Before the emergence of crypto exchanges and trustless multi-sig, early bitcoiners saw the need for an escrow service – a mediator to act as a go-between for strangers transacting online. Given the panoply of options now available, it is strange to think that escrow was once provided by a few early supporters, who put their reputation on the line to give buyer and seller the protection they desired. So, how did the first bitcoin escrow service come about?

Also read: Bitcoin History Part 22: The New Wealthy Elite

“Bitcoin Escrow?”

2010 was a watershed year for Bitcoin. Back then, when it was still possible to mine the currency on a humble home computer, we witnessed the first block size debate; bitcoin acquired its famous logo; Laszlo Hanyecz purchased a couple of pizzas with the currency; the first mining pool, Slush, was announced; and Satoshi observed that Wikileaks had “kicked the hornet’s nest” by seeking to raise funds in the nascent crypto. The enigmatic Nakamoto’s final message on the bitcointalk.org forum came a day later, on December 12.

The introduction of a makeshift bitcoin escrow service is arguably just as notable an event as any of the aforementioned milestones. As was invariably the case in those days, the topic was raised on a bitcointalk forum thread, with an anonymous poster asking “Does anyone currently offer this service? I am looking to offer this amongst the payment methods for bitcoin.”

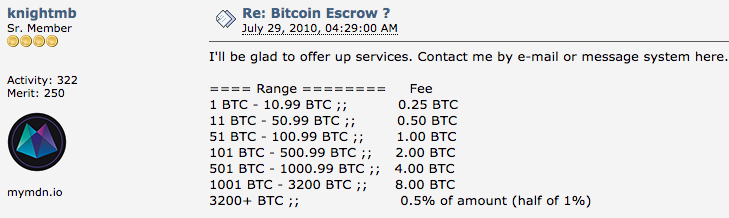

It didn’t take long for other forum members to wade in and assume the role of neutral middleman – in return for a 50 BTC fee. “There’s probably some market in it, who knows?!” said Xunie. If only he realized just how big a market that would turn out to be.

Current forum operator Theymos, who had been bequeathed moderator duties by Satoshi himself, had a different proposition, saying he would personally act as an arbitrator for “1% of the bitcoins to be transferred.” Theymos elaborated on his offer: “In case there’s a dispute I can’t solve, I’ll favor whichever party can provide me with the most detailed personal information that I can verify is actually correct (a certificate signed by a trusted CA would be ideal). Then I’ll give that info to the losing party so that they can attempt to find the other person and use the legal system.”

The Importance of Escrow in the Pre-Exchange Era

Back in the pre-exchange era, escrow was a sorely absent element from day-to-day crypto transactions. Trading bitcoin for something else was not altogether uncommon, but to do so over the web, with someone you didn’t know in real life, required complete trust. This was in the days before 2-of-3 wallets, where users could have a third party own partial keys to a wallet – as is now commonly used on sites like Localbitcoins and local.Bitcoin.com.

The fact that a bitcointalk OG like Theymos responded so enthusiastically to the idea attests to the acknowledgement that escrow was the next step in Bitcoin’s evolution. While there are a great many things that differentiate Bitcoin (and crypto, generally) from the traditional financial system, a trustworthy escrow service was clearly needed. Without it, parties would never gain confidence in the security of any trade. After all, bitcoin transactions are irreversible.

Although many members of the forum pitched in and offered to act as an escrow, the original problem – namely that two parties were entrusting a stranger to facilitate their transaction – remained. However, it was a more innocent age and the sense of community was palpable on the famous forum. Besides, with no reputable bitcoin escrow service available in 2010, using a third party with whom you might be familiar was seen by many as the next best thing. Bitcoin might be trustless, but in its early days, mutual trust was integral to its growth.

Bitcoin History is a multipart series from news.Bitcoin.com charting pivotal moments in the evolution of the world’s first cryptocurrency. Read part 22 here.

Images courtesy of Shutterstock.

Did you know you can verify any unconfirmed Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin address search to view it on the blockchain. Plus, visit our Bitcoin Charts to see what’s happening in the industry.