By CCN: Adamant Capital’s Tuur Demeester, an outspoken crypto analyst and proponent of Bitcoin, said on Twitter that using the flagship cryptocurrency’s blockchain will eventually be as expensive – and rare – as chartering an oil tanker.

Even the simple act of opening a Lightning Network channel will be cost-prohibitive and potentially slow once the network user base climbs into the billions.

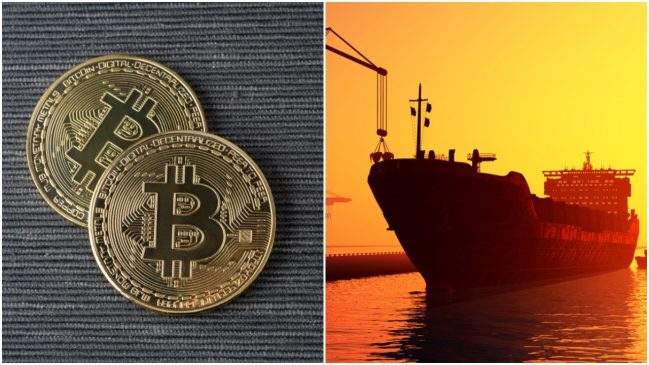

Bitcoin’s Blockchain Is Like an Oil Tanker – You Won’t Use Either of Them

At full maturity, using the Bitcoin blockchain will be as rare and specialized as chartering an oil tanker. https://t.co/lu1ORzrTjF

— Tuur Demeester (@TuurDemeester) May 29, 2019

Demeester then backed off his original statement a little and qualified it by saying he was talking about a situation where the majority of the world is using Bitcoin – which, of course, is what many bulls anticipate will happen.

In such a scenario, the demand for limited block space will skyrocket. On-chain scaling will eventually have to be considered, many assume. Even some “small blockers” admit that ultimately, the amount of transactions in each block has to increase. In other words, Bitcoin needs to become more efficient.

A few notes given the backlash. This statement assumed:

– Billions of Bitcoin users

– Ossification of Bitcoin Core, i.e. no further on-chain scaling

As neither is a given, I should have said “may” instead of “will”. https://t.co/HSsOEo0Ncl— Tuur Demeester (@TuurDemeester) May 30, 2019

Even opening individual lightning channels would take years for 7b+ people. Bitcoin block chain is the reserve asset and ultimate settlement of a new finance system. Direct use will be ridiculously expensive and that is ok.

— Tamas Blummer (@TamasBlummer) May 29, 2019

Bitcoin can act as a gateway drug for new crypto users, but if they’re going to stay, they’ll have to find the systems usable. At scale, even full Lightning adoption could prove expensive for the average user to afford. Rather than opening their own “payment channels,” as expected, most people would utilize a third-party service.

What Is The Real Cost of Bitcoin Mass Adoption?

Does this lead to increased centralization? It’s a question of cost versus convenience.

While many allege that some block size increase will one day be necessary, it’s mostly a question of when. Should it be when 1 million organic transactions are waiting in the mempool regularly? Ten million? More?

The average fee might increase, and that may be a natural market, but if on the whole people find BTC to be “slow,” they might consider the alternatives.

Bitcoin transaction fees have climbed considerably along with the BTC price. Some analysts believe they will one day be so expensive that the average user never actually makes an on-chain transaction. | Source: BitInfoCharts

Whether Bitcoin manages to scale efficiently or not, mass adoption of 1-3 billion people would significantly change the way people think about the power of crypto.

Suddenly everyone accepts and offers cryptocurrency. This scenario doesn’t make sense in a context which only allows for one cryptocurrency to “survive.” It’s far more likely that a variety of cryptocurrencies would be thriving, with Bitcoin on top as usual.

Some blockchains have cemented demand by partnering with companies to provide services. Others continue to grow under vibrant development communities. On-chain gambling is all the rage. These alternatives are fast and capable of handling many thousands of transactions per minute. It’s unlikely that they won’t see equivalent increased demand as the market expands beyond the 1, 2, and 3 billion user marks.

Bitcoin would still be “expensive” by some standards even if you doubled the block size now. However, easing congestion will eventually become a network effect question. If Bitcoin can expand its user base and therefore its interest from miners, investors, and the like, then it’s perhaps worth the effort to increase the maximum amount of usage at a given time.