An escalating trade war between the world’s two most powerful economies is paving the way for a broader bitcoin adoption, at least according to Grayscale Investments, LLC.

The New York-based asset management firm on Thursday published a report wherein it recommended fund managers to consider adding bitcoin to their portfolio as a measure against the ongoing US-China trade tensions. Calling the cryptocurrency “an exciting financial technology and investment opportunity,” Grayscale said it has the potential to act as a hedge against an impending economic crisis.

“With continued adoption, Bitcoin represents a transparent, immutable, and global form of liquidity that can provide both wealth preservation and growth opportunities. As a result, we believe it deserves a steady strategic position within many long-term investment portfolios,” – the report read.

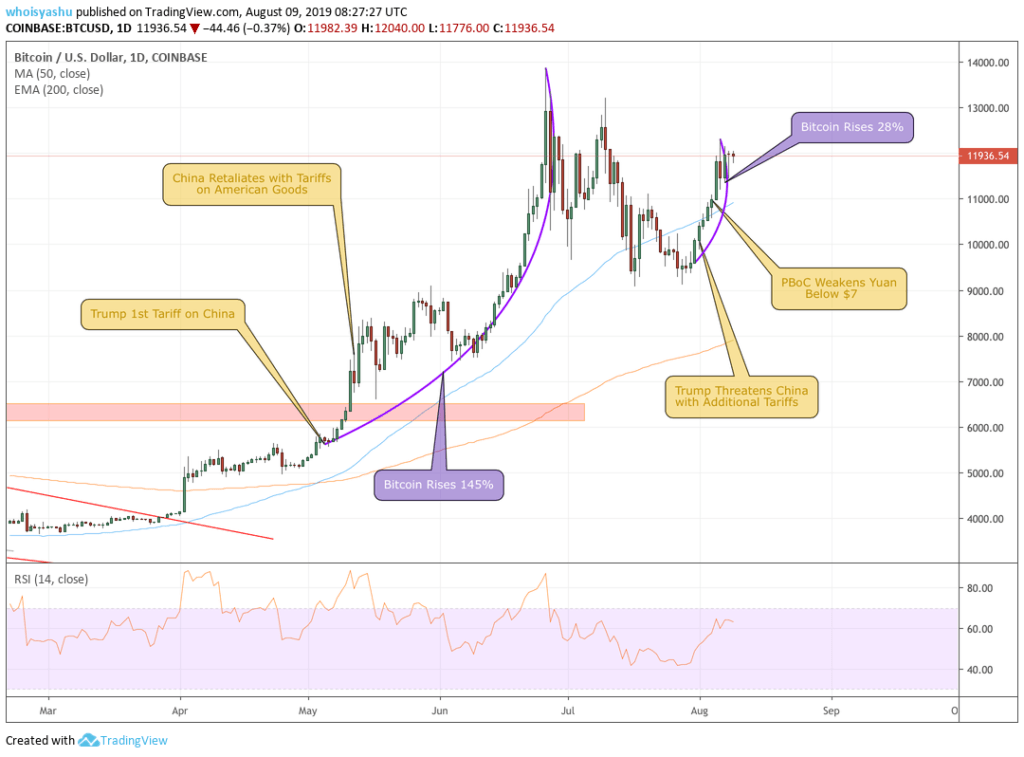

Inverse Correlation

The Grayscale study surfaced more than a week after the US President Donald Trump threatened to slap an additional 10 percent tariffs on Chinese imports worth $300 billion. On Monday, the US branded China as a currency manipulator after the latter weakened the value of its national currency – the Chinese yuan – beyond $7 as a retaliation against Trump’s tariffs threat.

The tit-for-tat tactic did not help the global market sentiment. On Wall Street, stocks experienced their worst day of the year after Trump’s tweet. That, in turn, followed an overnight sell-off in European and Asian markets. Haven assets like gold and bitcoin were the only saving grace, each rising impressively against otherwise weaker market sentiment.

Grayscale wrote that the global market’s drawdown is not looking to end in the near-term. The US and China combined represent 40 percent of the world’s global economic output, with control over $35 trillion worth of Gross Domestic Product (GDP). With the two superpowers not reaching a settlement, and Trump hell-bent in taking a deal of his choice out of a stubborn China, the global equity market is looking at the prospects of facing the next recession.

“Certainly, escalating trade tensions through higher tariffs and restricted access to markets is hurting sentiment, increasing costs, damaging supply chains and weakening corporate profitability,” Reuters cited James Knightley, the chief international economist at ING. “This then feeds through into consumer sentiment and spending more broadly in the economy with recession risks mounting.”

Bitcoin, Meanwhile

Grayscale believes bitcoin could provide a soft pad for investors trying to protect themselves from the US-China trade war.

The cryptocurrency’s upside swings following Trump’s anti-China tweets reflected its potential role as a hedging instrument. And while the skeptics doubt bitcoin can be a store of value due to its intrinsic price volatility, its gains show investors don’t care about the classic financial definitions anymore. They just want to try the cryptocurrency out. Grayscale weighs:

“While the risk asset drawdown is still in its very early stages, Bitcoin is on the rise as these risks are just beginning to show up in other asset and currency prices. Since Trump first announced the tariff hike in May, Bitcoin has generated a cumulative return of 104.8% through August 7, versus an average of -0.5% for the twenty other asset classes, markets, and currencies below during the same period.”