Bitcoin miners used to be the biggest cryptocurrency dumpers when its price traded near all-time highs. Nevertheless, their sentiment has changed drastically in the latest price rally.

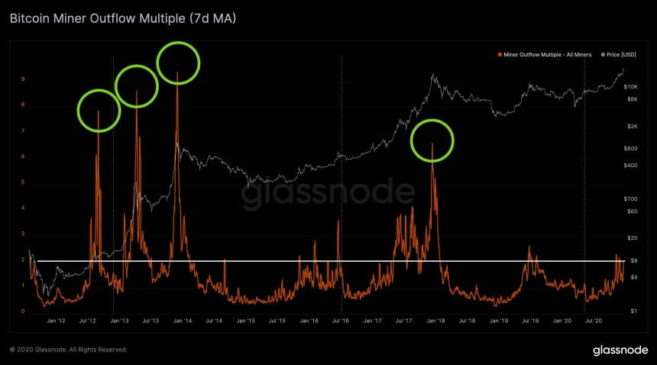

Data fetched from Glassnode, an on-chain market intelligence platform, shows that miners are not spending their Bitcoin than usual. It took cues from its proprietary indicator known as the Miner Outflow Multiple, which measures Bitcoin withdrawals from miners’ wallets on a seven-day average.

The readings on it showed miners spending BTC above the known historical average but not as much as they did during the previous highs.

“The Miner Outflow Multiple, which shows when BTC miner outflow is high with respect to its historical average, is far from previous tops and even below the 2019 local top,” commented Glassnode.

The Mining Psychology

Miners are at the forefront of Bitcoin production. They verify and add blocks to Bitcoin’s blockchain and, in return, receive bitcoin rewards. They prefer to sell those units in the open market to pay for their operational costs (mining equipment, electricity, etc.).

Meanwhile, miners also turn into investors by deciding to hold a portion of their Bitcoin rewards to speculate on their value. Their decision effectively reduces the cryptocurrency’s supply in the retail market. That plays an instrumental role in determining the BTC/USD price per the fluctuating demand.

A higher Bitcoin price gives miners plenty of reasons to sell-off their holdings. That happened in 2019 when BTC/USD reached a yearly high near $14,000. That also happened in 2017, when the pair closed towards $20,000.

Bitcoin price is trading near its all-time high of $24,300. Source: BTCUSD on TradingView.com

But in 2020, miners are showing relatively lesser interest in dumping their positions even as BTC/USD has closed above $24,000 for the first time in history. So it seems, many of them want to hold onto their BTC investments. That paints a bullish picture for Bitcoin based on Supply Deficit.

When more miners decide to hold Bitcoin instead of selling them, it creates a supply deficit. That should automatically improve the cryptocurrency’s bullish bias against a booming demand among institutional investors.