Bitcoin (BTC) has wowed investors with all-time highs and year-to-date returns of over 200% — but there are stocks that still beat it.

As of Dec. 22, markets’ data shows that no fewer than five companies’ stocks have given investors better rewards than a Bitcoin position since the start of 2020.

Peloton Interactive Inc.

First pitting itself against Bitcoin and winning is an unlikely success story — fitness equipment manufacturer Peloton Interactive.

At 384% annual returns, $PTON has delivered significantly thanks (most likely) to lockdowns forcing consumers to work out at home instead of at the gym or outside. The company also offers online fitness classes in a nod to the same market.

Peloton remains tiny compared to Bitcoin overall, however, with a market cap of $42.4 billion.

Moderna Inc.

Another player keenly benefiting from COVID-19 is biotechnology heavyweight Moderna, one of the companies developing a vaccine for the coronavirus.

With its product already being rolled out as of late December 2020, Moderna has emerged as one of the frontrunners when it comes to immunization in the United States.

Unsurprisingly, its stock has reacted in kind with year-to-date returns of 619%, giving the company a $54.7 billion market cap.

Zoom Video Communications Inc.

Already a household name this year, Zoom has exploded as the medium of choice for recreating office environments online in 2020.

Despite controversies regarding hacks and susceptibility to downtime, Zoom’s software has allowed it to gain a giant $116 billion market cap and annual stock returns of 495%.

Should a vaccine give governments confidence to allow physical offices to operate as normal, however, demand for work-from-home conference software could well drop.

Enphase Energy Inc.

In one of two entries not strictly tied to the virus, Enphase Energy, a renewable energy management company, has made huge gains this year.

The company is still small with a market cap of just $21 billion, but in a formative 12 months, its stock has delivered returns of almost 490%.

Like the best-performing stock of 2020 (see below), clean energy forms a popular market sector which is only set to expand despite questions over how far renewables can go in replacing fossil fuels throughout the global economy.

This month, Apple co-founder Steve Wozniak even launched an energy savings business with its own token, WOZX.

Tesla Inc.

It comes as no surprise, but Tesla is by far the best-performing stock of the year, shrugging off any suggestion of a bubble month in, month out.

The numbers are dizzying — 850% year-to-date returns, a market cap of nearly $620 billion and most recently an entry into the S&P 500.

Compared to Bitcoin’s 218%, $TSLA looks like a unicorn never seen before, but priced in BTC, the stock looks decidedly less parabolic.

Elon Musk, its CEO, meanwhile continues to flirt with Bitcoin on social media, sparking wild speculation about a potential buy-in or stock conversion.

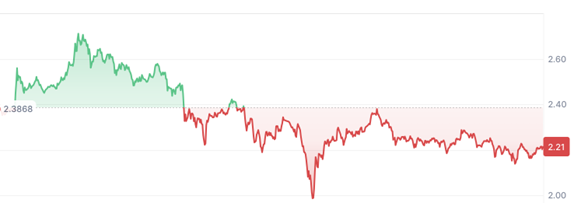

Zooming out, however, and Bitcoin remains the best-performing asset of the decade. Even at the start of the year, with BTC/USD at $7,200, its supremacy as an investment was undisputed.