The price of the top-ranked cryptocurrency by market capitalization, Bitcoin (BTC), is set to explode in the coming week providing the weekly candle opens above $9,200. This would signal the end of a 46-week descending channel that BTC/USD has been locked in since it nearly tapped $14,000 in the summer of 2019.

So is this the time to expect a new all-time high from the leading digital asset?

Daily crypto market performance. Source: Coin360.com

The weekly view

BTC USD weekly chart. Source: TradingView

At the time of writing, the price of Bitcoin is currently trading over $9,500. It almost seems inevitable that closing above $9,200 is a sure thing. But there are no definite results when it comes to Bitcoin.

However, with renewed post-halving retail interest it certainly does look likely, especially since Harry Potter author J.K. Rowling recently tweeting to her 14.6 million followers asking for someone to explain Bitcoin to her. This may certainly spark renewed public interest in BTC. Though, if crypto Twitter didn’t blow it by acting like baboons with cringeworthy replies that no one found funny, the chances of this would be higher.

Resistance flips to support

BTC USD daily chart. Source: TradingView

Moving over to the daily Bitcoin chart, and we can see that the previous resistance on the descending channel has now flipped to support, and using the Fibonacci retracement tool, it provides a little glimpse of where Bitcoin could go next.

The price is currently sitting just under .618, making the next immediate moves either being to the upside around $11,600 (.786) or to the downside around $8,790.

While a move to the downside is always a possibility, if that happens in the week ahead, it would mean that the support on both the daily and weekly has failed, which would not be good for Bitcoin.

However, each week that support gets lower within the channel. So while I’m generally bullish on Bitcoin at the moment, I don’t think a breakthrough of $10K again would hold for long — not until we start seeing a new path emerge on the charts.

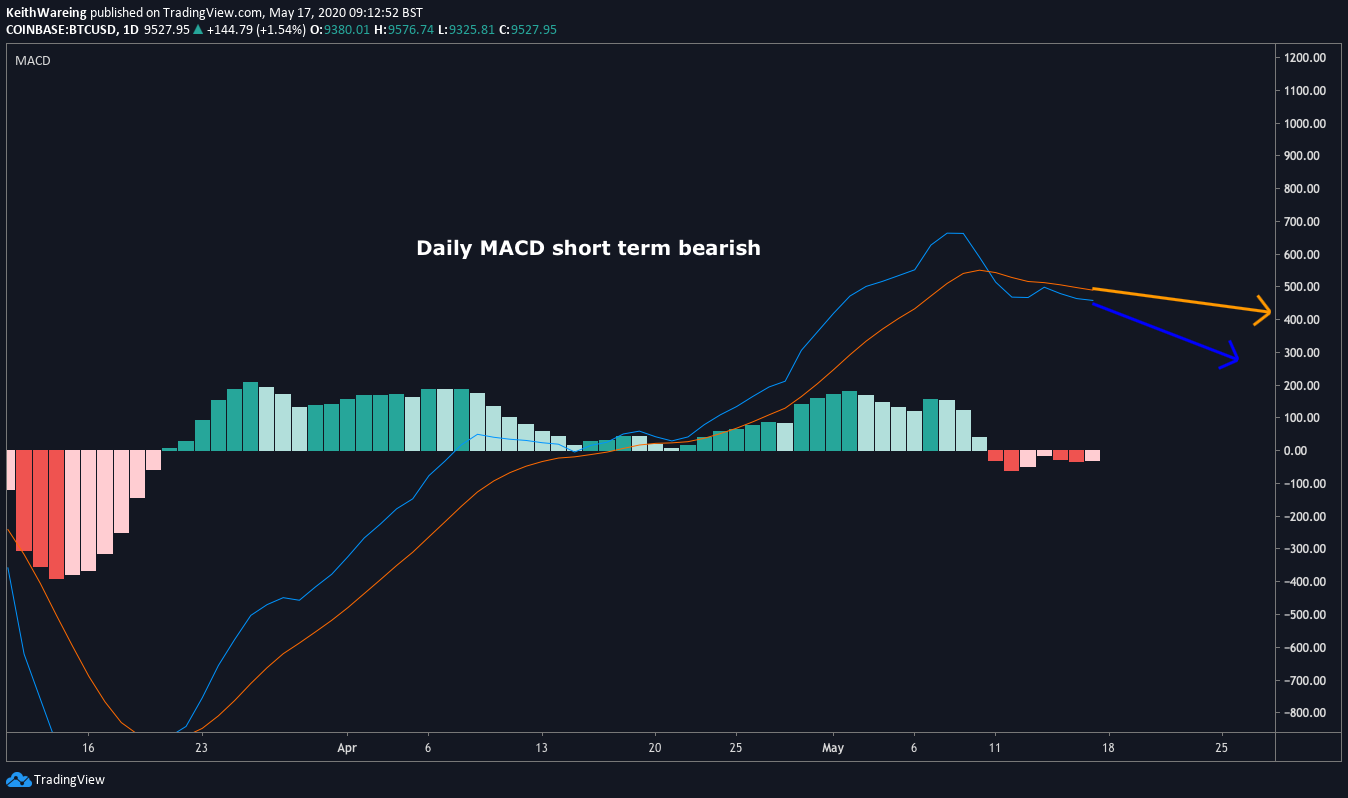

Daily MACD shows signs of a reversal

BTC USD daily MACD chart Source: TradingView

While the charts generally look bullish on higher time frames, some indicators on lower time frames are starting to show signs of weakness. The moving average convergence divergence (MACD) indicator, recently saw a bearish cross, and despite nearly crossing bullish a few days later, it has since resumed a downward trajectory.

Given that the weekly MACD is still looking very bullish, I wouldn’t be too worried about this in the medium term. However, in the short term, it looks as if a small pullback is imminent as people rush to take pre-10K level profits, which I would view as a temporary pullback.

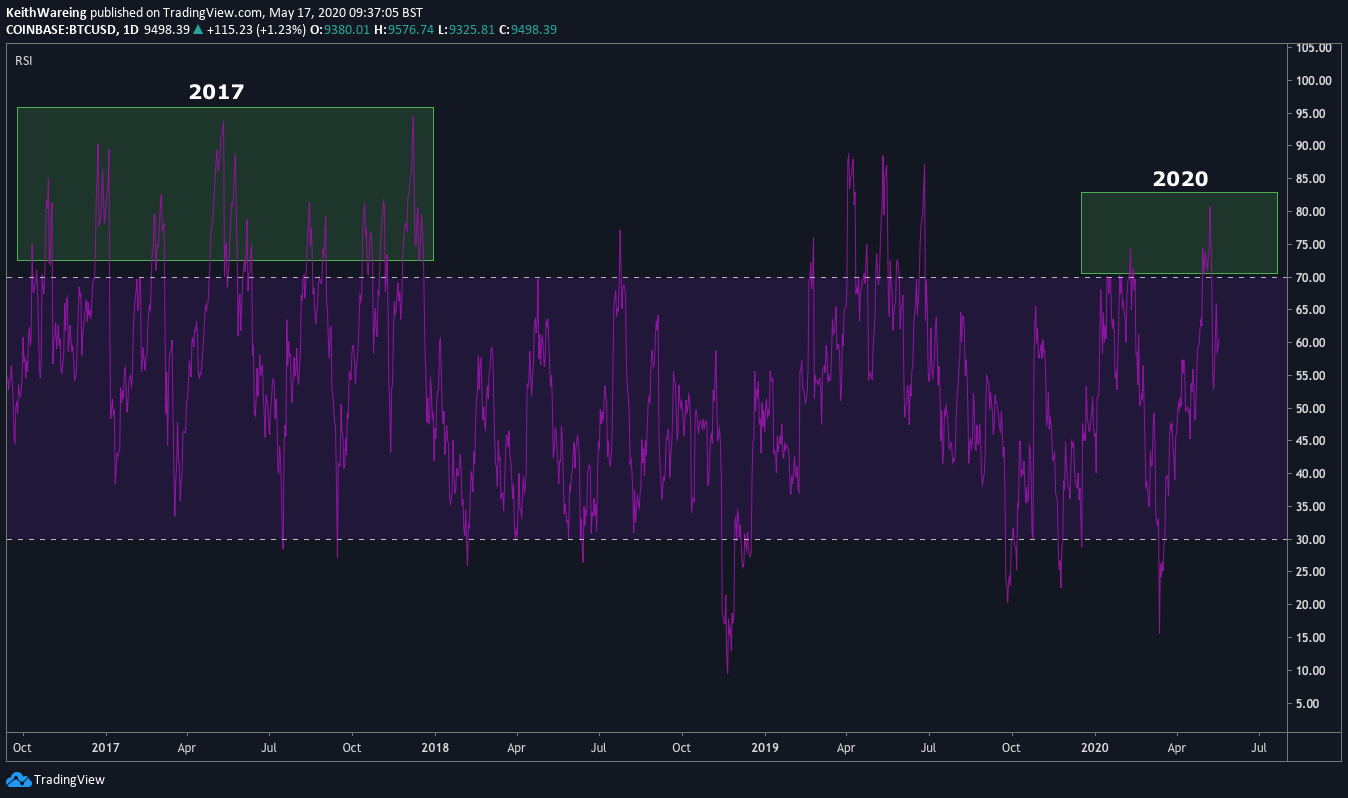

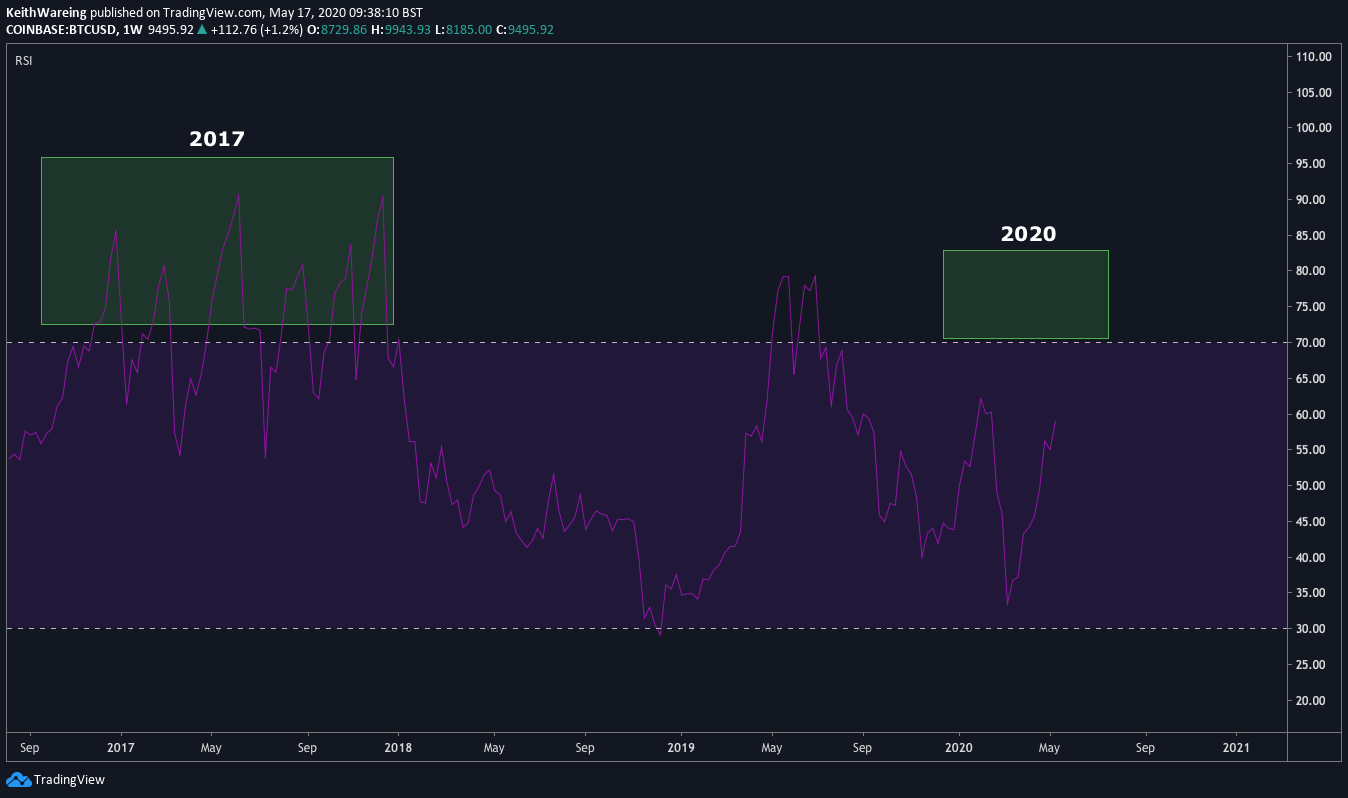

The Relative Strength Index

The RSI is looking equally bearish on the daily chart as it’s approaching overbought territory. However, you have to keep in mind that during 2017 the RSI was constantly showing as overbought and it just kept going.

That being said, if you look at the weekly chart, we’re not even there yet, which suggests that while a small pullback is likely, overall it’s looking good for the price of Bitcoin in the medium term.

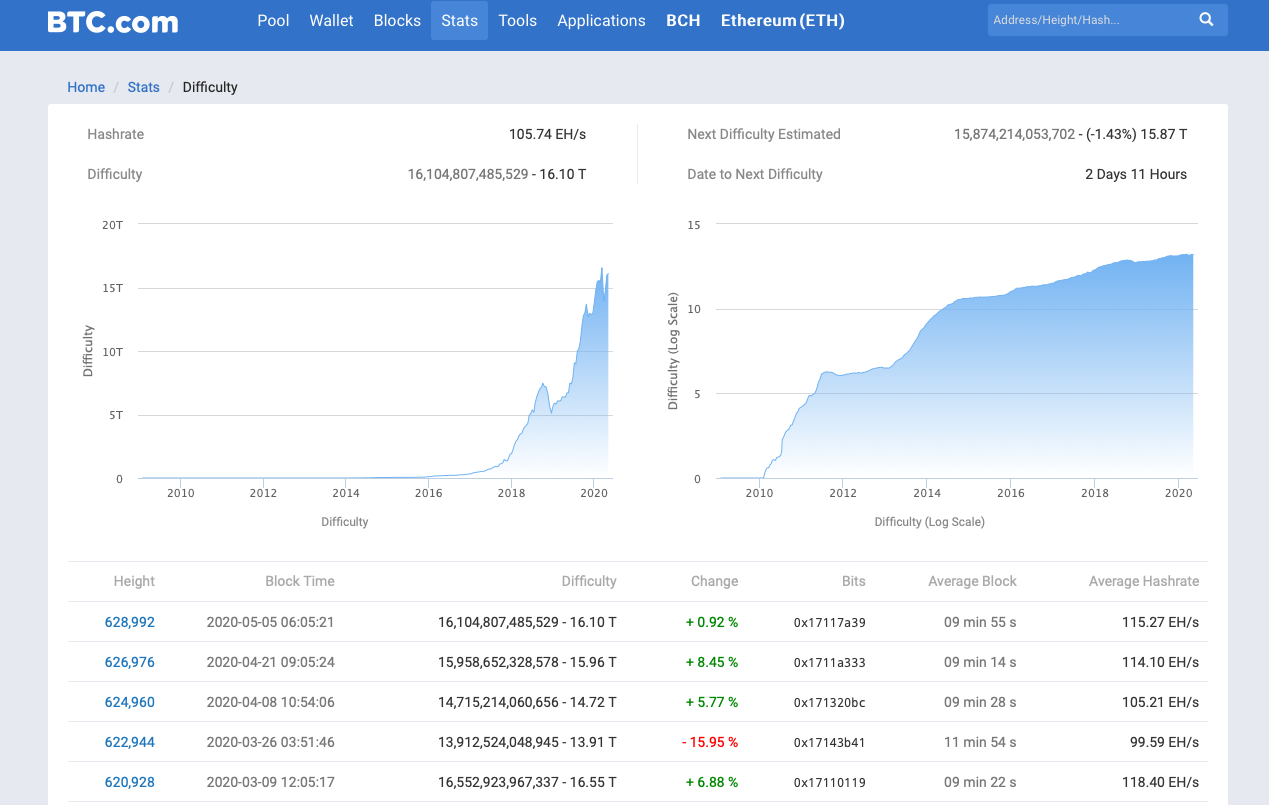

Mining difficulty reduction

BTC Mining Difficulty Adjustment Source: BTC.com

Another key metric that has proved useful in assessing the future price of Bitcoin is the Bitcoin mining difficulty, which at the moment is starting to decline and is set to be reduced by over 2% next week.

However, with the halving now behind us, more adjustments to the downside are to be expected since mining is currently no longer profitable. Yet despite this, there has been a surge in hash rate, topping out an average of 115 EH/s, which is an all-time high for BTC. That’s 115 quintillion (115,000,000,000,000,000,000) hashes per second.

Historically, when the hash rate is rising, the price always follows, and as this number continues to explode, it seems only likely that Bitcoins price will follow suit.

Bullish scenario

Closing above $9,200 today will be the single most bullish sign that Bitcoin has seen since before the 2017 bull run. This would put $9,980 as the next level of resistance before opening up $11,600 as the next target.

Bearish scenario

Not managing to hold above $9,200 would put $8,790 as the first level of support followed by $7,600. However, at this stage, a bearish outlook for Bitcoin is simply not something I see as likely. Even if the price fell to $8,790, I would still maintain a bullish bias. Nevertheless, losing this level would drastically reduce the likelihood of an imminent bull run.

The views and opinions expressed here are solely those of @officiallykeith and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.