The amount of Bitcoin stored on exchanges is “continuously plummeting,” according to a new report from CoinTelegraph.

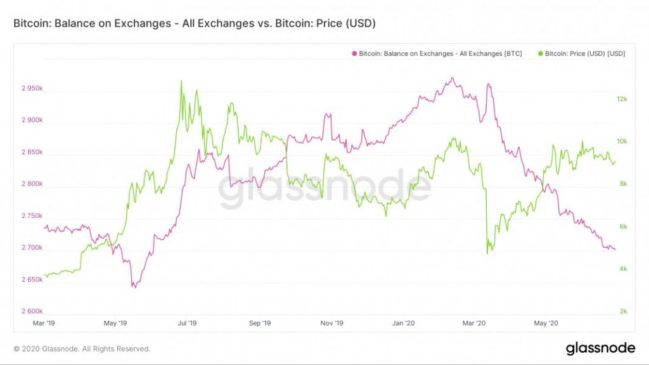

Indeed, since Crypto’s ‘Black Friday’ in March, when the price of Bitcoin swiftly fell from over $9,000 to nearly $4,000, data from Glassnode shows that the amount of Bitcoin that traders are storing in cryptocurrency exchange accounts has fallen to the tune of $2.85 billion (from 2,950,000 BTC to 2,700,000 BTC.)

What’s causing the decline? Analysts say that there are several factors at play: firstly, decreased trust in cryptocurrency exchanges–after all, this month has seen both the indictment of the four BitMEX co-founders as well as the arrest of OKEx founder Star Xu.

More importantly, however, the decrease in the amount of BTC on exchanges could be indicative of a decline in the number of BTC hodlers that are willing to sell their coins.

“Bitcoin accumulation has been on a constant upwards trend for months.”

Indeed, Glassnode said a large part of the Bitcoin supply is stored in so-called “accumulation addresses”, which are digital wallets that BTC has been moved into and never out of: “Bitcoin accumulation has been on a constant upwards trend for months. 2.6M $BTC (14% of supply) are currently held in accumulation addresses. Accumulation addresses are defined as addresses that have at least 2 incoming txs and have never spent BTC.”

Crypto Twitter commentator @Oddgems also wrote on Saturday that “more and more #Bitcoin getting out from exchanges and most probably being transferred to non-custodial wallets. This suggests slightly lower liquidity and lower selling pressure going forward.”

More and more #Bitcoin getting out from exchanges and most probably being transferred to non-custodial wallets.

This suggests slightly lower liquidity and lower selling pressure going forward.

Source @glassnode pic.twitter.com/tBTRWV7yY6

— Oddgems (🅑) 🏝️🤘🏼 (@oddgems) October 17, 2020

Suggested articles

Turning Challenges into Opportunities: A Conversation with Tickmill’s Carla NemrGo to article >>

Additionally, at press time, Bitcoin’s “Fear and Greed” Index was tipped toward “greed,” which indicates that Bitcoin hodlers could be taking steps to sustain and build their reserves of BTC.

Bitcoin Fear and Greed Index is 55 – Greed pic.twitter.com/9P9yuviytn

— Bitcoin Fear and Greed Index (@BitcoinFear) October 18, 2020

Bitcoin hodlers are hoarding coins as market indicators show bullish trend

This kind of BTC-hoarding behavior has also been happening among institutional Bitcoin investors. Last week, Stone Ridge announced a $115 million investment into Bitcoin; earlier this month, Square announced a $50 million BTC investment. Business intelligence firm Microstrategy announced a $425 million Bitcoin investment at the end of September.

The news of BTC shortages on exchanges coincides with BTC hitting its least volatile point in months, according to data from crypto analytics firm Skew.

Who said bitcoin was volatile?

Bitcoin realized volatility drifting back towards historical lows – moved < 2% daily over the last 10 days pic.twitter.com/XFflXjjNC5

— skew (@skewdotcom) October 21, 2019

Historically speaking, periods of low volatility tend to precede substantial price movements. Earlier this year, David Waslen, co-founder and chief executive of HedgeTrade, told Finance Magnates that “generally speaking, a drawn-out period of low-volatility price consolidation will lead to a huge move on either side.”

“The longer the consolidation persists, the more violent the breakout or breakdown will end up being,” he explained.