launched their blockchain-based money transfer service called Santander One Pay FX in April 2018.One of the biggest cryptocurrency exchanges in terms of daily volume, Huobi, announced it would start offering XRP futures contracts on its Huobi Derivative Market platform. The weekly, bi-weekly, and quarterly contracts will be available for users this on March 29.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4