Bitcoin’s market dynamic has been shifting over the past week. The CFTC’s pursuit of the BitMEX co-founders has sparked some fear regarding the safety of funds on margin trading platforms that could be vulnerable to regulatory crackdowns in the US.

Although BitMEX – and virtually all other crypto derivatives platforms – are registered offshore and limit US-based IP addresses, the country’s control over the .com infrastructure and international legal reach makes it a force to be reckoned with.

Because of lower than usual trading volumes on margin trading platforms like BitMEX, the market has been less volatile, and less prone to seeing knee-jerk reactions to bearish news.

This may be why Bitcoin’s price has remained strong in the face of multiple bearish news developments, which would typically catalyze far-reaching selloffs.

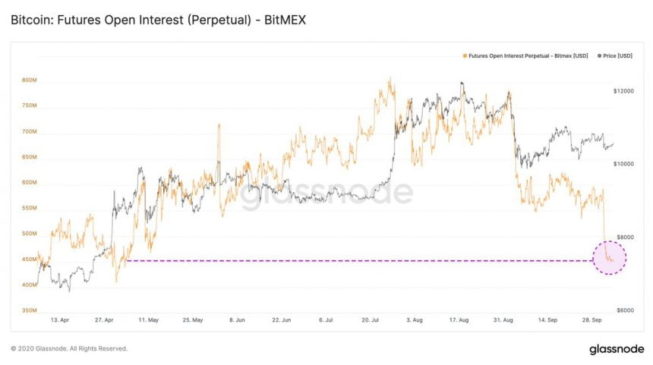

While contextualizing the magnitude of the outflows from BitMEX, analytics platform Glassnode explained that one fourth of the open interest on the platform has been eliminated, bringing the remaining OI down to levels not seen since May.

Bitcoin Stable Despite Recent News Developments

Bitcoin’s price has been shockingly unmoved by the recent news surrounding the $150m KuCoin hack as well as the CFTC’s pursuit of the three BitMEX co-founders.

In the past, these types of news developments have led the markets to see serious selloffs that alter mid-term trends.

That being said, this time was different, as the price action seen following the initial 5% selloff has favored bulls.

BTC is now trading less than 2% below where it was prior to the news reports regarding the BitMEX imbroglio, indicating that it wasn’t a trend-defining event.

BitMEX OI Continues Plunging as Regulatory Concerns Grow

Bitcoin open interest on BitMEX has seen a rash decline in recent days, plunging by nearly 25% due to concerns of funds potentially being locked in the platform if the three co-founders are all arrested, or if the site is seized by authorities.

According to Glassnode, OI is now sitting around $450 million, down from pre-news highs of $590 million.

“Bitcoin open interest in perpetual futures contracts on BitMEX saw a significant decline as well. It decreased by almost 24%, from $590M to currently $450M – levels not seen since May 2020.”

Image Courtesy of Glassnode.

Until there is more clarity regarding BitMEX’s fate, open interest on the platform will likely continue declining, contributing to greater Bitcoin price stability.

Featured image from Shutterstock. Pricing data from TradingView.