- Bitcoin has been struggling to find any strong momentum throughout the past few days, with bears rapidly gaining control over its price action

- This trend has not yet been enough to invalidate the cryptocurrency’s technical strength, but it does seem as though it may strike a blow to its macro uptrend

- Until BTC can enter a price discovery mode and break above its all-time highs, there’s a strong possibility that it will soon see some serious near-term downside

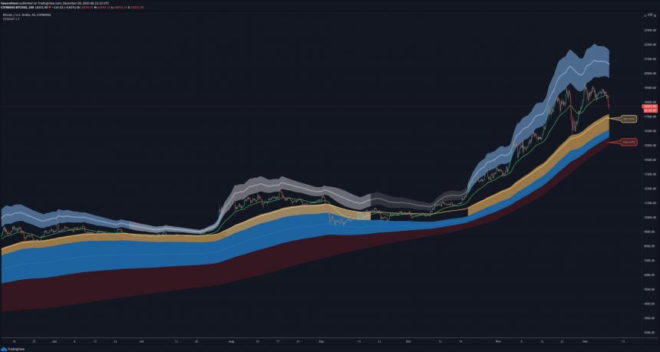

- One trader is pointing to a historically accurate indicator that seems to suggest further downside could be imminent

- He notes that a move towards the price region between $16,500 and $17,500 marks an ideal buy-zone

Bitcoin has been creating shockwaves for the entire crypto market throughout the past few days and weeks, with its inability to set fresh all-time highs causing it to see multiple selloffs and multiple consolidation bouts.

If this trend persists in the mid-term, it could mean that the cryptocurrency is bound to see a stronger decline that ultimately spurs enough buying pressure to spark a new wave of buying activities that send it racing past its highs.

One indicator is suggesting that this price region exists between $16,500 and $17,500. A break below this region could lead to significantly lower prices, including $12,500.

Bitcoin Shows Signs of Weakness as Momentum Fades

At the time of writing, Bitcoin is trading down marginally at its current price of $18,300.

Before yesterday’s decline, the cryptocurrency was attempting to gain a strong foothold above $19,000. This has marked a pivotal level for BTC in the past.

However, the break below this level led it to see some serious losses, with its decline reaching as far as $17,600.

This Indicator Suggests BTC has Yet to Visit Its Key Buy-Zone

One trader explained in a recent tweet that he is closely watching to see how Bitcoin reacts to the price region between $16,500 and $17,500.

He believes that this is a crucial region to watch, as one indicator suggests that this will be where its descent slows in the mid-term.

“EMASAR buy zone is $16,500 – $17,500 with the stop at $15,900. If that doesn’t hold I’ll be looking to reenter at $12,500 – $14,000 due to critical weekly levels. That being said I still have 50% of my spot long that I’ll hold as long as structural / trend support holds.”

Image Courtesy of Tyler D. Coates. Source: BTCUSD on TradingView.

Where the entire market trends in the mid-term will depend on Bitcoin, making it crucial that the benchmark crypto gains some near-term momentum and begins rising higher.

Featured image from Unsplash. Charts from TradingView.