Bitcoin’s (BTC) bears may be building for a strong comeback, having pushed prices to a eight-day low below $6,300 earlier on Friday.

The price fell to $6,286 on Bitfinex at 09:50 UTC, the lowest level since June 14, and, at press time, was changing hands at $6,326, down around 6 percent over 24 hours.

As discussed yesterday, the cryptocurrency’s persistent failure to scale the $6,800 mark in a convincing manner had raised the prospects of another leg down in bitcoin prices.

It seems that process is now underway. Bitcoin breached the key support of $6,620 a couple of hours ago – signaling that the relief rally from the June 13 low of $6,108 has ended at $6,850 (June 18 high) and the bears have regained control.

The technical charts now indicate scope for a drop below $6,000 over the weekend.

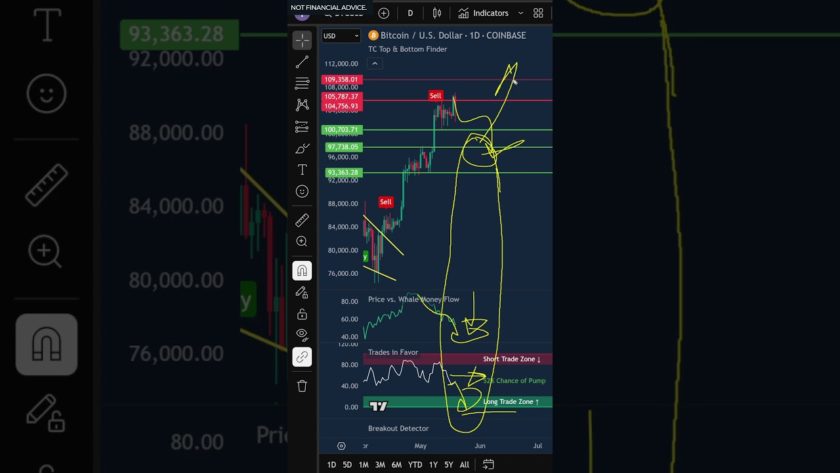

4-hour chart

BTC’s drop below $6,620 has confirmed a rising wedge breakdown – a bearish reversal pattern indicating the corrective rally has ended and the broader bearish trend has resumed.

The stage is now set for a drop to $5,090 (target as per the measured height method, i.e. pole height subtracted from breakdown price).

The target looks feasible as the long-term technical charts are also biased to the bears.

Weekly chart

As seen above, the pennant breakdown confirmed earlier this month opened up downside towards 100-week moving average (MA), currently located at $4,551.

Meanwhile, the bearish crossover between the 5-month and 10-month moving averages (MAs) also favors a convincing break below the immediate support of $6,000 (February low).

View

- BTC will likely find acceptance below the immediate support of $6,000 (February low) over the weekend, and could drop to $5,090 (target as per the measured height method) over the next couple of weeks.

- A daily close (as per UTC) above $6,850 (June 18 high) would abort the immediate bearish view.

- A high volume break above the 50-week MA, currently located at $6,958 would signal long-term bearish invalidation.

Bitcoin image via Shutterstock