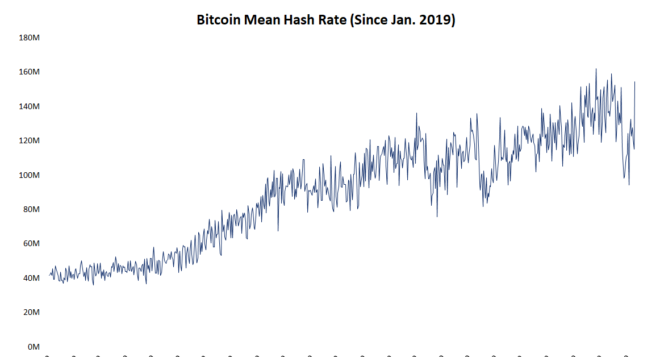

Bitcoin’s hashrate bounced 30% Wednesday from quarterly lows on Nov. 2 as miners brought ASIC machines back online after relocating them out of China’s Sichuan province as the wet season ended in late October, as CoinDesk previously reported.

Bitcoin’s mining difficulty registered a record-setting percentage decrease on Nov. 3 – the largest since the advent of ASIC miners – as bitcoin miners shuffled their machines around the globe to access cheaper power causing the network’s hashrate to drop considerably.

A “large percentage” of all machines taken offline through the end of October are back online, said Alejandro De La Torre, vice president at Poolin, in a direct message with CoinDesk Wednesday. “There are, of course, some that may take longer,” he added, but most of the relocation process – typically a brief two-week period – is finished.

For most miners, the migration process is not very difficult, said Ethan Vera, co-founder of Seattle-based mining company Luxor Technology, in a conversation with CoinDesk about miners migrating from Sichuan to Inner Mongolia, Xinjiang and other regions. “Most miners can un-rack, drive them over and re-install in less than two weeks,” he said.

Miners return to Inner Mongolia, Xinjiang, Tibet and other regions to tap into “fossil fuel, wind, or geothermal” power sources in those regions, De La Torre explained.

But this year’s miner migration is different from previous years. According to Vera, “Some Chinese miners have decided to move out of China altogether.” He named Iran, Kazakhstan and Venezuela as popular, low-cost mining destinations. “The Chinese are getting very comfortable with hosting their miners in [Iran and Kazakhstan] with local partners,” Vera told CoinDesk.

The rapid increase in hashrate should continue over the next couple of weeks, said Qingfei Lei, CMO at F2Pool. “Most of the rigs are back online, but not all of them,” Lei said, noting that he expects more hash power to return since “some rigs in transit are still offline.”

The returning hash power is helping to clean out Bitcoin’s previously congested mempool, a sort of holding depot for transactions awaiting confirmation by miners. The volume of transactions filling the mempool neared two-year highs on Oct. 28, reaching the highest unconfirmed transaction count since January 2018. Following the return of hash power, mempool transaction count has returned to somewhat normal levels through early November.

A positive difficulty adjustment is expected as the network reacts to the surge in temporarily inactive hash power, said De La Torre. Estimated to happen on Nov. 16, the increase would start the network’s rebound following the record-setting difficulty drop two weeks prior on Nov. 3.

At the current block pace, the adjustment is expected to be above 6%, Vera told CoinDesk. But he thinks it’s likely to reach a more-than-8% increase.