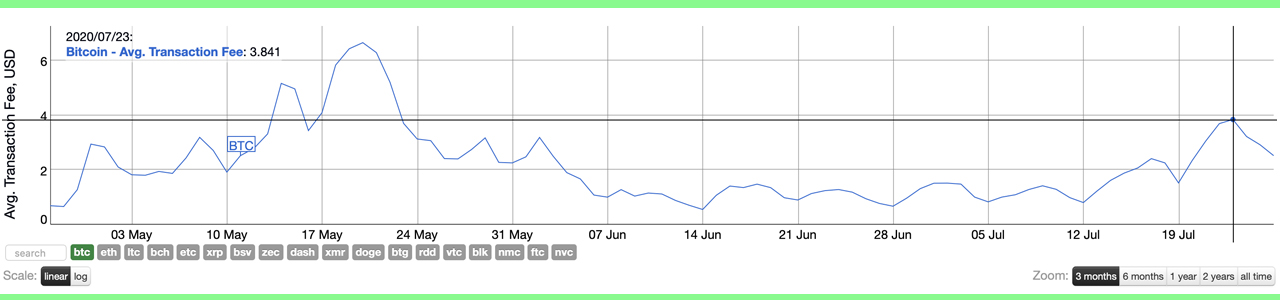

Bitcoin fees have grown much larger in recent days spiking to a two-month high to $3.80 per network transaction. The crypto asset’s fees have jumped 590% since June 14 and the mempool (transaction backlog) has grown significantly.

Digital currency markets have been extremely bullish lately as bitcoin (BTC) touched a high of $10,974 on Bitfinex on Monday. BTC’s price has jumped over 8.8% in the last 24 hours and over 17% during the last seven days.

Despite the huge spike in value, digital currency advocates have been complaining about the network’s transaction fees spiking as well. The BTC network has seen unconfirmed transactions climb and the mempool size (transaction queue) has grown quite large.

On June 12, software developer Jameson Lopp said: “Sure, bitcoin transaction fees have gone up a lot. But what’s more interesting is the volatility increase in the fee estimate market.”

Two days later on June 14, BTC fees jumped to $0.55 per transaction (txn) but that number jumped 590% to $3.80 per on July 23. On July 26, the popular analyst Willy Woo said that “bullishness is returning” when he tweeted:

One month update on this model for predictive timing of macro bull runs, this should be it. Bullishness returning. Alts frothy, ETH getting a defi tailwind, volatility returning, BTC mempool peaking, BTC txs clogging, this is all great signs for the months ahead.

Meanwhile, a number of BTC supporters have been criticizing the high network fees Ethereum users are experiencing right now.

An ETH supporter on July 22, called maximalists out over this behavior and tweeted: “Some BTC maximalists are making fun of ETH gas prices, but when you say the same thing about BTC blocks being full and fees going up, then they say that’s Satoshi’s vision to have full blocks. Is Ethereum fulfilling Satoshi’s vision better than bitcoin?”

Almost every day there’s a post on the Reddit forum r/bitcoin in regard to high BTC network fees, the mempool, and people sending txns with a low fee by accident. Similar to Woo’s opinion, some members of r/bitcoin are also “bullish” about the clogged mempool. “I don’t know about you guys, but the fact that the blocks being full for ten days in a row is bullish for me,” an individual wrote on the forum three days ago.

Meanwhile, one person disagreed and said: “It’s not really bullish. It’s most likely happening because there’s a rally and people want to get ready to sell their bitcoin on exchanges.”

Bitcoin’s rising fee market makes a number of investors bullish and this trend can be seen across Twitter. One individual recently tweeted: “Fee [is] market working — Oh look, solid increase in the fees ensures bitcoin’s security is perpetual – Bullish.”

Another person wrote: “[BTC] failed to be electronic cash, just like a Rolex Submariner failed to be used as a diving watch. They have a different purpose, they now are a store of value. There’s the value now.” Meanwhile, Ethereum has largely become bitcoin’s sidechain and the Lightning Network and Blockstream’s Liquid combined haven’t really seen any meaningful migration thus far.

What do you think about bitcoin fees jumping 590%? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Bitcoin Wisdom,bitinfocharts.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.