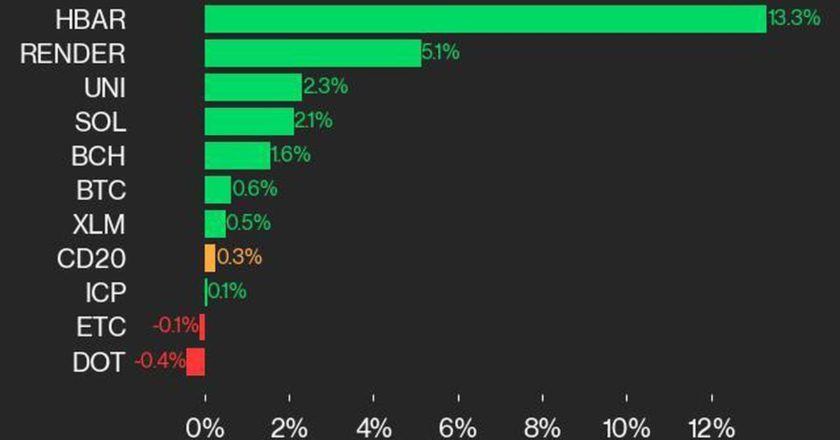

The total crypto market cap added $13.5 billion to its value for the last seven days and now stands at $552.8 billion. The top 10 currencies showed mixed results for the same time period – Ripple’s (XRP) added 40 percent while Polkadot (DOT) and Litecoin (LTC) lost 5.8 and 4.6 percent respectively. By the time of writing bitcoin (BTC) is trading at $18,354, ether (ETH) moved up to $582. XRP stabilized around $0.624.

BTC/USD

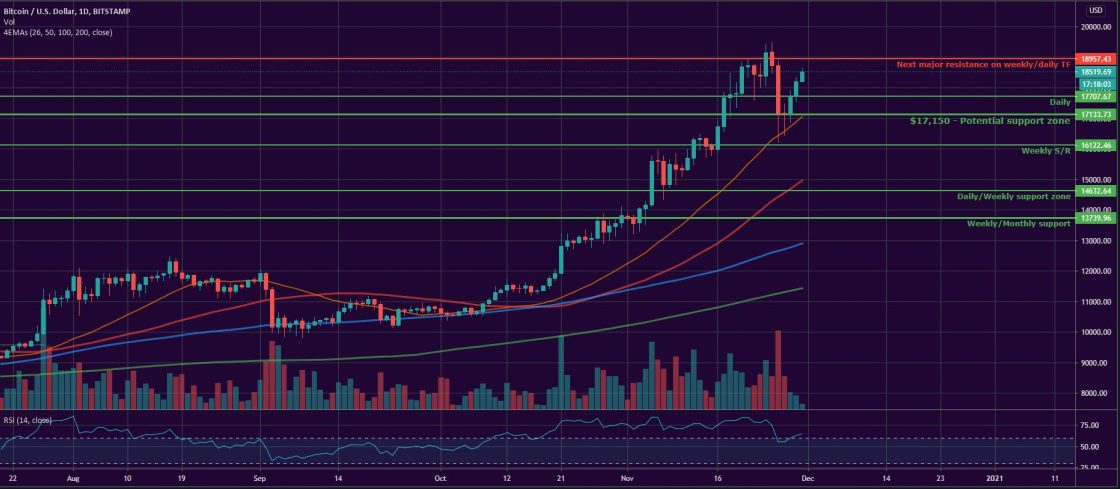

Bitcoin closed the trading day on Sunday, November 22 at $18,432 or 15 percent higher compared to the previous seven-day period. The coin made a slight pullback after almost hitting $19,000 during the previous session and temporarily dropped below the daily support at $17,700.

The leading cryptocurrency fell for a second consecutive day at the start of the new week forming a short red candle to $18,375. Still, buyers managed to keep the price floating above the $18,000 line and the overall uptrend remained intact.

On Tuesday, November 24, the BTC/USD pair climbed up to $19,160 and surpassed the next major resistance on the weekly and daily timeframes – $19,000. From a weekly chart perspective, this level is the highest ever reached by BTC. The move resulted in another 4.2 percent added to its value.

The mid-week session on Wednesday was a bad one for bulls. Bitcoin fell down to $18,730 and lost the horizontal support. The selloff was most probably triggered by the upcoming Thanksgiving holidays in the United States and was preceded by a double-top formation on the 1-hour chart.

On Thursday, the coin dropped to $17,150, losing 8.5 percent of its value for the day. Bears were even able to push the price all the way down to the weekly support at $16,150 in the early hours of trading.

The last day of the workweek came with another attempt to break below the mentioned support line. Still, bitcoin was flat at the end of the session.

The weekend of November 28-29 started with a fresh green candle to $17,700 on Saturday that marked the return of buyers. Then on Sunday, it made one more leg up, this time to $18,213.

ETH/USD

The Ethereum Project token ETH is on its way up ever since it found support at the 100-day EMA on the daily timeframe on September 23. Since then, the coin has added approximately 85 percent to its value.

It ended the previous seven-day period at $561 or 25 higher. One of the driving forces behind the recent surge was without a doubt the upcoming launch of the Ethereum 2.0 protocol and the preceding network staking.

On Monday, November 23, the ether surpassed the psychological resistance line at $600 and closed at $608, adding yet another 8.5 percent.

Buyers, however, were unpleasantly surprised on the next day when they were rejected at the next major horizontal level on a weekly – $620. The ETH corrected its price down to $606.

What we saw on Wednesday, November 25 was ETH mirroring the selloff in the BTC/USD pair. The whole crypto market started bleeding and the biggest altcoin was no exception. It fell down to $570 losing 6.3 percent.

The next two sessions were also colored in red. First, on Thursday, the ether dropped sharply and stopped at $520, or 8.7 lower. It is worth noting that sellers drove the price down to $480 and almost hit the 26-day EMA in the morning. Then on Friday, it formed a short red candle to $517, but with a long wick down, which proofed the strength of the selling pressure.

The first day of the weekend was a good one for ETH as it initiated a short-term reversal by climbing up to $537. On Sunday, November 29 it continued to surge and reached $576.

XRP/USD

XRP closed the trading session on Sunday, November 22 at $0.446 adding 65 percent to its value. It also stabilized above the $0.445 horizontal support confirming the uptrend reversal that was trigger a week before. The coin continued to produce a better rate of return compared to the rest of the major alts in the Top 10.

On Monday, it made another huge move upwards and ended the day at $0.616, or 38 percent higher. The monthly resistance at $0.58 was easily surpassed and the “ripple” bulls were already targeting $1 per token.

The XRP/USD pair was trading in the wide range between $0.79 – $0.56 on Tuesday, November 24 before closing with a green candle to $0.69, but initiated a price correction on the third day of the workweek. It dropped to $0.63 on the same day and then to $0.53 on Thursday erasing 23 percent for the two sessions combined.

Buyers, though, managed to keep the general uptrend intact after finding support at the $0.50 level. On Friday, November 27, the price of XRP rebounded from that level and reached $0.563.

It continued to climb on the first day of the weekend and reached $0.627 once again re-taking the monthly resistance.

Then on Sunday, November 29, it made an unexpected step-down and closed the day and the week at $0.604, hitting the monthly support during intraday.

Altcoin of the Week

Our Altcoin of the week is Stellar (XLM). The XLM lumens grew by 76 percent for the week and moved up to #11 on CoinGecko’s Top 100 list with a total market capitalization of $4.15 billion. It also registered a stunning 135 percent increase for the last 14 days.

It is difficult to say what the exact reason for the surge is, but the Stellar public network upgraded or Protocol 15 that was launched on November 23 surely contributed to the good performance of the coin.

The coin peaked at $0.223 on Wednesday, November 25 and as of the time of writing is trading at $0.197 against USDT on the Binance platform.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4