Bitcoin (BTC) continues to lead the popularity contest among the top cryptocurrencies — but it has fewer addresses with actual coins in them than Ethereum.

According to data from on-chain market analyst Glassnode, Bitcoin has almost three times as many daily active addresses as Ethereum (ETH), 11 times more than Litecoin (LTC) and 140 times more than Ripple (XRP).

Source: Glassnode

Bitcoin is growing faster than others

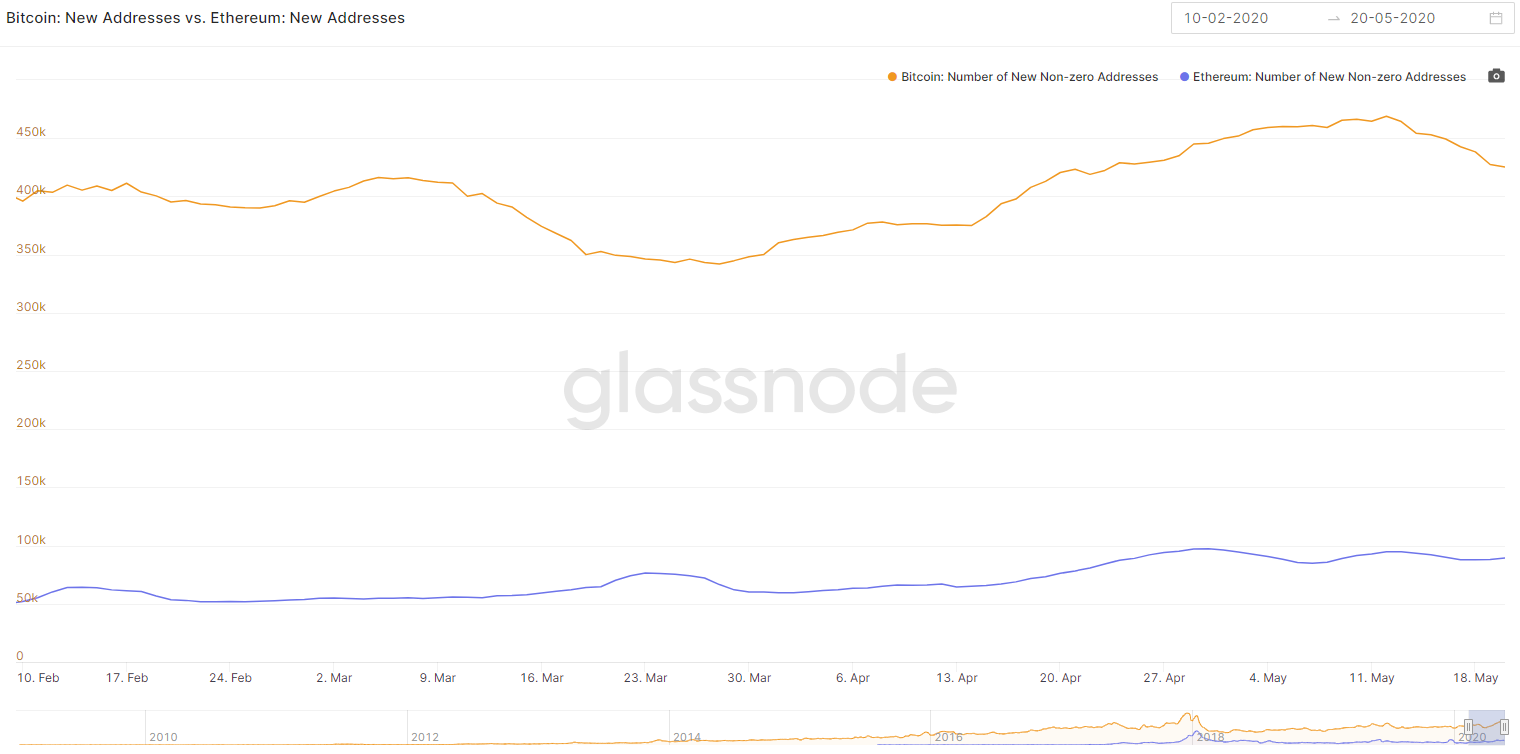

The number of new Bitcoin addresses being created each day is almost five times that of Ethereum. New Bitcoin addresses reached almost 470K in 24 hours, the day after the Bitcoin halving, in contrast to Ethereum increasing by only 90K new addresses daily

Source: Glassnode

The number of addresses holding more than 0.1 BTC and more than 1 BTC also reached ATHs of 3,053,970 and 815,698 respectively.

📈 #Bitcoin $BTC Number of Addresses holding 1+ coins just reached an ATH of 815,698.000

Previous ATH of 815,615.000 was observed on 19 May 2020

View metric:https://t.co/s7tx1xxyz3 pic.twitter.com/nQDG2DsAUz

— glassnode alerts (@glassnodealerts) May 20, 2020

Is it true growth?

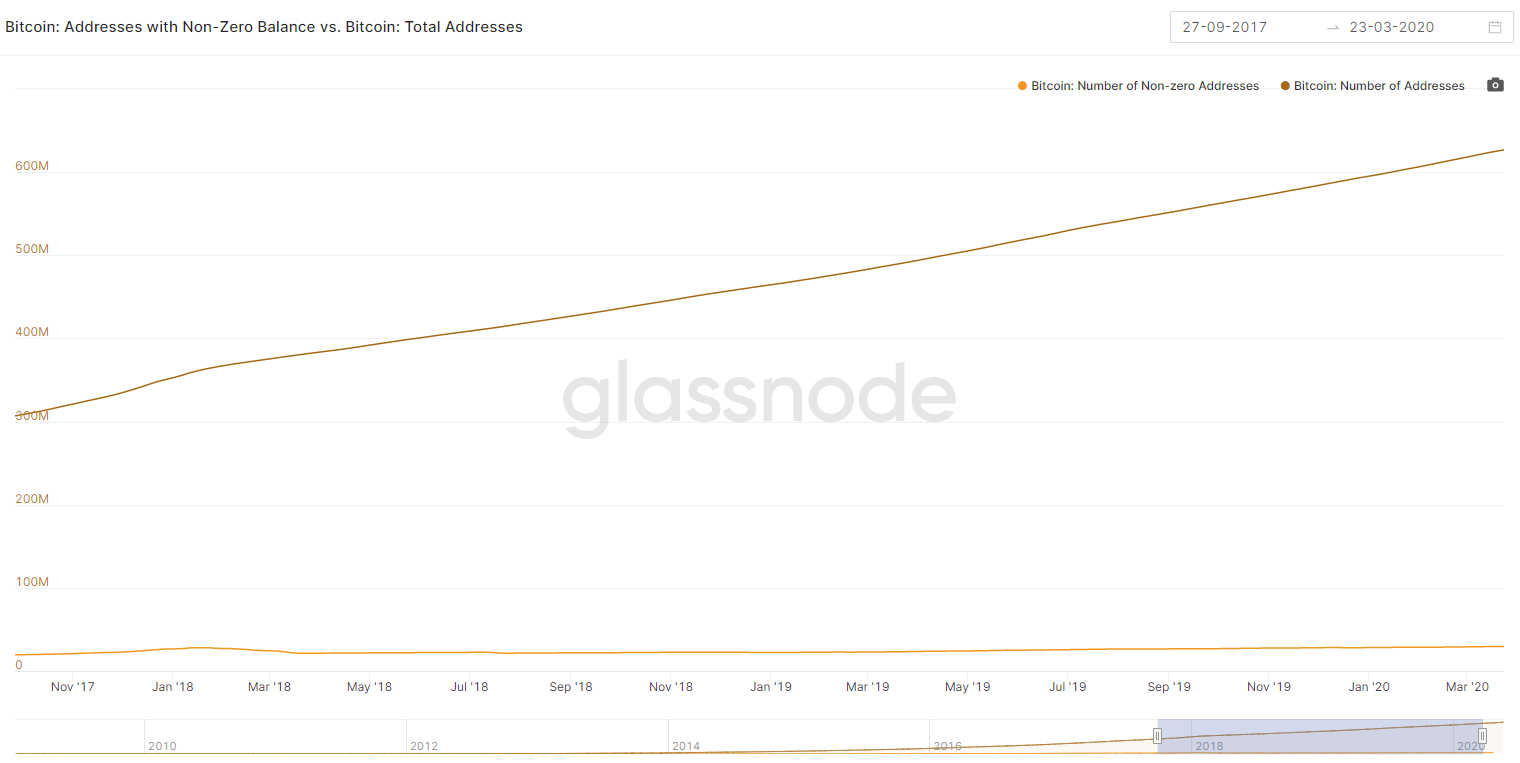

However, 95% of the total number of Bitcoin addresses in existence — 626 million — hold zero Bitcoin. This calls into question the state of the network’s true growth.

Source: Glassnode

Ethereum is looking positive

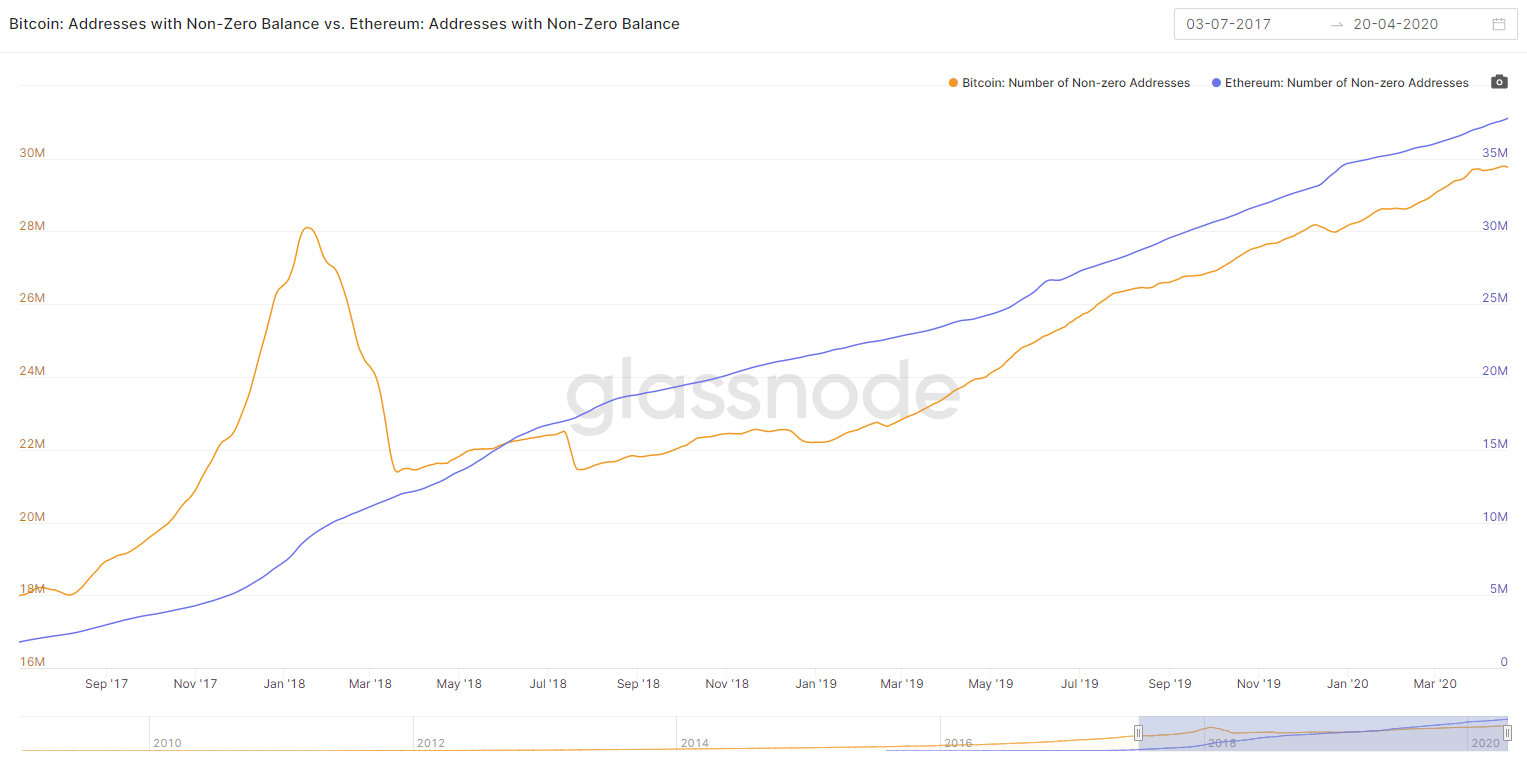

Following the 2017/2018 bull run, millions of Bitcoin addresses were emptied to zero on multiple occasions, however the number of Ethereum addresses with a positive balance continued to grow at a steady rate.

Since February 2019, Ethereum has overtaken Bitcoin in the number of ‘non-zero’ addresses and currently has almost 10 million more than Bitcoin. The need to keep addresses with small amounts of Ethereum for gas may account for some of the difference.

Source: Glassnode

The number of active wallets to non-zero wallets on Bitcoin and Ethereum sit at 3% and 0.8% respectively. Considering Ethereum has millions more addresses with tokens in them, but only one third of Bitcoin’s active addresses, it suggests that small hodlers and network users are more inclined to invest in Ethereum while large hodlers and traders are more likely to invest in bitcoin.