Bitcoin and ether were again trading lower in Asian hours, continuing the year-long trend of losing ground mainly when America is asleep. The decline comes as traditional markets turn a blind eye to China’s interest rate cut and remain risk-averse.

At press time, bitcoin, the top cryptocurrency by market value, was trading near $46,600, representing a 0.5% drop on the day. Ether was changing hands near $3,850, down nearly 2% on the day.

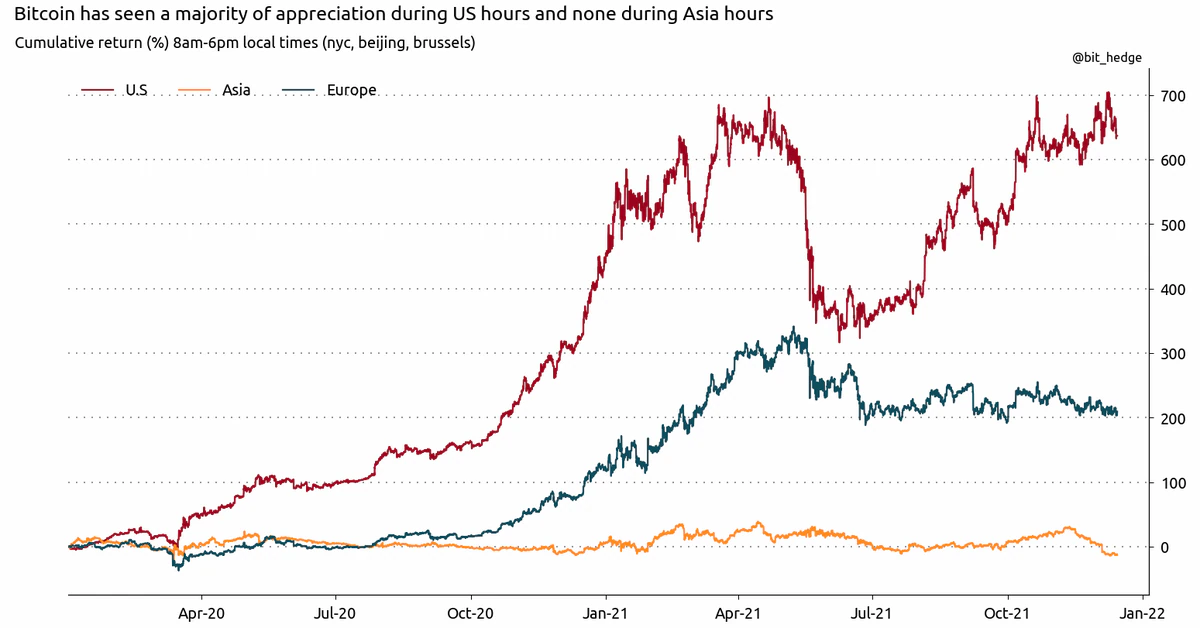

Data provided by options trader Fredrick Collins shows that bitcoin and ether have consistently faced selling pressure during the Asian hours this year. Most of year-to-date gains made by bitcoin and ether, 60% and 420% respectively, have come during the American hours, represented by 8:00 am to 6:00 pm New York time.

Both cryptocurrencies have taken a big hit in recent weeks, dragging the broader crypto market lower as the U.S. Federal Reserve and other major central banks began unwinding the liquidity-boosting stimulus to contain inflation.

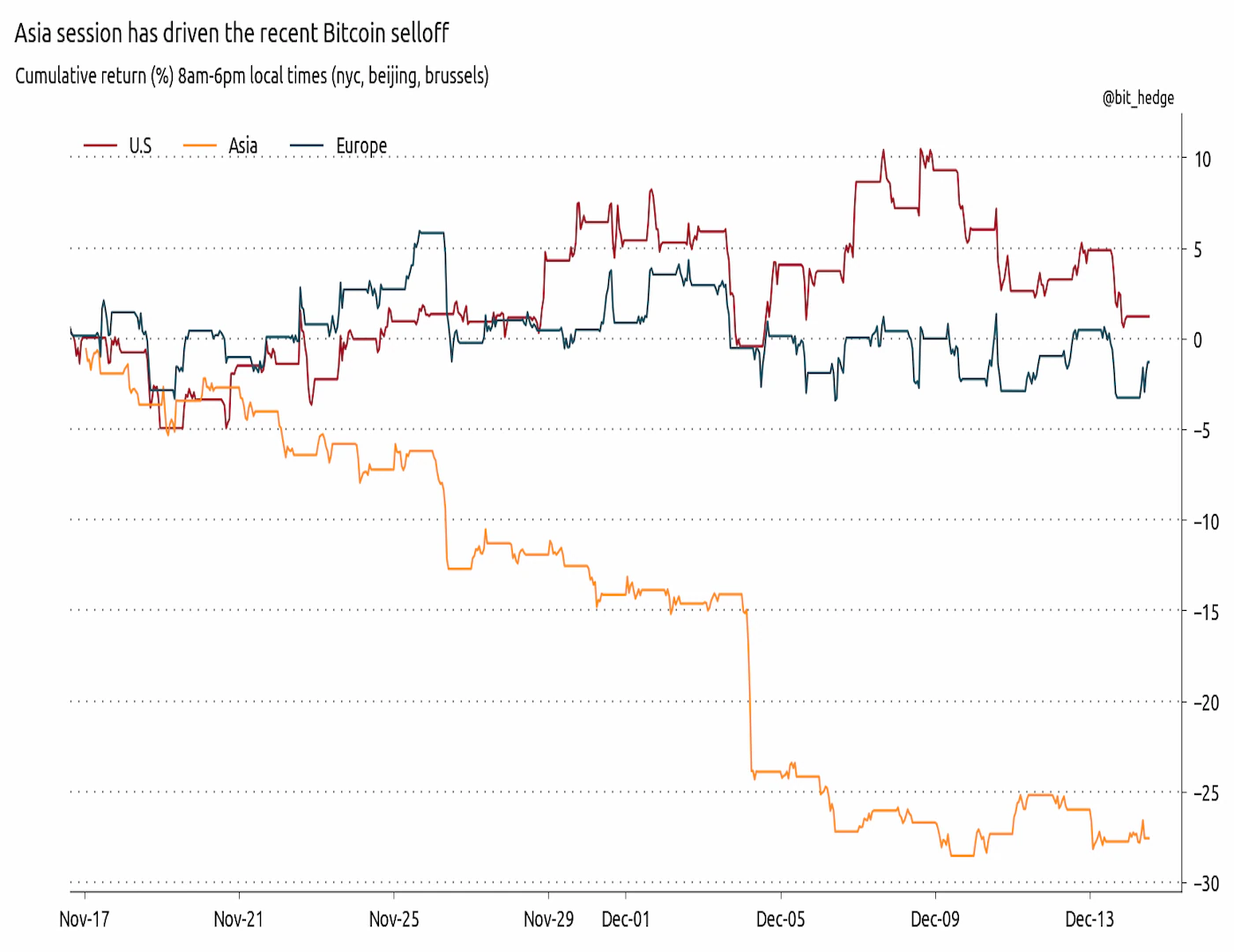

Bitcoin has declined more than 30% since peaking near $69,000 on Nov. 10, with sellers dominating the market during the Asian hours – 8:00 am to 6:00 pm Beijing time.

The trend continued on Monday despite the People’s Bank of China (PBOC) taking steps to cushion the economy from the negative impact of property market woes and renewed coronavirus concerns.

The Chinese central bank announced a cut in its one-year loan prime rate, a de facto benchmark rate since 2019, from 3.85% to 3.8%, confirming the first reduction in nearly two years.

Interest rate cuts tend to inject liquidity into the economy. Thus, perceived inflation hedges like bitcoin, gold, and asset prices, in general, typically react positively to rate cuts.

However, Asian equities are currently flashing red alongside a 1.10% drop in the futures tied to the S&P 500. Oil prices are down more than 3% and the anti-risk currencies like the Japanese yen are drawing safe-haven bids.

The market action suggests China’s rate cut is perhaps too small compared to the impending tightening by the Fed and other central banks. Last week, the Fed signaled three rate hikes in 2022 and the Bank of England delivered a surprise interest rate hike.

Heightened fears of coronavirus lockdowns also appear to be overshadowing Beijing’s move to improve market sentiment. European nations are reimposing stricter measures to stem the Omicron wave and China’s COVID zero policy is threatening to disrupt the global supply chain.

5/14

China does not screw around. Everything goes to zero when cases are found.

So, while the China chart above is "only" 136 cases, that is historically been enough to close everything and weld people in their house.https://t.co/E6tYW3eVKN

— Jim Bianco biancoresearch.eth (@biancoresearch) December 18, 2021

Lockdowns and supply chain disruptions are inflationary, which are seen as a positive development for a perceived store of value assets. Lockdowns also weigh over economic growth.

However, with elevated global price pressures, central banks appear to have little room for higher liquidity injection to prioritise growth as they did after the first COVID wave in the first half of 2020. Back then, inflation in the U.S. stood well below the Fed’s 2% target. As of November, U.S inflation stood at a four-decade high of 6.8%.

Fed’s Chairman Jerome Powell recently retired the world transitory from inflation discussions, signaling a shift in focus from employment (growth) to inflation control. The International Monetary Fund also urged the Fed to speed up policy tightening to contain inflation.