The total crypto market cap added $186 billion to its value for the last seven-days and now stands at $1,209 billion. The majority of the coins on the top 10 list registered solid gains with XRP (XRP) being the only exception losing 13.5 percent for the period. By the time of writing bitcoin (BTC) is trading at $39,440, ether (ETH) is at $1,658.

BTC/USD

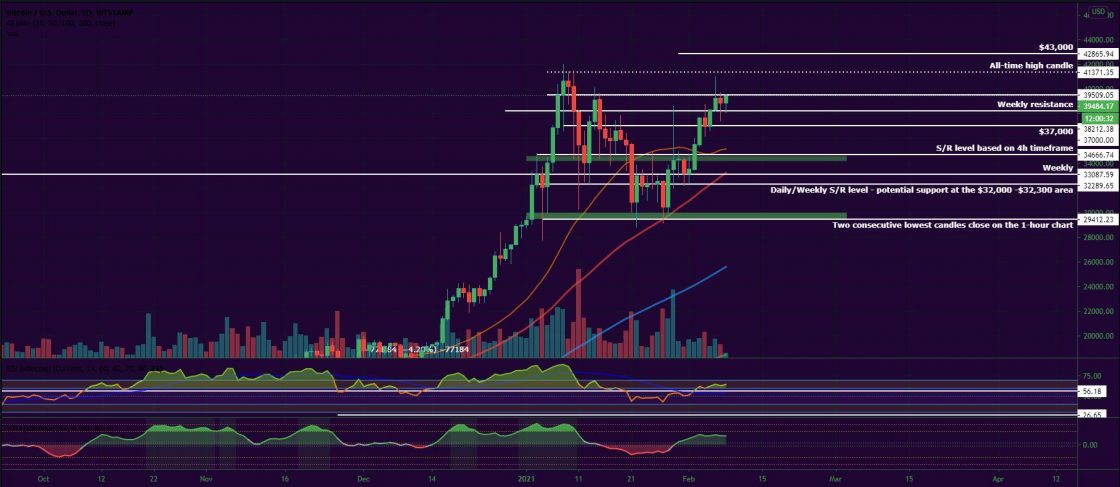

Bitcoin closed the trading day on Sunday, January 31 at the weekly support level of $33,105. The coin erased 3.3 percent of its value and briefly touched the next strong support on the daily/weekly timeframes during intraday – $32,300. Despite the decline and the recent volatility, BTC managed to grow by 11.7 percent during the first month of 2021.

On Monday, the bull traders launched another attack on the $34,700 level and even though they were rejected, the upside reversal was already in the making. The BTC/USD pair ended the session at $33,560 after moving up and down in the wide range between $34,700 and $32,300.

What we saw on February 2 was unexpected to many as BTC was not showing the necessary bullish momentum and the required strength to break above both the diagonal and horizontal resistances. That is exactly what happened as the biggest cryptocurrency stormed pass the $34,700 level, the mid-term diagonal resistance line and the 26-day EMA on the daily chart. The coin added 6.2 percent and reached $35,520.

The mid-week session on Wednesday was a continuation of the upward movement. It was the third straight day in green for bitcoin as it surpassed the psychological level of $37,000 for the first time since January 19 (if we exclude the so-called “Musk candle” from January 29).

On Thursday morning, it printed a weekly high of $38,769 before dropping back to sub-$37k levels in the evening. The coin closed with a loss of 1.8 percent

The Friday session was a good one for bulls as they managed to quickly regain positions above $37,000 in the morning and then formed a solid green candle to $38,369, or right above the weekly resistance level.

The next step was taken on the first day of the weekend when the important $38,700 level was taken out. The coin closed at $39,314 adding another 2.4 percent to its valuation. It was trading as high as $41,071 during intraday, for the first time since January 10.

On Sunday, February 7 we started seeing weaknesses in the BTC setup. The coin crashed down to $37,400 in the morning and partially recovered, closing the week at $38,850.

ETH/USD

The Ethereum Project token ETH concluded the month of January with an impressive 78.5 percent of the price increase. It was also one of the best performing major altcoins for the period and still considered by many as severely undervalued. The coin was rejected at the daily resistance level of $1,375 on January 31 and erased 4.6 percent, closing the day at $1,314. Nevertheless, the ETH/USD pair maintained its course in the uptrend channel and continued with the formation of the ascending triangle pattern.

On Monday, February 1, it once again reached $1,375 after rebounding from the 26-day EMA on the daily chart.

The move was followed by a solid upside impulse on Tuesday when the ether skyrocketed all the way up to $1,514, or 10 percent higher, also breaking out of the already-mentioned triangle pattern. It registered a new all-time high level.

On the third day of the workweek, it continued to climb breaking above the uptrend channel, and the $1,600 level, stopping at $1,670.

On Thursday, February 4, the major altcoin corrected its price down to $1,597 right after hitting the $1,700 mark. The pullback corresponded to a 4.3 percent decline.

The last day of the workweek came with another leg up for the ETH/USD pair as it surpassed its previous high and touched $1,765 before stopping at $1,722 at the end of the session. The coin was once again in price discovery mode as traders and analysts were already predicting that the next major milestone – hitting $2,000 before the end of February.

The weekend trading, however, brought an end to the winning streak. First, on Saturday, the ether dropped to $1,677, and then on Sunday, it fell all the way down to $1,490 before closing a little bit higher – at $1,614 after finding support at the former diagonal resistance line.

Leading Majors

The Binance blockchain native currency re-entered Top 10 after adding 51 percent to its price for the last seven days. It peaked at $75.6 on Saturday, February 6 and with a total market capitalization of $10 billion was now sitting comfortably on the 7th spot on CoinGecko’s Top 100 list.

The break of the important $45 daily/weekly resistance level in combination with the rapidly increasing exchange volumes and overall trading activity on the Binance platform were the main causes for the good performance of BNB.

Current price: $72.45

DOGE continued to amaze the crypto world not without Elon Musk’s solid support. The most popular meme-coin saw its price dropping to a $0.022 low on January 30 then quickly recovering to hit a fresh weekly high of $0.0876 on Sunday, February 7 thanks to the $11 billion of trading volume during the day.

The DOGE/USDT pair registered a 112 percent of growth for the week and was the #1 trending cryptocurrency on social media.

Current price: $0.0744

Altcoin of the Week

One of the best performing altcoins during the last week was Elrond (EGLD). The native currency of the recently launched Elrond mainnet – eGLD or eGold as it is also known, grew by the stunning 120 percent for the seven-day period leading to February 8 and was also 239 percent up on a two-week basis.

The recent surge in price resulted in EGLD moving up to #21 as of the time of writing this article with a total market valuation of approximately $3.112 billion.

The most probable reason for the good performance of Elrond is the recent launch of the Maiar Wallet feature in early February.

The coin peaked at $142 on Sunday evening and is currently trading at $176 against USDT on Binance:

Like BTCMANAGER? Send us a tip!

Our Bitcoin Address: 3AbQrAyRsdM5NX5BQh8qWYePEpGjCYLCy4