When Craig Wright formed an alliance with CoinGeek founder Calvin Ayre to launch a hostile takeover of the Bitcoin Cash (BCH) network, the two men predicted that their BCH implementation — Bitcoin SV (BSV) — would quickly accrue near universal support among miners due to its allegedly miner-friendly protocol specifications. This support would be so comprehensive, they boasted, that the other BCH would quickly cease to exist. Actual events, of course, took a very different turn, and before long, BSV’s backers had resigned themselves to pursuing “Satoshi’s original ‘original vision’” on yet another independent blockchain.

Now that the dust has settled, Bitcoin Cash and Bitcoin SV have similar hash rates, though BCH has accumulated 28.9 percent more proof of work since the fork. Notably, though, there is a stark contrast in the economics of mining these two networks, both of which continue to utilize the SHA-256 hashing algorithm.

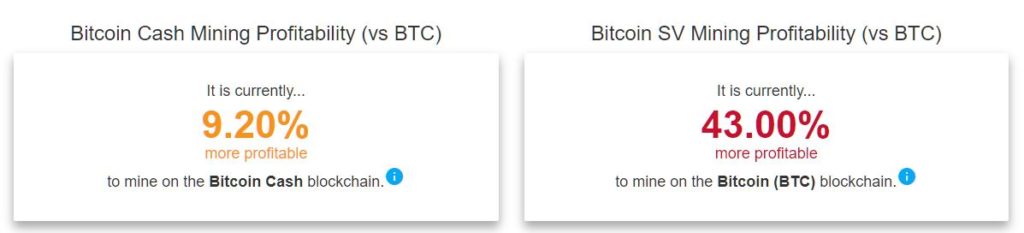

Taking coin price, network difficulty, and block rewards into account and using Bitcoin (BTC) as a baseline, Coin Dance estimates that BTC is a full 43 percent more profitable to mine than BSV, meaning that BSV miners are throwing away significant revenue by continuing to mine this blockchain — much as they mined at a loss in the aftermath of the fork.

That’s more than a bit ironic, considering that BSV was supposed to be the miner-friendly implementation of BCH, which itself positioned itself as the miner-friendly alternative to BTC.

Speaking of Bitcoin Cash, despite its post-fork price collapse, BCH is currently the most profitable of the three major Bitcoin iterations, at least for miners. At present, BCH is 9.2 percent more profitable than BTC — even after its recent difficulty reduction — making it around 47 percent more lucrative for miners than BSV.

Of the three networks, Bitcoin’s is not only the most secure but also features the most decentralized hash rate. BTC’s largest mining pool, BTC.com, accounts for 16.5 percent of the blocks mined over the past week (BTC.com is owned by Bitmain, which also owns AntPool. Together, these pools possess 30 percent of the hash rate). Bitcoin Cash, in contrast, features two Bitmain-linked mining pools — ViaBTC and BTC.com — that collectively manage around 56 percent of the BCH hashrate. BSV is also quite centralized, with CoinGeek’s mining pool accounting for 36.1 percent of the hash rate and SVPool — which is operated by Craig Wright’s firm, nChain — possessing another 20.8 percent.

For all their talk of on-chain scaling, BCH and BSV continue to process much smaller blocks than BTC. As of the time of writing, most BTC blocks were approaching the maximum block weight of 4 MB. BCH, with its 32 MB block size limit, was averaging blocks around 50 KB, while BSV — which Craig Wright claims will process blocks up to 1 TB within two years — was averaging less than 13 KB per block.

Featured Image from nChain/YouTube

Get Exclusive Crypto Analysis by Professional Traders and Investors on Hacked.com. Sign up now and get the first month for free. Click here.