It has been a rocky past couple of weeks for Bitcoin. The cryptocurrency was able to surge as high as $12,400 just a couple of weeks ago before it lost its momentum and began plunging lower, ultimately hitting lows of $9,900 before bouncing higher.

This has done little to offer insight into its near-term outlook, although it has elucidated underlying strength amongst the crypto’s bears.

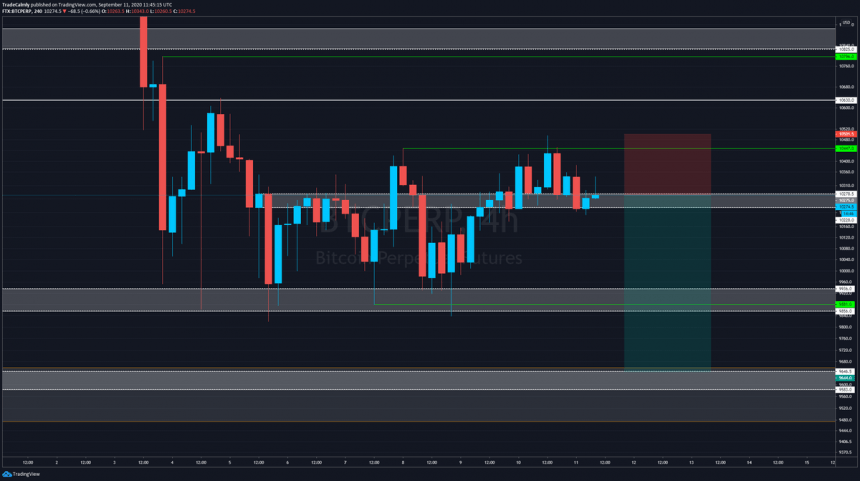

One analyst is now noting that he is flipping short on BTC, hoping to trade a move down to $9,600. He indicates that this fresh technical weakness has come about due to the selling pressure at $10,500 it faced yesterday.

This recent price action has also had interesting impacts on crypto investors, as data shows that market sentiment remains incredibly mixed, with traders and investors growing increasingly bearish when it comes to where Bitcoin may trend in the near-term.

A confluence of technical weakness and unclear directional bias amongst investors may plague Bitcoin’s near-term outlook and help fuel another sharp move lower.

Bitcoin Investors are Becoming Less Bullish as BTC Hovers at $10,000

At the time of writing, Bitcoin is trading down roughly 1% at its current price of $10,270. This marks a notable decline from recent highs of $10,500 that were set around this time yesterday.

Overnight, bulls did defend the $10,200 level on a few occasions, but this isn’t a notable support level and is unlikely to support BTC’s price if it faces an influx of selling pressure.

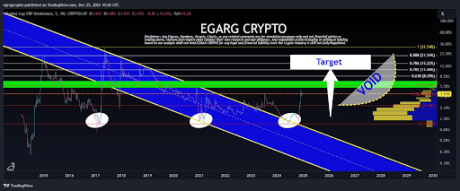

Analytics platform CryptoQuant explained in a recent tweet that their Estimated Leverage Ratios show that market sentiment is growing uncertain, with some previously bullish investors beginning to flip short.

“According to the Estimated Leverage Ratios, the BTC market sentiment remains uncertain. Traders are conservative in their directional bets,” they said while referencing the below charts.

BTC’s Technical Strength Degrades Due to Rejection at $10,500

While speaking about Bitcoin’s mid-term technical outlook, one analyst explained that he is eyeing further downside for the cryptocurrency in the near-term.

He is specifically watching for a move towards $9,600, which is where it has some strong support.

However, he also notes that a break above the resistance that has been established around $10,500 could be enough to invalidate this technical weakness.

“Bitcoin – Doesn’t look like I’m going to get filled before another low, so I’ll go ahead and take this trade here,” he said while pointing to the chart seen below.

Image Courtesy of Calmly. Chart via TradingView.

The confluence of waning investor sentiment and mounting technical weakness may help catalyze a sharp BTC decline in the near-term.

Featured image from Shutterstock. Charts from TradingView.