Key Highlights:

- Consolidation is ongoing on the Bitcoin market;

- break out is imminent;

- traders should remain flat.

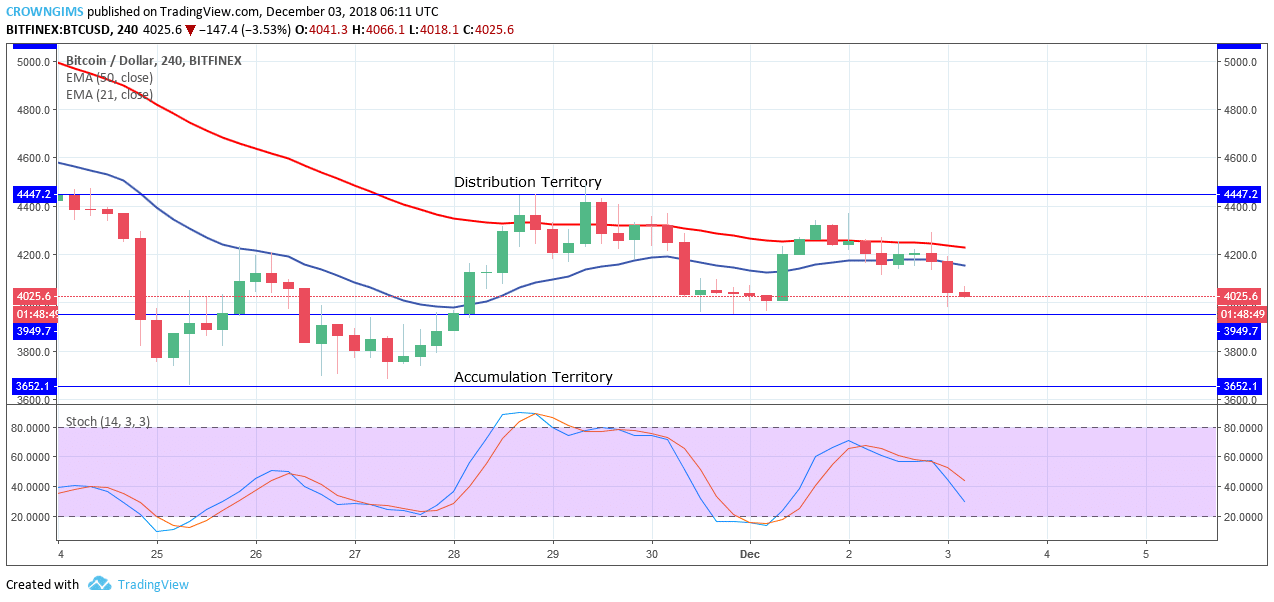

BTC/USD Long-term Trend: Ranging

Distribution Territories: $4,447, $5,084, $5,667

Accumulation Territories: $3,949, $3,652, $3,450Ranging movement in the Bitcoin market on the long-term outlook; on the daily chart above BTC price is consolidating between the key distribution territories of $4,447 and an accumulation territory of $3,949. After BTC price pulled back from the accumulation territory of $3,652, the bulls lost the pressure and could not break the distribution territory of $4,447.

Bitcoin price remains bearish as long as it is contained below the 21-day EMA and 50-day EMA. The Stochastic Oscillator is above 20 levels (oversold region) with the two signal lines interlocked and flat to the level without direction which indicates consolidation is ongoing. In case the accumulation territory of $3,949 is broken by the bears BTC price may have its low between the accumulation territory of $3,652 and $3,450.

Should the bulls defend the $3,949 price level, the Bitcoin price may rally to the north and have its target at $5,084 – $5,667 price level. The traders are advised to watch out for the breakout before taking the position.

BTC/USD Medium-term Trend: Ranging

The Bitcoin price remains below the 21-day EMA and 50-day EMA and the Stochastic Oscillator period 14 is at 40 levels with the signal lines point to the south connotes sell signal in which if the bears increase their pressure and a breakout downside the accumulation territory of $3,949, BTC price may have its low at $3,652 – $3,450.