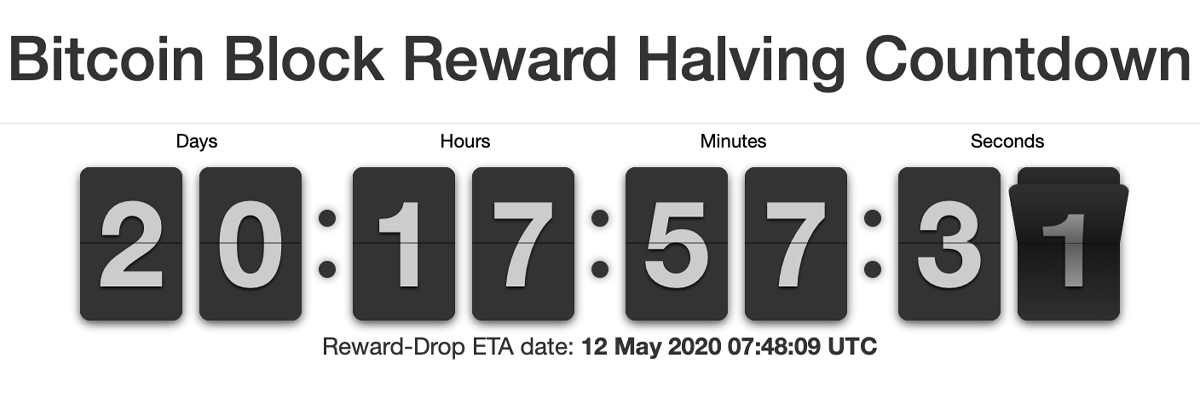

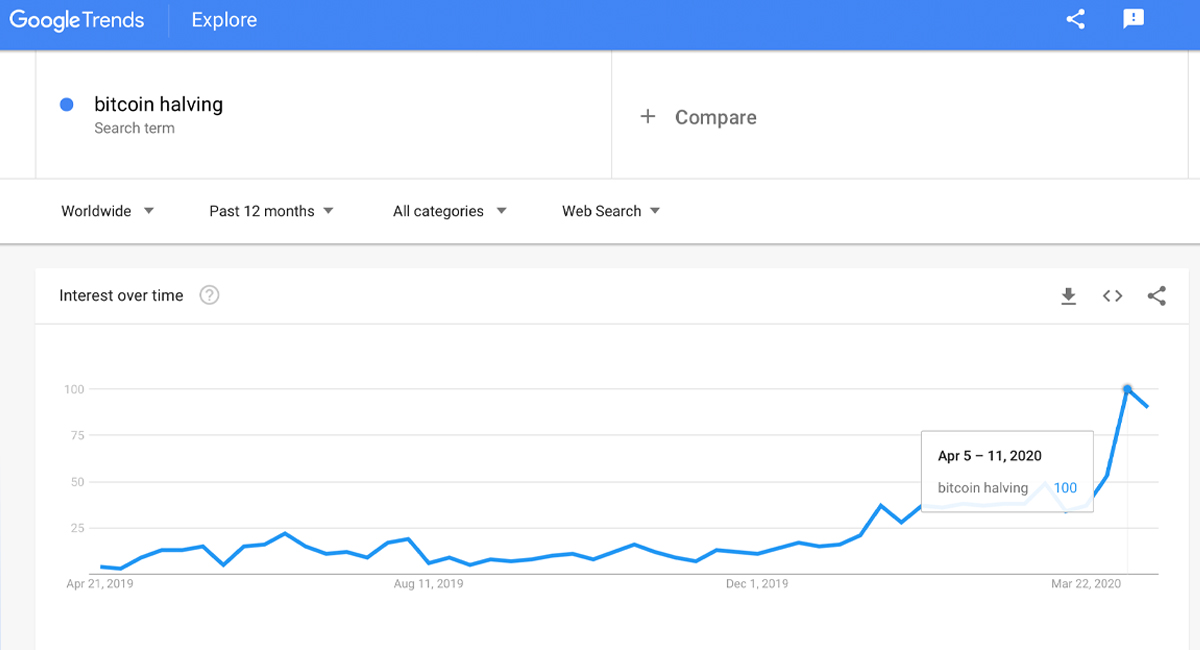

The notorious bitcoin halving is expected to happen in 20 days either on or around May 12, 2020. The anticipation leading up to the event is at an all-time high, as last week worldwide queries for the phrase “bitcoin halving” using Google peaked with a top score of 100. On Tuesday, Google Trends shows the phrase is still surging holding a score of 90 over 100 during the last 24 hours.

The Phrase ‘Bitcoin Halving’ Rises Exponentially on Google Trends

Every four years or 210,000 blocks, the network Satoshi Nakamoto created, experiences a block reward halving. When miners hash away at the BTC blockchain they are rewarded fresh coins every ten minutes when they find a block. Today, any miner who happens to find a BTC block gets 12.5 virgin coins that have never been in circulation. After the bitcoin halving in 20 days or on or around May 12, miners will get half the reward and obtain 6.25 BTC per block found. This mathematical and predictable system Nakamoto created, makes it so BTC is scarce and hard to come by going forward. Today BTC’s issuance has a per annum inflation rate of around 3.6% but after May 12, the inflation rate will drop to 1.8%.

At the time of publication, there is 18,337,650 BTC in circulation and there will only be 21 million BTC issued. With the halving approaching with a quickness, searches about the subject have skyrocketed during the last three weeks. This week (April 19-25), the query for the phrase “bitcoin halving” is hovering around a 90 out of 100. During the week of April 5-11, the phrase touched an all-time high at 100, which is the highest score a subject can obtain on Google Trends.

The reason the upward trend of searches about the bitcoin halving subject is so high is because cryptocurrency participants worldwide are curious about what will happen next. Additionally, while many crypto veterans have experienced two previous halvings, some people are just learning about the subject today.

Institutional Investors Interested in the Bitcoin Halving and Great Expectations

Recently, a survey conducted by Genesis Mining explained that more than 50% of mining participants think the price of BTC will increase after the halving. Some studies estimate that the price has to rise to at least above $12,500 per BTC post-halving. Moreover, owners of large ASIC mining facilities are concerned about the upcoming bitcoin halving and mining rig shipment delays from China. While the world’s economy is in turmoil and the price of a barrel of crude oil dropped -305% on April 20.

More signs of institutional involvement in #bitcoin. We are seeing more sophisticated players embrace this new asset class as #bitcoin continues its #QuantitativeHardening

Flagship Renaissance fund dabbles with bitcoin https://t.co/N320QtHsof via @financialtimes

— Brian Kelly (@BKBrianKelly) April 18, 2020

Reports also note that institutional investors have a fever for the bitcoin halving and point to the firm Renaissance Technologies and its mega-hedge fund called Medallion. Renaissance established the Medallion fund in 1988 and it is one of the most profitable portfolios worldwide. A recent regulatory filing submitted just before the bitcoin halving shows that Renaissance is now “permitted to enter into bitcoin futures transactions.”

What do you think about the bitcoin halving coming up in 20 days? Let us know in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, bitcoinblockhalf.com

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer