There’s an ominous “Death Cross” maturing on the Bitcoin price chart, foretelling a grim outlook for the cryptocurrency soon.

The benchmark cryptocurrency has tumbled aggressively after forming a record high near $41,986 (data from Coinbase) on Friday. At its recent low, it was trading at $30,100 but managed to instill hopes of a bullish revival as traders bought the level, pushing prices above $35,000 as of this Tuesday.

Nevertheless, the intermingling between Bitcoin’s short- and long-term moving averages on a four-hour chart has raised the alarm about a potential bearish continuation ahead.

The cryptocurrency’s 20-period EMA, viewed as a tracker of short-term trends, slipped below its 50-period SMA, seen as an indicator of slightly long-term price patterns. That led to the formation of the Death Cross, a pattern that traders view as a signal to increase their short exposure in the market.

Bitcoin forms the Death Cross pattern on the 4H chart. Source: BTCUSD on TradingView.com

The point where the two moving average waves converge in the chart above capped Bitcoin from extending its rebound move higher. That showed a strong technical confluence of two resistance levels, increasing BTC/USD’s potential to fall short while attempting to close over it.

Additional Factor

Part of the reason was a wobbling US dollar.

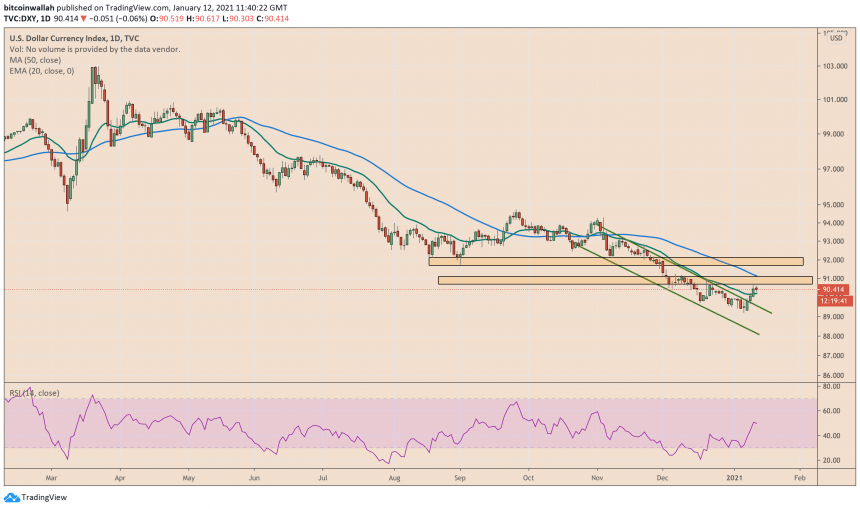

The greenback rebounded sharply from its two-year low in the past six days, pushing an inversely-correlated Bitcoin lower. On Tuesday morning, the US dollar index pared a small portion of its gains, lifting BTC/USD higher. But as the US session neared, the trend showed signs of reversing, resuming sell-off pressure in the Bitcoin market.

US Dollar Index undergoes modest correction after testing its historical resistance range. Source: DXY on TradingView.com

Overall, a confluence of dollar and death cross MA resistances kept Bitcoin from extending its retracement.

Dissenting Bitcoin Bears

Investors nonetheless expected the dollar to resume its downtrend on prospects of additional stimulus from the incoming Joe Biden administration in the US. More greenback liquidity has earlier helped Bitcoin rising from as low as $3,858 to a record high above $41,000 in just nine months of trading.

“This is a big head fake before Biden’s Covid/Stimulus plan,” said Jason A Williams, an independent market analyst, and author.

“HODL. Zoom out. Bitcoin is still up only,” he added.