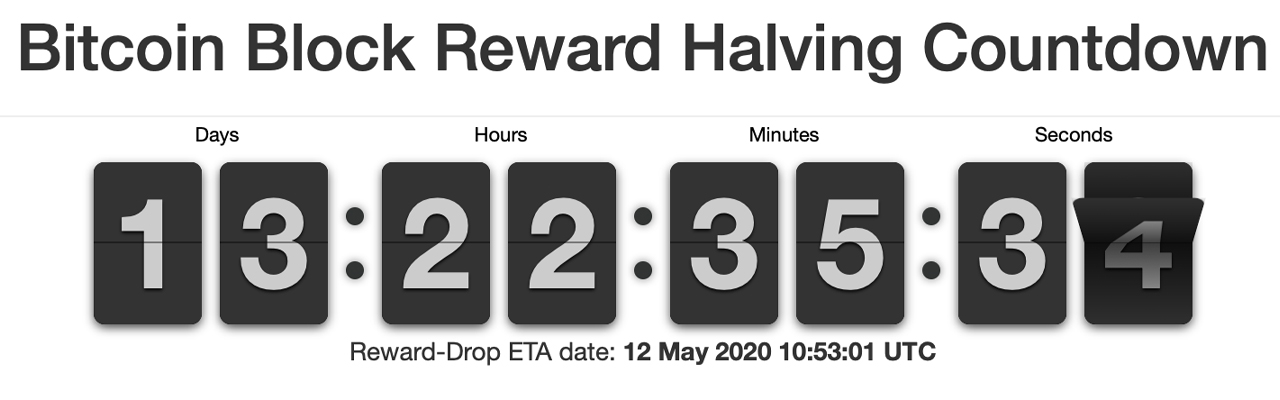

In less than two weeks, the Bitcoin block reward halving will take place and BTC miners will receive half the reward going forward after May 12. Since ‘Black Thursday’ (March 12), bitcoin prices have gained 103% since then rising from $3,800 to $7,750 per coin. With the halving fast approaching, many cryptocurrency proponents believe the event will create significant demand for the digital asset bringing the price back to all-time-highs.

The Great Bitcoin Halving

One of the most anticipated events in Bitcoin history is taking place on or around May 12, 2020. The event is called the “Bitcoin Halving,” and it means that the block reward miners receive for finding blocks on the BTC chain will see the reward slashed in half. When the BTC network first launched, miners got 50 BTC per block found, and in 2012 that reward changed to 25 coins per block. Then in July 2016, miners saw the second halving, which saw rewards cut in half from 25 coins to 12.5 BTC per block. In less than two weeks, the 12.5 coinbase reward will be chopped in half, and miners will only obtain 6.25 coins per block plus transaction fees. The reason this happens is because Satoshi Nakamoto created a mathematical and predictable system that encourages scarcity and savings.

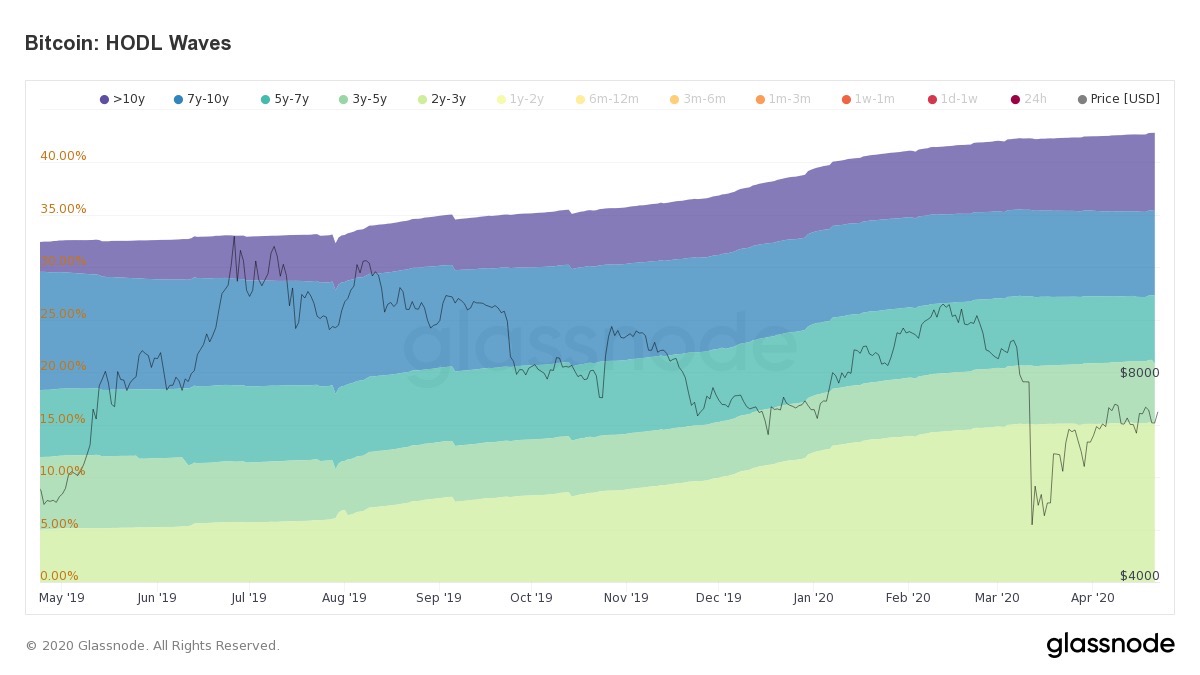

On Tuesday, April 28 there are 18,349,900 BTC in circulation and there will only be 21 million BTC in existence after the last coin is mined. Between now and the halving, roughly 25,000 virgin coins will be obtained from mining before the event. BTC still has an inflation rate per annum of around 3.65% per day, with $13,923,540 worth issued per day. If prices were to remain the same as today, the $13 million will be chopped in half and the per annum inflation rate will drop to 1.8%. However, the 18.3 million BTC in circulation is not a correct representation of what’s really in circulation. Millions worth of BTC have been lost or stolen, and many investors are holding their BTC for dear life in hopes the price will spike higher. A good example of this trend stems from the data provided by Glassnode, which notes that 42.83% of all circulating BTC has not moved in at least two years. The Twitter account @cryptounfolded states that this figure has increased by 10.4% during the last 12 months.

‘Nonsensical Narratives’

Not everyone on ‘crypto Twitter’ has the high expectations that BTC prices will skyrocket after the halving. The well known bitcoin proponent on Twitter known as @joe007, told his 28,000 followers that he doesn’t believe the price will spike after the halving event. “No, of course, it’s not priced in,” he sarcastically tweeted. “On the very day of The Great Halvening, everybody will finally realize how underpriced BTC is, and they will all rush to buy it. In droves. With their unemployment checks.” Following @joe007’s tweet, many people didn’t care for his speculative attitude. He replied to them saying:

It’s one thing being bullish, quite another being drunk on hopium and buying into nonsensical narratives. Not that I care, really. Everyone is free to donate their money to the cause of their own choosing.

Weiss Ratings: ‘A Rare Trigger Event Is About to Unleash a New Cryptocurrency Superboom’

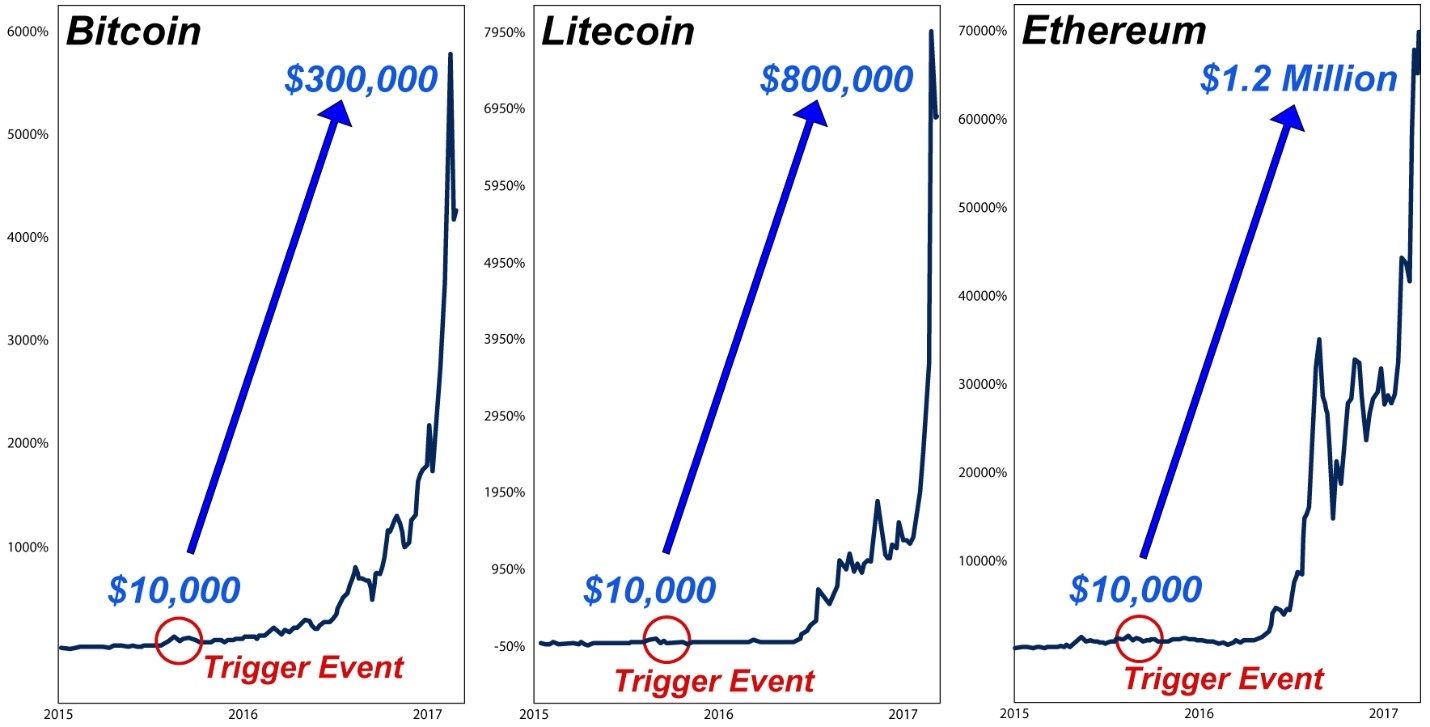

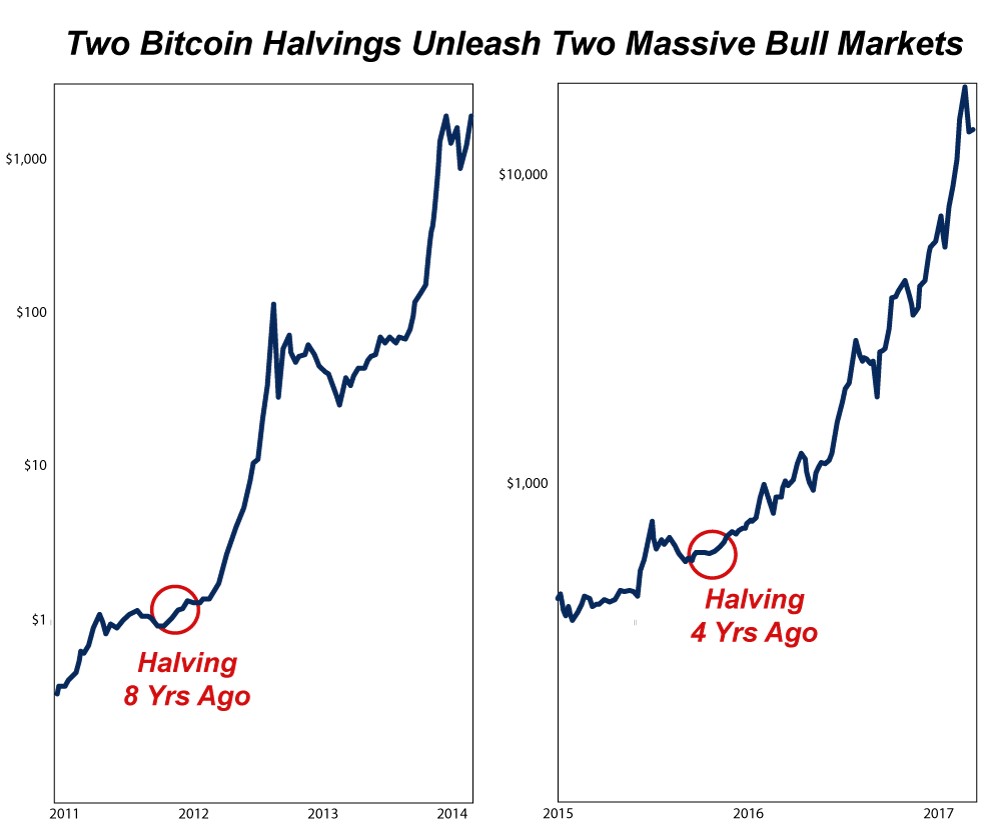

Despite the bitcoin pundit’s opinion, many other investors and think tanks believe the halving will catapult BTC’s price northbound. The founder of Weiss Ratings, Dr. Martin Weiss recently revealed his opinion of the aftereffect of BTC’s next halving. Weiss Ratings has been around for quite some time, and the researchers have developed a web portal called Weiss Cryptocurrency Ratings. The website gives cryptocurrencies different grades like you would get in school from an A+ rating to an F. Weiss says historically, the BTC halving has “unleashed a historic bull market in cryptocurrencies, creating massive wealth for investors.”

The doctor further noted that leveraging the team’s “Crypto Timings Model” and “Crypto Ratings Model” would lead to avoiding low-rated cryptocurrencies. A cryptocurrency with an overall B+ rating would be the best crypto assets to research. Weiss explained that if Villaverde’s Crypto Timing Model existed years ago, anyone could have turned $1,000 into $1.5 billion by investing. For this halving event, Weiss stressed investors should purchase the “best” if Villaverde’s Crypto Timing Model says to buy and sell when the model indicates you should sell.

The report written by Dr. Martin Weiss states:

A rare event will soon trigger a massive cryptocurrency superboom, sending Bitcoin and other select coins to new, all-time highs.Because this trigger event is built right into the code. No government, no organization, and no group of individuals, no matter how rich or powerful can prevent this trigger from being pulled. And every time this event has occurred in the past, it has always unleashed a historic bull market in cryptocurrencies, creating massive wealth for investors.

When asked if the term “massive wealth” was an overstatement, Weiss said that it really wasn’t. “It’s actually an understatement,” the doctor replied. “If you bought bitcoin during the last trigger event, you could have multiplied your money more than 30-fold … turning every $10,000 invested into more than $300,000,” Weiss added.

Right now, in the eyes of many, the halving is a big deal but a lot of investors think it will be a non-event as well. Crypto proponents are also aware that there is a lot of money invested in stablecoins at the moment, as a decent amount of those funds could find their way into markets like ETH, BTC, or BCH. In the last 30 days, BTC prices are up 20% and the firm Tether has issued $1 billion stablecoins this past month. In fact, the USDT crypto market cap is half of the size of XRP’s market valuation, as USDT’s cap is steadily advancing toward the third-largest position.

What do you think about the upcoming Bitcoin halving? Let us know in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Glassnode, finance.weisscrypto.com

Disclaimer: This article is for informational purposes only. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer