Bitcoin gained momentum to continue a recent winning streak as the Chinese Yuan dropped to its weakest level in more than a decade.

The benchmark cryptoasset accelerated its early morning advance with a 1.14 percent gain, adding up to 12.44 percent since August 30 low of $9,337. The upside move also brought bitcoin’s market capitalization to about $180.90 billion, which covered more than 70 percent of the total cryptocurrency market valuation.

Chinese Fleeing to Safe-Haven Assets

Bitcoin’s upside closely followed the escalation of the trade dispute between the US and China. On September 1, Washington introduced additional tariffs of 15 percent on $112 billion of Chinese imports and Beijing retracted by putting extra duties on US products, including crude oil. Investors took the said tit-for-tat approach as a cue to fly into safe-haven assets, sending the prices of Gold, Silver, and Japanese Yen higher against the US dollar.

Meanwhile, yuan depreciated to levels last seen during the 2008 financial crisis, fueling demand for offshore assets. Financial Times reported that household demand for foreign exchange surged “gradually” in 2019 as the People’s Bank of China maintained renminbi’s rate near seven a dollar. Hedging, according to FT, was the third most popular reason for people to flee from yuan-based markets. The media service surveyed 1,000 urban residents to reach the said conclusion.

Analysts have long argued that Chinese investors flee into the Bitcoin market, perceiving that it is one of the hedging assets that could circumvent state-imposed capital controls. Chris Keshian, a hedge fund manager, described bitcoin as “a hedge against destabilization in global currency markets,” telling Forbes that “any downturn in a major global currency would lead traders to move into bitcoin.”

Bitcoin’s correlation with the USD/yuan is rising. @business market strategists point out it may reflect the view of #bitcoin as digital gold. Weakening yuan is symptom of the trade war and its effects on economic growth. In turn, gold & bitcoin can prosper pic.twitter.com/12pc1kS6n1

— Selina Wang (@selinawangtv) September 3, 2019

Speculative Buying?

Some intellectuals believe bitcoin is not behaving like a safe-haven asset against the weakening Yuan – or a broader risk sentiment arising from the US-China trade war. Peter Schiff, who heads Connecticut-based Investment Management Firm Euro Pacific Capital, believes insiders in the bitcoin market falsely pump the price around yuan’s bad times. He said bitcoin does not correlate with the Chinese currency – and it not an investor’s fly-to-safety asset. Excerpts:

“As trade tensions rise and the yuan falls, Bitcoin is trading back above 10K. But don’t believe the hype that this rise reflects safe-haven buying, similar to gold. Bitcoin is not being bought by investors searching for safe havens, but by speculators betting that they are.”

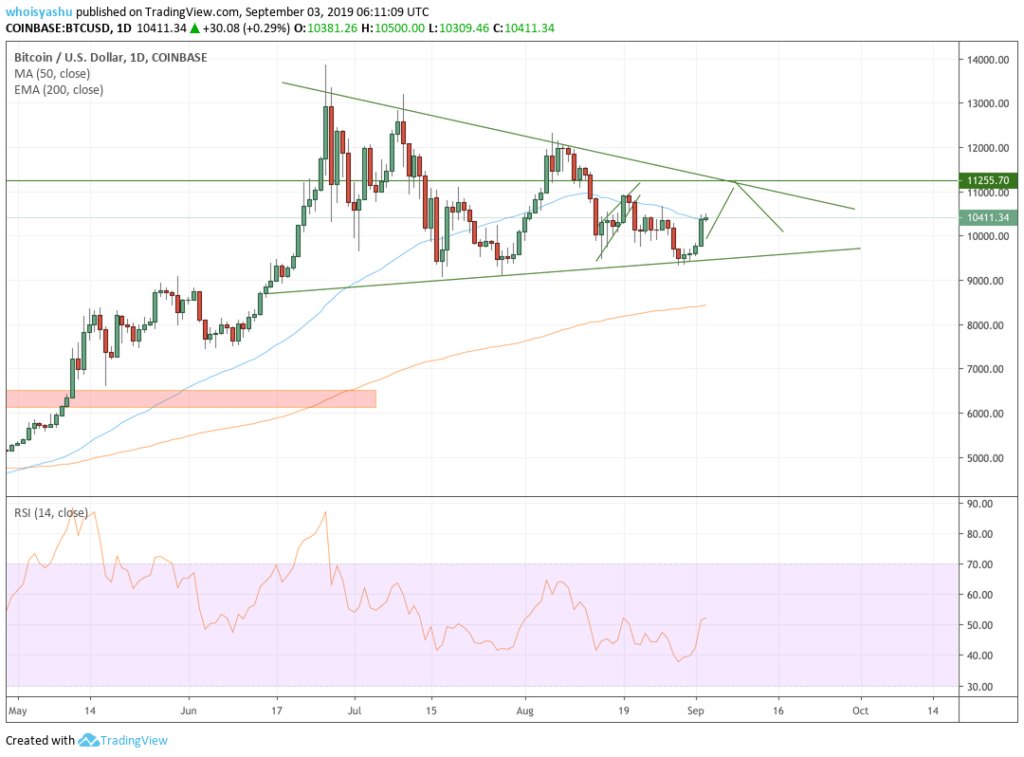

The price of bitcoin at this time of writing was $10,400, up 184 percent on a year-t0-date basis.

Click here for a real-time bitcoin price chart.