Many crypto enthusiasts love to hype the ever elusive altcoin season (“altseason“), which has long been hailed as one of the most profitable bitcoin market cycles for active cryptocurrency traders.

When the season is in full swing, larger altcoins like Ethereum, Ripple, and even small-cap assets like Pundi X exponentially rise in value against bitcoin. Traders who catch the trend early can grow their bitcoin holdings in a relatively short period of time.

There’s money to be made during an altseason. However, empirical data shows that simply being a bitcoin maximalist pays off in the long-run. This is particularly true for retail traders who have little to no experience trading volatile assets.

Blue Chips and BTC Outperform Small Caps Over a Three-Year Period

Earlier this week, VanEck digital asset strategist Gabor Gurbacs Gurbacs took to Twitter to reveal his firm’s latest findings on the performance of digital assets over various time periods.

VanEck expanded into the cryptocurrency space through its MV Index Solutions (MVIS), which offers clients exposure to various indices. These include bonds, countries, hard assets, digital assets, sector assets, and specialty assets.

In the digital asset space, the firm’s CryptoCompare Digital Assets 10 Index (MVDA10) includes the ten largest cryptocurrencies. This index has outperformed the CryptoCompare Bitcoin Index (MVBTC) over the last 3 years. The MVDA10 is also way ahead of the CryptoCompare Digital Assets 100 Small-Cap Index (MVDASC) which is composed of 50 small crypto tokens such as Pundi X, Huobi Token, and Hshare.

Over a three-year timeline, the MVDA10 (blue chips) is up by 2,837 percent. While the MVBTC and the MVDASC are up by 1,928.2 percent and 1,243.8 percent, respectively:

1/2 Over the past 3 years, #Bitcoin and blue chips significantly outperformed small caps in the digital asset space.

+ Bitcoin ($MVBTC:) + 1,928.2%

+ Blue Chips ($MVDA10): +2,837%

+ Small Caps ($MVDASC): +1,243.8%

Data:@MVISIndices,@CryptoCompare pic.twitter.com/UojThkOEdh— Gabor Gurbacs (@gaborgurbacs) July 3, 2019

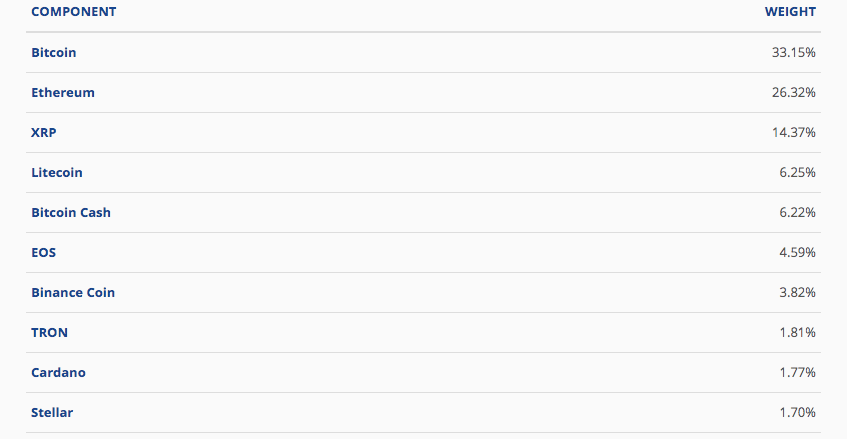

Although the blue chips index is way ahead of the pack, a closer inspection reveals that bitcoin represents more than a third of the basket. The MVIS gave it a weight of 33.15 percent. Ethereum was a close second at 26.32 percent. Ripple is in third place, at just below 15 percent of the index. The firm assigned a weight that’s less than 30 percent to other large-cap digital assets.

Bitcoin Carrying the Digital Asset Space Over the Last 12 Months

Gabor Gurbacs also shared on Twitter that in the past year, the CryptoCompare Bitcoin Index (MVBTC) has “left both blue chips and small caps in the dust.” The MVBTC has grown by 71.5 percent while the blue chips (MVDA10) has gone down by 6.5 percent and the small caps (MVDASC) has plummeted by 64.6 percent.

2/2 Over the past 1 year, #Bitcoin left both blue chips and small caps in the dust within the digital asset space.

+ Bitcoin ($MVBTC:) +71.5%

+ Blue Chips ($MVDA10): -6.5%

+ Small Caps ($MVDASC): -64.6%

Data: @MVISIndices,@CryptoCompare pic.twitter.com/BANNX72n9r— Gabor Gurbacs (@gaborgurbacs) July 3, 2019

Bottom Line: Bitcoin Remains the King of the Hill

This new research confirms the thesis that bitcoin is a safe haven as a store of value in the long-term. While the blue chips index outpaced the bitcoin index over a three-year window, the fact that bitcoin has the highest weight in the blue chips basket reveals that the king of cryptocurrencies is doing a lot of the heavy lifting.

In addition, the MVBTC is the only index among the three that’s in the green over a 12-month timeframe. Consequently, the blue-chip index should be deep in the red – just like the small-cap basket – if not for bitcoin’s stellar performance over the last twelve months.

Turns out that unless you’re a professional trader, simply parking your capital in bitcoin might be the best way to maximize your crypto investment.

Click here for a real-time bitcoin price chart.

Live Crypto News Show