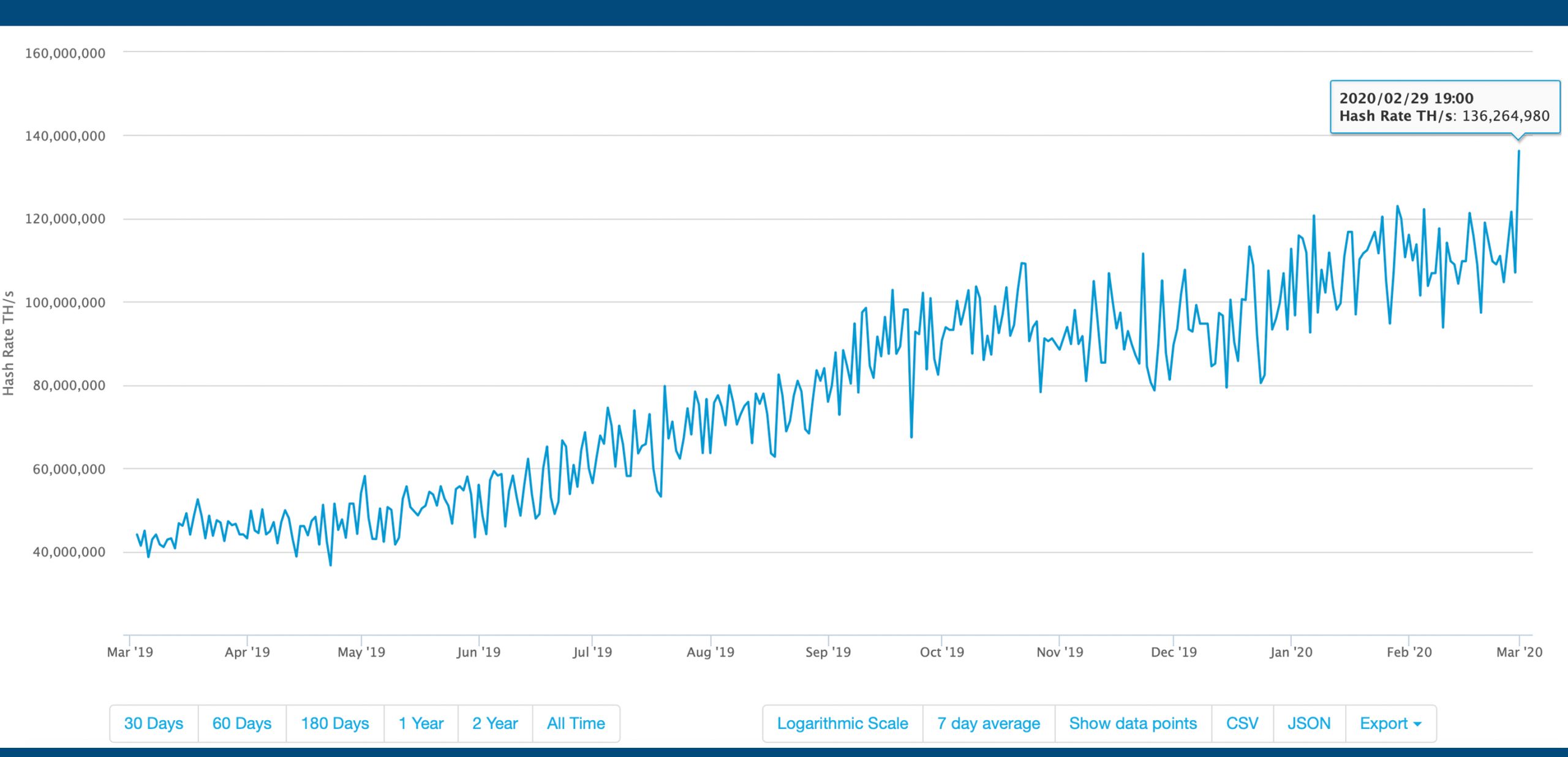

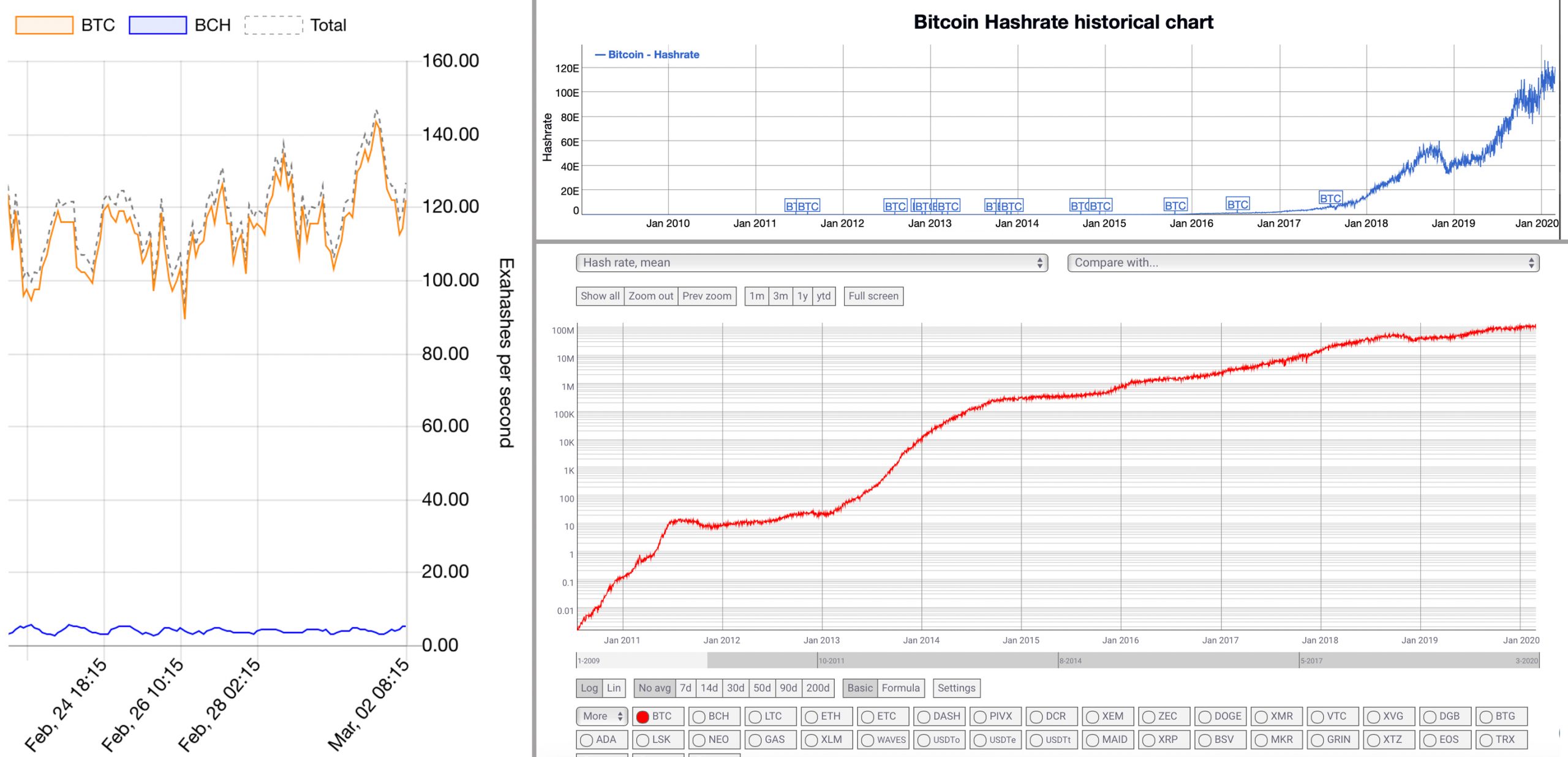

On Monday, March 2, miners processing blocks on the BTC network surpassed the network’s all-time high as the overall hashrate touched 136 exahash (EH/s). The record-breaking achievement happened despite the price of BTC dropping below the $9K region throughout the course of the last week. In four years’ time, BTC’s hashrate has risen over 13,500% and it doesn’t look like slowing up anytime soon.

Also read: 13 Crypto Debit Cards You Can Use Right Now

BTC’s Hashrate Between 136-145EH/s on Monday

Since the innovative payment network Bitcoin was invented, the hashrate has always been an indicator of security and the network’s overall wellbeing. Essentially, a hash is the output of a hash function applied to the Bitcoin software. When bitcoin miners are searching for blocks they leverage their processing power (hashrate) in order to increase their chances of acquiring freshly minted coins. The overall hashrate combined, meaning all the processing power between all the participating miners on the Bitcoin network, is basically the estimated measurement of how many hash functions are used in order to find a block. At the end of January 2016, the BTC network touched one exahash per second (EH/s). Since then, the hashrate has increased exponentially capturing 136EH/s on March 2, 2020. Blockchain.com and Fork.lol charts show BTC’s hashrate averages to be between 136 to 145EH/s.

In the last few years, Bitcoin mining investments have been strong and there’s been a number of new mining data centers added worldwide. For instance, the Peter Thiel-backed mining operation Layer1 recently started mining in West Texas. The company raised more than $50 million from investors like Peter Thiel, Digital Currency Group, and Shasta Ventures. Layer1 aims to scale operations to 200MW this year and there are many others in Texas mining as well. Last year, Bitmain revealed it would build a 300MW facility in Rockdale, Texas and started operations with 25MW.

During the second week of February 2020, Riot Blockchain revealed it had purchased 1,000+ Bitmain miners for its data center in Oklahoma. Riot Blockchain’s mine aims to capture 300MW of hashpower as well and the firm said the new batch of miners would be turned on immediately. Even smaller operations are investing in the industry, as this February Xtra Bitcoin announced the creation of a 2.5 MW facility with plans to increase to 10MW. Digihost claims to have a 70,000 square foot operation in Buffalo, New York with 12,895 bitcoin mining rigs (17.5 MW of computing power). New mining operations are popping up in Central Asia, the U.S., Canada, and many other nation-states which are fueling the rising hashrate.

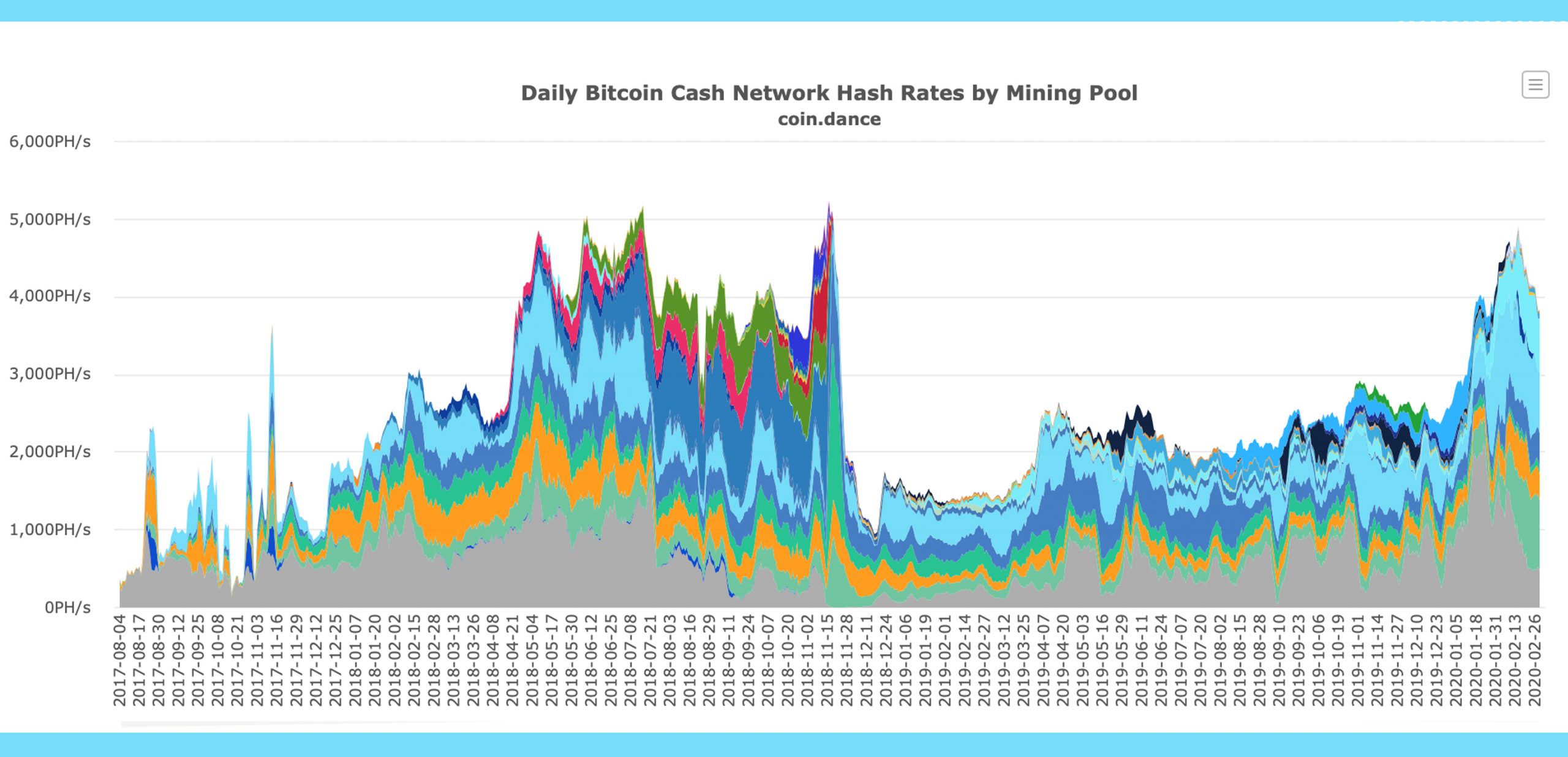

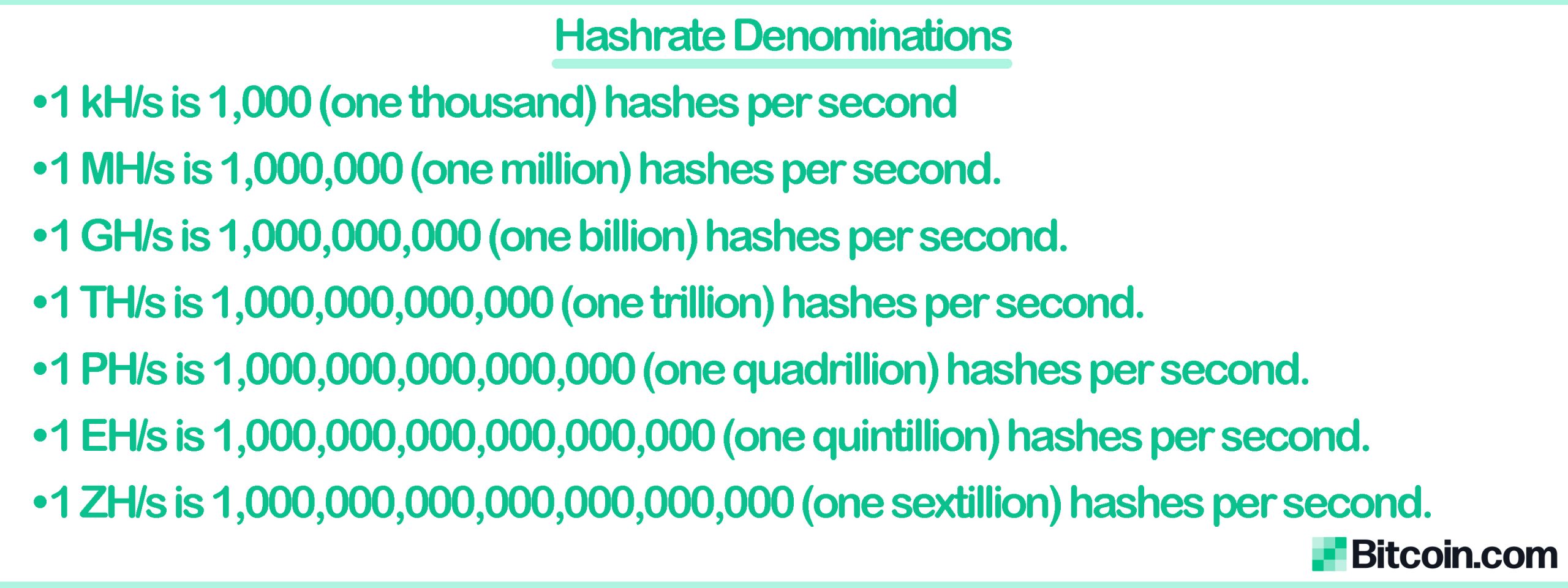

Additionally, other SHA256 networks have seen an increase in hashrate, as Bitcoin Cash (BCH) has jumped from 1EH/s to 3.5-5EH/s, gathering a 400% increase since December 2018. Bitcoin SV (BSV) had around 1.3EH/s in December 2018 and that has expanded 130% to roughly 2.5-3EH/s in 2020. All three of these networks make up the overall SHA256 hashrate, which is one of the largest computational networks ever created. Satoshi Nakamoto launching the BTC network in 2009 has led to the significant advancement in Exascale computing. But people often wonder what an exahash is and all the other funny terms bitcoiners use like kilohash, megahash, gigahash, terahash, and petahash.

The Exahash Era Continues

A kilohash (1 kH/s) is 1,000 hashes per second, one megahash (MH/s) is approximately one million hashes per second, a gigahash (GH/s) is one billion hashes per second, a single terahash (TH/s) equals one trillion hashes per second, and one petahash (PH/s) is a quadrillion hashes per second. When we start measuring the hashrate in exahashes per second (EH/s), it is approximately one quintillion hashes per second. Right now, BTC’s network hashrate is roughly less than a quarter of the way toward reaching the zetahash (ZH/s) era, which is a whopping one sextillion hashes per second or 500 exahash. At 140EH/s, every second of the day the BTC network hashes 20x the number of grains of sand on earth, which is roughly estimated at 7.5 quintillion grains.

The 136-145EH/s record is quite a milestone and every time the network’s hashrate grows larger it makes it much harder to cheat the system. For instance a few minutes ago the mining operation Poolin found block 619845 and if a malicious miner wanted to alter block 619800, the miner would have to work on altering 45 blocks of extremely expensive computing (Proof-of-Work) with a one-hour attack cost of $775,936 at the time of writing. The malicious miner would need to expend around $18,622,461 during the course of a 24-hour period and meanwhile competing against all the honest miners processing the next blocks. Every time an honest miner finds another block it puts the attacker behind significantly, making it very expensive for miners to deviate from the rules.

Many speculators believe that the increased hashrate means that miners wholeheartedly believe in the future of SHA256 networks like BTC. Miners dedicate significant amounts of money to validate transactions in order to acquire 12.5 bitcoins and all the fees tied to the block’s transactions. In two months, all three SHA256 networks will see the network’s block subsidy chopped in half and miners dedicating hash toward BTC, BCH and BSV will only get 6.25 coins plus the fees.

The increase in combined computing power shows these entities have a lot of skin in the game, especially when estimates say BTC miners will need prices to be over $12,000 per BTC after the halving. So far, the BTC network has seen a natural progression of miners increasing the hashrate and there hasn’t been a major miner capitulation in over a decade. After the BTC halving occurs, all eyes will be watching the hashrate going forward as the metric has always been a solid indicator of the network’s overall security and growth.

What do you think about BTC’s hashrate touching between 136-145EH/s on March 2? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Bitcoin.com, Fork.lol, Fair Use, Bitmain Miners, Coin Metrics, Bitinfocharts.com, Coin.dance, Pixabay, and Blockchain.com charts.