Many Bitcoin analysts agreed that Bitcoin would stop rallying after its price hits $14,500. The cryptocurrency looked overbought on medium-term timeframes, a technical alert that typically amounts to a downside correction.

But the bearish calls took a backseat on Thursday as Bitcoin extended its upside above $14,500, coming less than a hundred dollars closer to hitting the $15,000-level. A majority of retail traders/investors obviously ignored the “overbought” warnings as hype overtook caution.

Bitcoin was changing hands for as much as $14,945 ahead of the New York opening bell. Its gains, so it appeared, closely followed similar upside moves in the S&P 500 futures, further validating their erratically positive correlation.

Bitcoin-S&P 500 maintains a positive correlation as the former targets $15,000. Source: BTCUSD on TradingView.com

The cryptocurrency and the US benchmark both rose in sync amid the environment of ultralow interest rates and unlimited quantitative easing policies by global central banks. According to the Wall Street Journal, the S&P 500 on Thursday will “log its sharpest rally in a week since April.”

Fundamentals Take the Front Seat

The S&P futures surged 1.98 percent as investors grappled with the prospect of a hub tax reform bill for corporates.

Democratic candidate Joe Biden came closers to snatching the presidency away from his Republican rival Donald Trump. Nevertheless, the Republicans won enough seats to retain control of the Senate, possibly. At the same time, the Democrats gained a strong foothold in the House.

That left the government divided. Investors noted that it would be difficult for Mr. Biden to pass legislation to raise corporate taxes and regulate technology companies. As a result, tech stocks, which now makes up about 18 percent of the S&P 500, surged higher.

WHAT? US election jam bolsters Big Tech as a safe haven.

Tech stocks like Facebook & Alphabet rose more than non-tech peers after neither Trump nor Biden got a quick win. Likely DC paralysis means tech giants should escape most damaging antitrust backlash. https://t.co/b3jkryV05c pic.twitter.com/AI1e0cjNkE— Holger Zschaepitz (@Schuldensuehner) November 4, 2020

Bitcoin traders appeared to have tailed the stock market as they raised their bids for the cryptocurrency. Nevertheless, they ignored that gridlock between the Democratically-controlled US Congress and the Republican-led Senate risked delaying the second coronavirus relief package.

Both Bitcoin and the S&P 500 surged higher this year against a ballooning fiscal deficit. Traders anticipated that the injection of $2.3 trillion liquidity into the market would reduce the US dollar’s purchasing power. That prompted them to move their capital into riskier assets.

Bitcoin Technicals Indicate Divergence

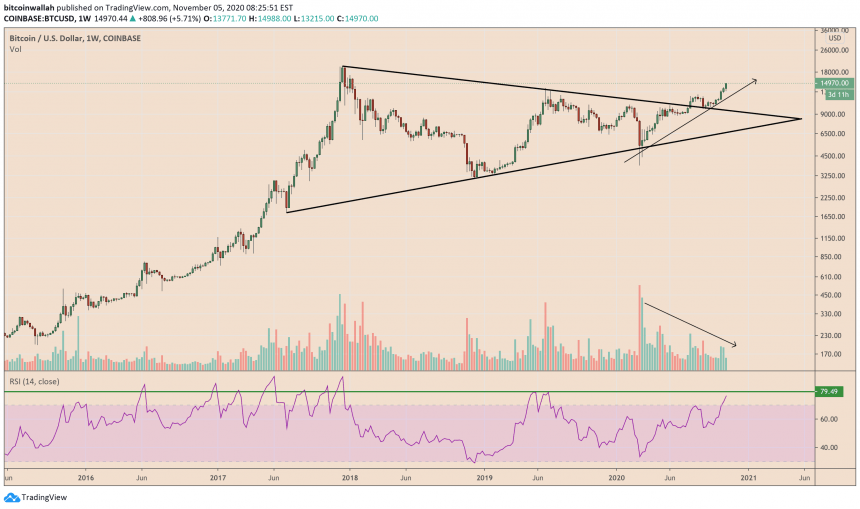

A long-term outlook of the Bitcoin price rally – again – showed the cryptocurrency as overbought – and as an asset whose volume is heading in the opposite direction of its price gains.

Bitcoin hints bearish correction as RSI surges above 70, volume dips. Source: BTCUSD on TradingView.com

The Relative Strength Index, a momentum oscillator, is inching towards a provable deflection level at 79.49. Meanwhile, the weekly trade volume is heading downwards against the rising price. Both the indicators point to an imminent bearish correction ahead.

Should the fall take place, it won’t necessarily mean the end of the Bitcoin uptrend.

Traders with a long-term risk appetite would use the local support levels to repurchase Bitcoin. The global central banks have raised the global debt at an unsustainable 320 percent of the GDP. Also, the lending rates are either near-zero or below it.

That leaves investors with little yields in the cash and bond markets. Bitcoin will likely benefit from that.