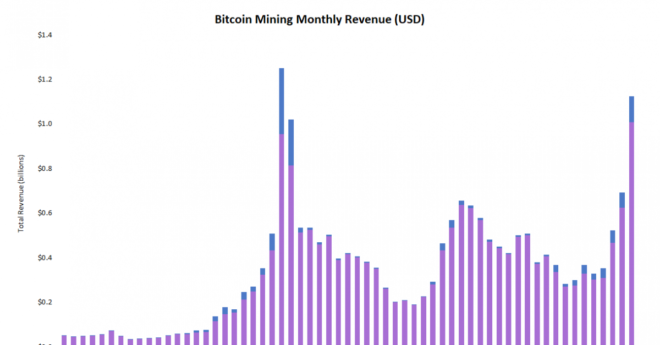

Bitcoin miners generated an estimated $1.1 billion in revenue in January, up 62% from December, according to on-chain data from Coin Metrics analyzed by CoinDesk.

The surge in revenue came as bitcoin‘s price climbed from $29,000 to just below $42,000 in the first half of the month before levelling off through the last two weeks.

Revenue estimates assume miners sell their BTC immediately.

Measured by per terahash per second (TH/s), miner revenues bounced between $0.2 and $0.27 for most of the month after peaking near $0.32 early in the month, per data from Luxor Technologies.

Network fees brought in $116 million in January, or over 10% of total revenue, a slight percentage increase from the 9.8% of revenue represented by fees last month. Fee revenue hit its highest mark since January 2018, per Coin Metrics data.

Fees measured in dollars were quite volatile in January, with average transaction costs bouncing between $5 to all the way to above $16 throughout the month, per Coin Metrics.

Notably, fees as a percentage of total revenue continues a strong upward trend since April, prior to the network’s third-ever block subsidy halving in May. Increases in fee revenue are important to sustain the network’s security as the subsidy decreases every four years.

Despite calls by some investment professionals like Guggenheim’s CIO Scott Minerd that bitcoin’s price currently is too high, miners eye a continued phase of strong revenue. Around the world, bitcoin miners continue buying more mining machines and are beginning to receive and deploy ASICs pre-ordered last year as they act on plans for continued expansion.