Bitcoin (BTC) has been highly volatile in recent weeks, rallying above $16,000 for the first time in three years. But the futures market’s open interest indicates that a large volatility spike is likely very close.

The term “open interest” refers to the total sum of contracts that are actively open in the futures market. If the open interest is high, it means there is a high number of traders betting on Bitcoin price action.

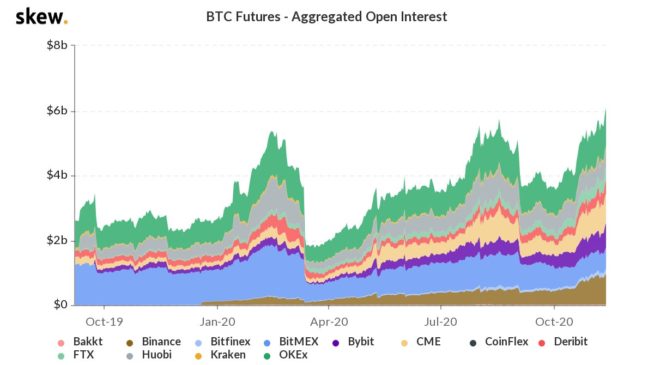

Currently, as of Nov. 13, Bitazu Capital founding partner Mohit Sorout pointed out that the open interest of Bitcoin futures is at an all-time high. This means that the chances of heightened volatility in the near term should not come as a surprise.

Sorout said that the “liquidation fest” has not started, referring to Bitcoin’s tendency to see cascading liquidations following large price movements. He said:

“BTC futures and perpetuals aggregated Open Interest has made a new all time high today Liquidation fest hasn’t even started.”

Higher open interest may trigger major volatility

Bitcoin futures contracts typically offer high leverage of up to 125x. Traders can gain access to anywhere between 1x to 125x leverage depending on the platform.

When the leverage of a position is high, it means the liquidation price is closer to the entry price. As an example, if a trader places a 20x Bitcoin long at $16,300. With a 20x leverage, a trader can trade $200,000 with $10,000 worth of capital.

But the high leverage means that the liquidation price ranger is tighter. In the case of the 20x long at $16,300, if BTC drops below $15,600, the position would get liquidated.

If a position gets liquidated with a stop-loss in place, the trade would wipe out the entire position. Hence, if a $10,000 long ($200,000 position) on 20x gets liquidated, then $10,000 would be lost completely.

As such, when a major price movement occurs and the open interest of the futures market is high, Bitcoin tends to see massive volatility spikes.

Whether this trend would have a positive or a negative impact on Bitcoin’s near-term price cycle remains uncertain. If long contracts get squeezed, then the BTC price drops, and if short contracts get liquidated, it increases.

Across major futures exchanges, the average funding rate of Bitcoin is 0.01%. This means that the market is relatively balanced, and neither buyers nor sellers are overwhelming the market.

The options market is also heating up

The rest of the Bitcoin derivatives market is similarly seeing an increase in trading activity and open interest.

Deribit, the top cryptocurrency options exchange, shared Skew’s chart showing total Bitcoin options open interest also reached a record high in the past few days.

The timing of the options market’s open interest soaring is noteworthy because theoretically, options open interest should peak toward the end of the month.

The monthly BTC options contracts expire on the fourth Friday of each month, and as such, open interest tends to spike in the last week of every month.

But, as Cointelegraph reported, data shows that bulls are not fazed by the upcoming $525 million options expiry. As long as BTC remains above $15,500, the large options expiry won’t likely have a major impact on the price.