Bitcoin (BTC) regained $8,000 on Oct. 23 after a fresh bearish move canceled out progress towards the top of its trading range.

Cryptocurrency market daily overview. Source: Coin360

Bitcoin rejected at $8.3K

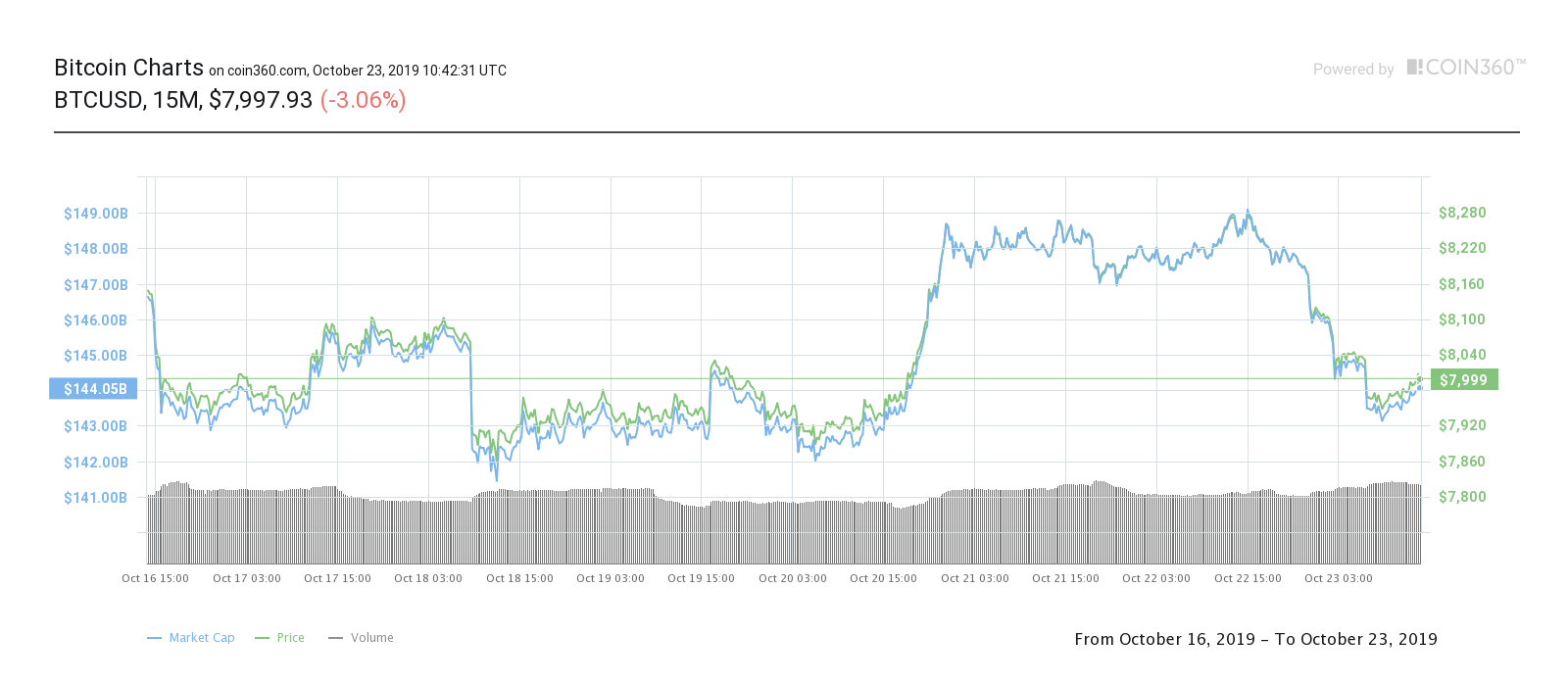

Data from Coin360 showed another frustrating 24 hours for BTC investors, who on Tuesday watched as markets briefly passed $8,300 before tumbling to a low of $7,930.

Bitcoin seven-day price chart. Source: Coin360

The move underscores a familiar pattern for BTC/USD, which remains stuck in a narrow trading corridor. As Cointelegraph reported, analysts believe its range lies between $7,400 and $8,500.

Heavy resistance has meant Bitcoin has so far failed to stay closer towards the top of that range, despite late optimism on Tuesday.

For regular Cointelegraph contributor Michaël van der Poppe, the latest retreat simply signifies a continuation of the status quo.

“Well, Bitcoin says; we’ll continue the ranging and won’t be breaking above $8,300 yet,” he summarized in an update on Twitter.

While price action has underwhelmed since August, proponents have stopped short of calling current conditions a bear market. Retaining coins in the face of a slow grind downwards can test resolve, Van der Poppe added, but this should not be a cause for brash moves.

“Holding through a bear market is hard, however holding through a bull market can even be harder. The fear of missing more profits or the fear of losing it all again (in case of a retrace) are hard to deal with,” he wrote.

Altcoin holders limit fallout

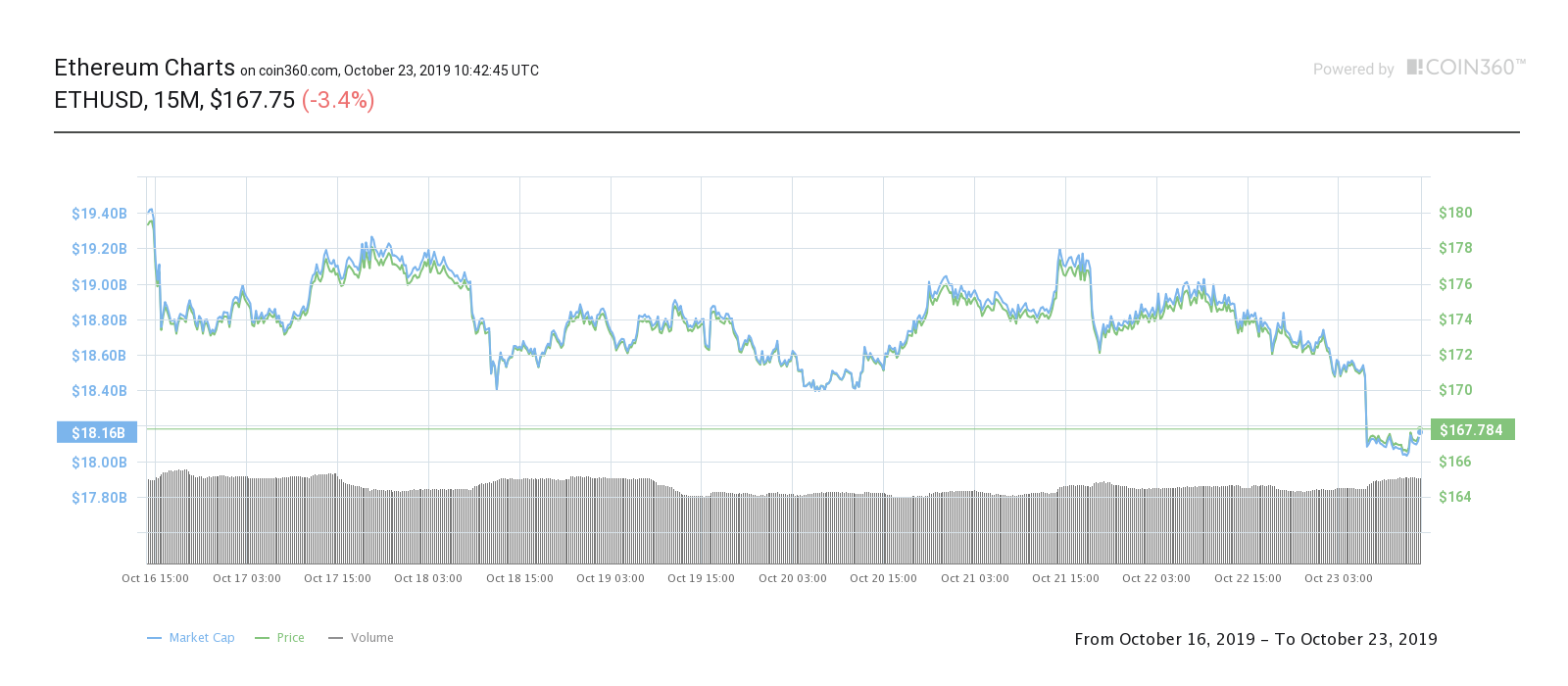

Bitcoin’s 3% daily losses translated into similarly weak performance for some altcoins. Ether (ETH), the largest altcoin by market cap, fell 3.7% to hit $167.

Ether seven-day price chart. Source: Coin360

Some in the top ten fared worse, including both Bitcoin Cash (BCH) and Bitcoin SV (BSV), which shed 4.3% and 4.2% respectively.

Others limited their losses, such as XRP retaining its $0.29 level on the back of a 1.6% dip.

The overall cryptocurrency market cap shed a total of $8 billion overnight to hit $218 billion, with Bitcoin’s share nonetheless still at 66.5%.