Photo: QuoteInspector

Key Highlights:

- The bulls are still in control of the Bitcoin market;

- the Bulls currently have weak momentum;

- the coin may find its resistance at $4,254 price level.

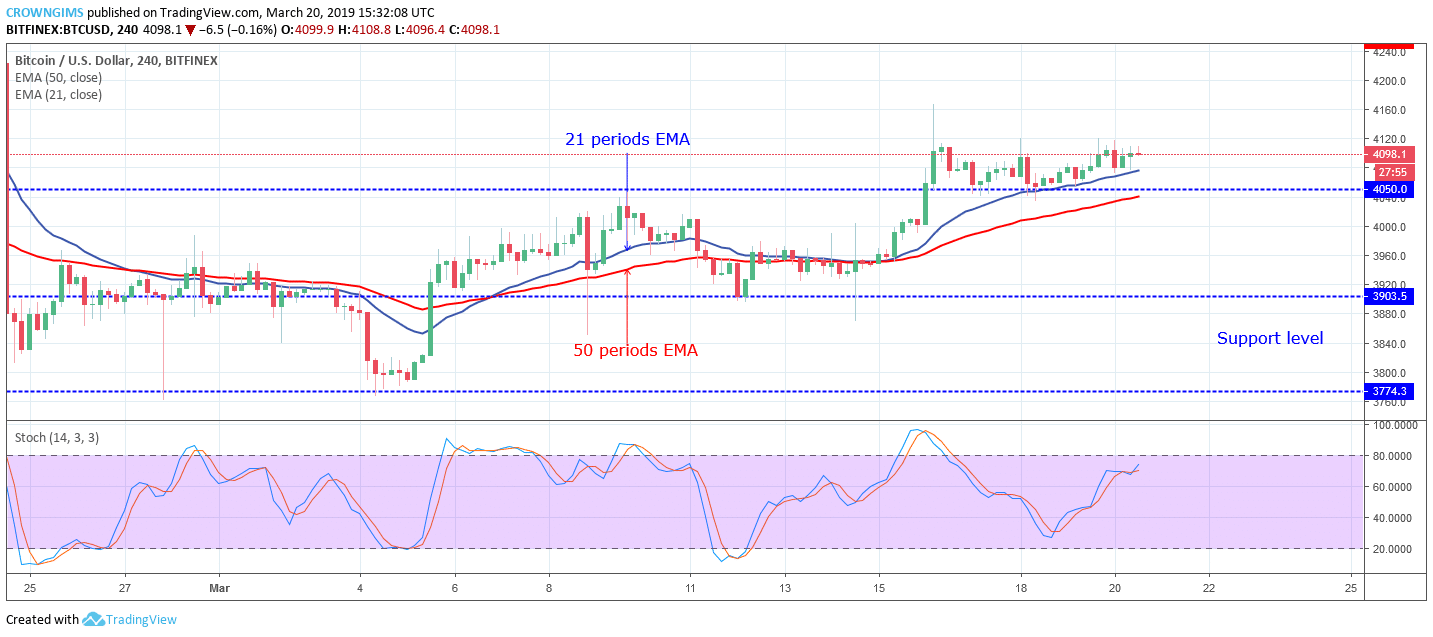

BTC/USD Medium-term Trend: Bullish

Resistance levels: $4,254, $4,692, $4,960

Support levels: $4,050, $3,903, $3,774

BTC/USD is on the bullish trend on the Medium-term outlook. The crypto sustains its bullish trend on the 4-hour chart; as long as the Bitcoin price is above the 21 periods EMA and the 50 period EMA. The Bulls are trying to make significant progress towards the resistance level of $4,254 but the bears’ pressure is opposing the move and that is why the BTC price remains a little distance above $4,050 level.

The 21 periods EMA remains above the 50 periods EMA, the two EMA are at a distance from each other which is a sign of a bullish trend. Bitcoin price is consolidating above the two EMAs which indicate that the Bulls are still in control of the BTC market but with weak momentum. The stochastic Oscillator period 14 is above 60 levels and its signal lines pointing up to indicate buy signal.

Increase in the Bulls’ momentum will make the coin to rally towards the resistance level of $4,254as its target but lose in the Bull’s momentum may lead to further consolidation around $4,050 price level.

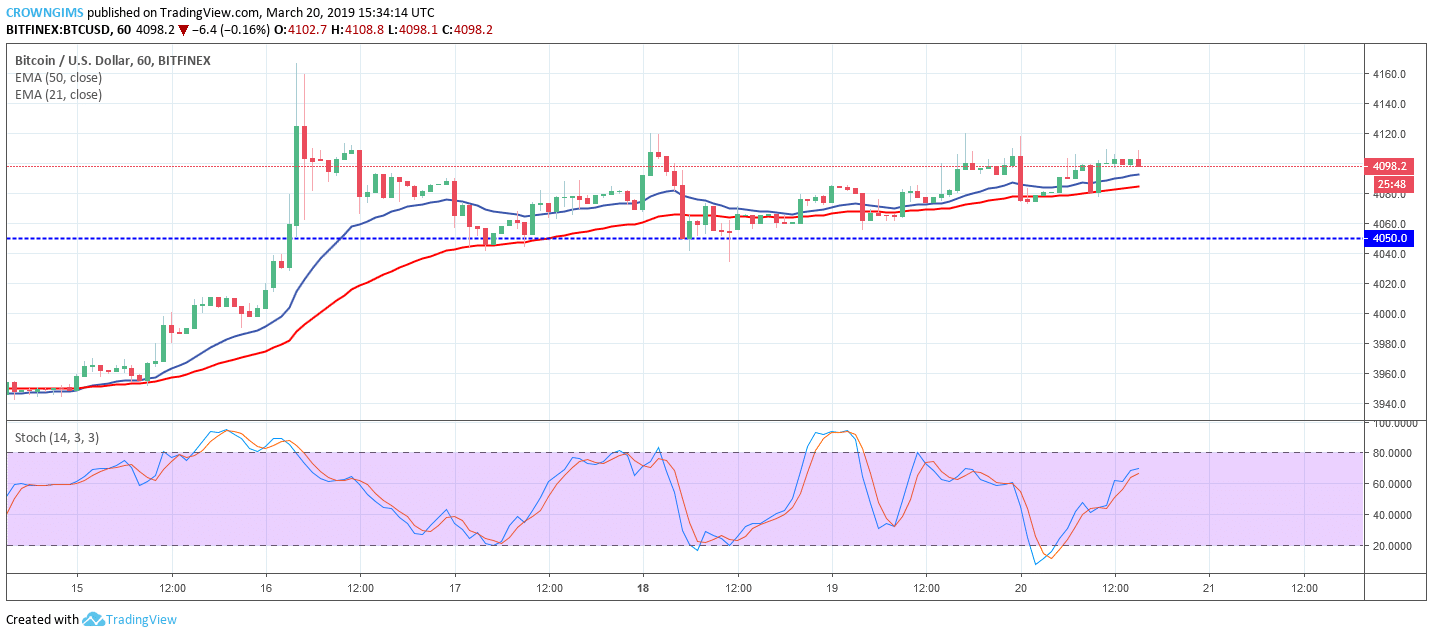

BTC/USD Short-term Trend: Ranging

The BTC/USD is on the ranging trend on the short-term outlook. After the Bulls broke up the $4,050 price level on March 16 and carried out a retest to the broken level, the Bulls’ momentum becomes weak and could not push up Bitcoin price to reach the resistance level of $4,254 and this led to a ranging movement in the BTC market.

The two EMAs are close to each other and the BTC price is currently trading on the 21 periods and 50 periods EMAs which indicate that consolidation is ongoing currently which may continue for a while. The Stochastic Oscillator period 14 is above 60 levels with signal lines pointing up which indicates buy signal.