Bitcoin (BTC) corrected as low as $10,380 before rebounding above $11,000 on June 27 as commentators remain highly bullish about the market’s potential.

Market visualization courtesy of Coin360

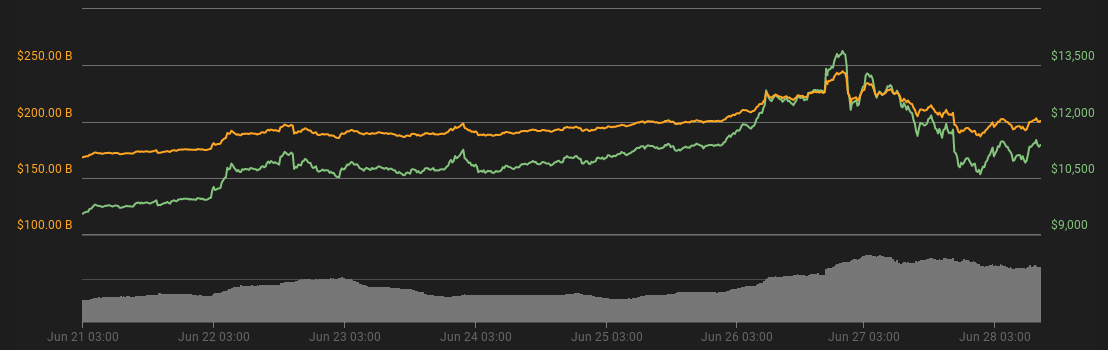

Data from Coin360 showed the bitcoin price dipping down from recent highs of $13,800 in a pullback many had anticipated.

BTC/USD gained rapidly throughout this week and last, adding thousands of dollars over several days before resistance at $14,000 finally checked the speed of the growth.

Estimates had said the pair could go as high as $16,000 before reversing, with Cointelegraph reporting on Thursday that breaking the $13,800 barrier could now prove significant.

At press time, BTC/USD traded around $11,280. According to an increasing number of analysts, the losses seen over the past 24 hours are not only healthy, but reflect previous patterns of price behavior.

Bitcoin 7-day price chart. Source: Coin360

“A 20%-30% pullback would not be surprising and very consistent with bitcoin’s recent bull-market pullbacks,” Robert Sluymer, managing director and technical strategist at Fundstrat Global Advisors, said in a note to clients quoted by ratings agency Weiss Ratings.

Crypto investor and trader Josh Rager went further, suggesting the roughly 20% dip this week could form a new, less volatile pattern for bitcoin.

“18% pullback might be the new 30% pullback we’re expecting,” he summarized on Twitter, comparing this year to the last bull market’s top in December 2017.

Weiss was more bearish, arguing a more intense reversal was still to come.

Altcoins meanwhile continued to lick their wounds after bitcoin’s downward trend saw most tokens hemorrhage value.

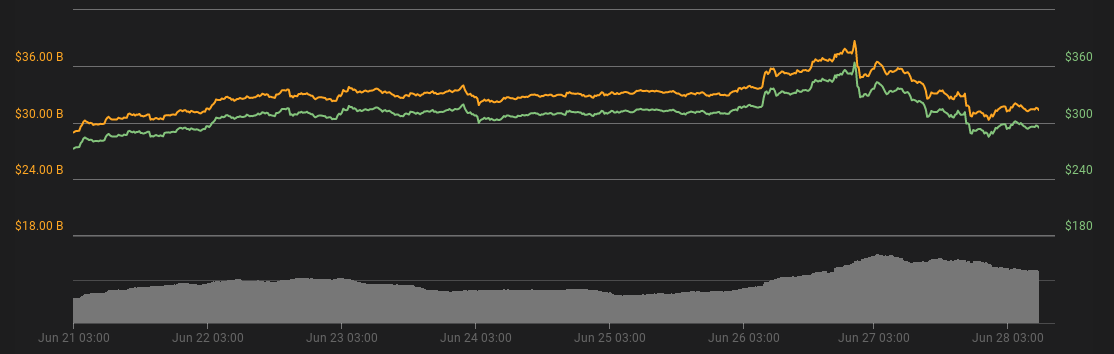

A look at the top twenty cryptocurrencies by market cap sees leader ethereum (ETH) back below $300 on 6.4% daily losses after rising as high as $350.

Ether 7-day price chart. Source: Coin360

Most others behaved similarly, with tron (TRX) and bitcoin cash (BCH) the worst performers on 10.5% losses.