Bitcoin price bounced into the green during the European morning session yesterday and hasn’t left the territory ever since.

The bitcoin-to-dollar exchange rate today established an intraday high of $12,794.27 on Coinbase exchange. The move upside brought the pair’s month-to-date returns 19.17 percent higher. But most importantly, the move helped bitcoin break above a crucial resistance area, indicating the asset’s likelihood of retesting its year-to-date highs of $13,868.44.

The bitcoin price rally appeared despite a stronger intraday US dollar sentiment. The greenback on Monday edged up on a stronger-than-expected jobs data. It also seems that traders digested the possibility of the Federal Reserve not to raise benchmark interest rates this month. Former White House Communications Director Anthony Scaramucci said on Sunday that the Fed might delay their plans to make lending cheaper now that the US economy is looking stronger.

Nevertheless, fears of a weaker US dollar remained high after noted economist Arthur Laffer supported the idea of the US government – especially President Donald Trump – taking control of the monetary policies.

“I don’t understand why the Fed is independent, to be honest,” Laffer told CNBC. “Fiscal policy is not independent. Military policy is not independent. Social policy is not. Why should monetary policy, this [very powerful] tool to control the economy not be subjected to democracy just like every other instrument of government?”

Bitcoin Eyeing $13,868.44 Retest

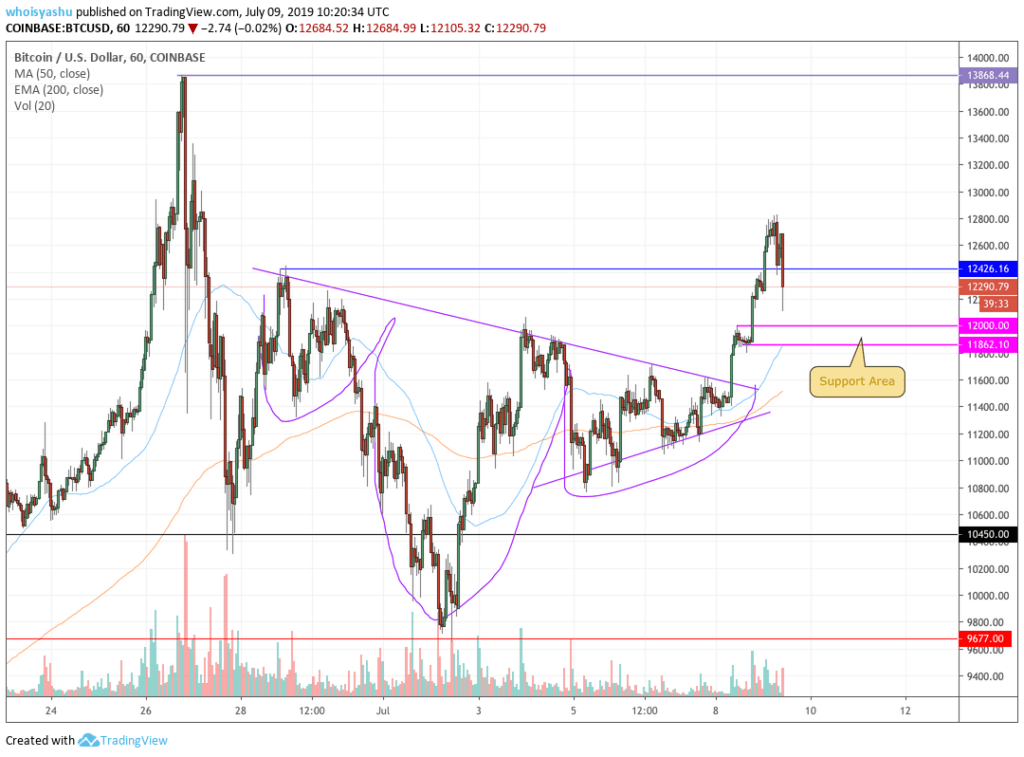

As discussed in CCN’s previous analysis, the bitcoin price was hinting to test the neckline of an inverse head and shoulder pattern for a potential breakout. The Monday trading session saw it happening, as shown in the chart below:

As of 10:23 UTC today, the bitcoin-to-dollar exchange rate was trading at $12,290.79, down 4.25 percent from its intraday high. The correction could extend until the $12,000-11,862.10 support area before pulling back to reclaim the local top of $12,794.27.

Nevertheless, on a broader scale, the price is looking to retest the $13,868.44 level as a minimal breakout target of the previous inverse head and shoulder pattern. The height of this pattern is close to $2,485. It means that bitcoin’s upside target should be at least $2,485 higher from the point of breakout ( which is $11,575.50).

That prompts bitcoin to test circa $14,000 as its extended breakout.

Click here for a real-time bitcoin price chart.

Live Crypto News Show