The total crypto market cap added $2.5 billion to its value during the last seven days and now stands at $267.5 billion. The top 10 currencies are mostly in green for the same time frame with EOS (EOS) and ether (ETH) being the best performers with 8.6 and 7.1 percent of gains respectively. By the time of writing bitcoin (BTC) is trading at $10,322 while ether skyrocketed to $195. Ripple’s XRP moved up to $0.262.

BTC/USD

Bitcoin closed the previous seven-day period with 5.6 percent increase on Sunday, September 8 and climbed up to $10,400.

The BTC/USD pair opened the new trading week with a volatile session during which we saw it moving in the $10,600-$10,200 range. It closed the day on Monday, September 9 at $10,297.

On Tuesday, September 10, it moved even lower losing 2.4 percent of its value by closing at $10,070. The coin was now once again close to the last five-figure support.

The $10,000 level was not quite stable during the past few weeks, still, bulls were hoping to hold it for a longer period this time in order to consolidate.

The mid-week session on September 11 brought some stability as the most popular cryptocurrency erased some part of the losses from the previous session and climbed to $10,158.

Bitcoin continued its good performance on Thursday, September 12 and moved up to $10,420 after adding 2.5 percent to its value.

The last day of the workweek, September 13, came with an attempt from bears to push the price back down to the levels around $10,400. Although the BTC/USD pair was trading as low as $10,120 during intraday, it managed to end the day session at $10,374 with a minimum loss.

On the first day of the weekend, the coin remained relatively flat, still, it lost $23 of its value and formed a short red candle to $10,351.

On Sunday, September 15 we witnessed the price of BTC moving down to $10,300 closing the seven-day period one percent lower.

ETH/USD

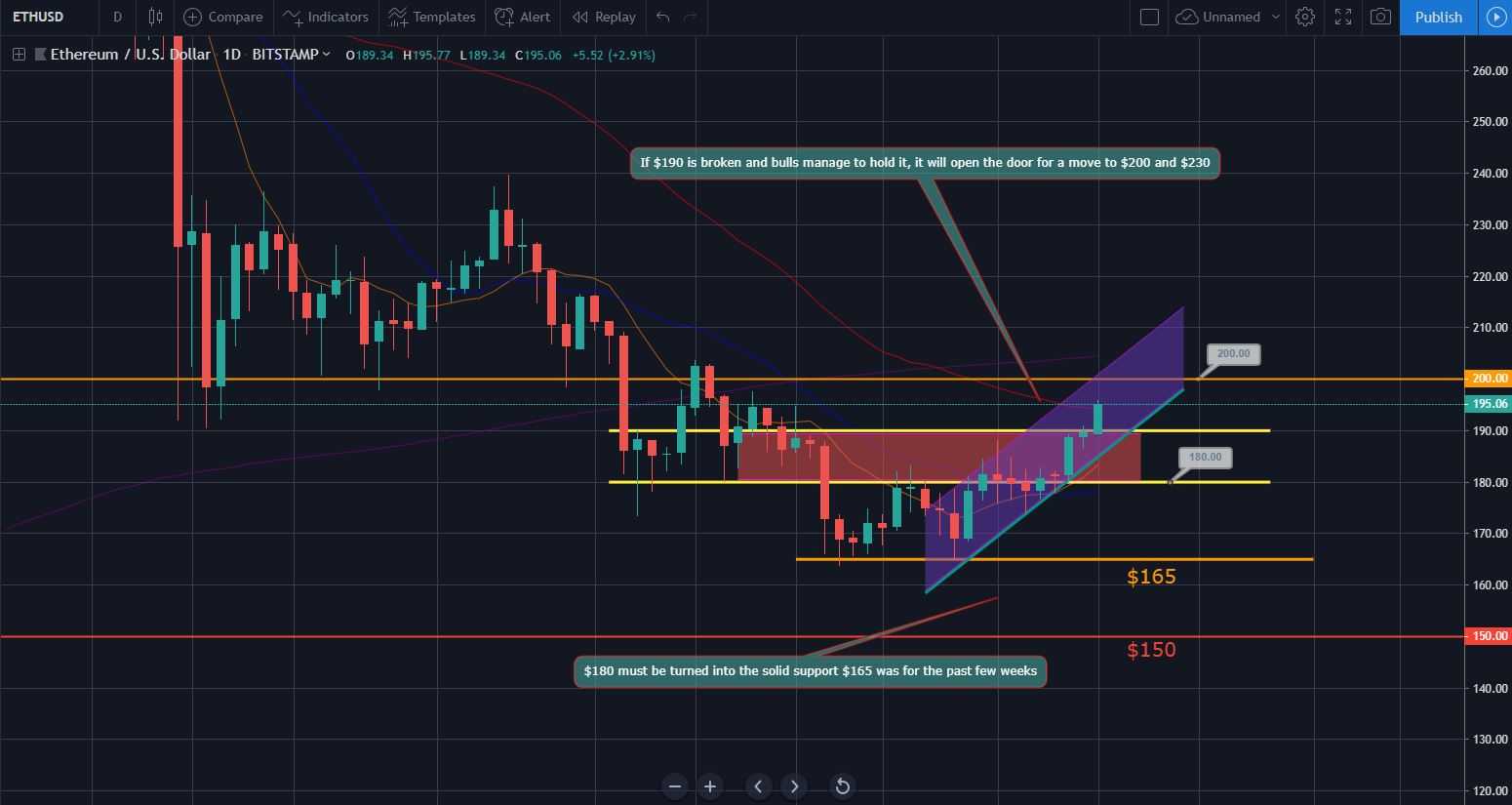

The Ethereum Project token ETH peaked at $184 during intraday on Sunday, September 8 and closed the previous week at $182 with 4 percent increase for the period.

On Monday, September 9, the ether was trading in the wide $187-$176 range, reaching new monthly high. Bulls were not able to hold their gains, however, and closed at $180.

We saw the exact same pattern repeating the next two sessions as the ETH/USD pair formed two more red candles on the daily chart and dropped first to $179 on Tuesday, September 10 and then to $178 on September 11.

The first three days of the week were quite volatile, still, the tight closing levels were suggesting that neither bulls nor bears were able to take over control and establish a valuable trend.

On Thursday, September 12, the ETH formed its first green candle on the daily chart since September 8 and once again reached the $180 mark. We did not observe any significant changes during trading session on Friday, September 13 as the coin stayed around the $180 zone.

The weekend of September 14-15 started positively with the ETH/USD pair adding 3.8 percent to its value and climbing all the way up to $188, right below the upper end of the $180-$190 channel.

On Sunday, September 15, the coin moved even higher and touched $190 ending the week with a 5 percent increase.

XRP/USD

The Ripple company token XRP closed at $0.262 on September 8 with 1 percent of increase for the previous week.

It started the new trading period by once again loosing the $0.26 level. The coin moved down to $0.258 on Monday, September 9 as bulls were not able to regain their positions above this major level for more than two weeks now.

On September 10 we saw the XRP/USD pair move in the wide range between $0.264-$0.253. It briefly touched the upper side of the downtrend channel at $0.264 without being able to break it and finally closed at $0.258 with no price changes compared to the previous session.

The “ripple” formed a red candle on Wednesday, September 11 and fell to $0.254. The move was followed by another losing session, on September 12, during which the major altcoin continued to slide closing at $0.253.

XRP bulls saw some light on the last day of the workweek as their favorite altcoin bounced back and climbed to $0.255.

Following the general crypto market trend, XRP/USD pair registered some serious increase on Saturday, September 14 and skyrocketed all the way up to $0.262.

It is of critical importance for buyers to hold in the zone North of $0.26 as long as possible to confirmed break of the mid-term downtrend and consolidate.

On the last day of the week, the “ripple” dropped back to $0.26 without breaking below this important level. It closed the week almost flat, loosing less than a percent.

Altcoin of the Week

Our Altcoin of the week is EOS (EOS). The open-source blockchain protocol, which is one of the leading platforms for decentralized applications (dApps) creation and management added 8.6 percent to its value for the last seven days and peaked at $4.08 on Sunday, September 15. EOS is also 25 percent up for the last 14 days.

The coin is currently ranked at #6 in the Top 100 coins by market capitalization with a total evaluation of approximately $4.2 billion.

Without a doubt, the driving force behind the current rally is the upcoming upgrade of the EOS mainnet, which is the largest since its inception and the first to require a hard fork. The consensus update will take place on September 23 when the EOSIO version 1.8 will be activated. The new upgrade will bring improved security on-chain and smart contract level as well as enhanced scalability and hard for upgrade mechanism.

As of the early hours of September 16, EOS is trading at $4.11 against the USD on the Bitfinex daily chart.

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4