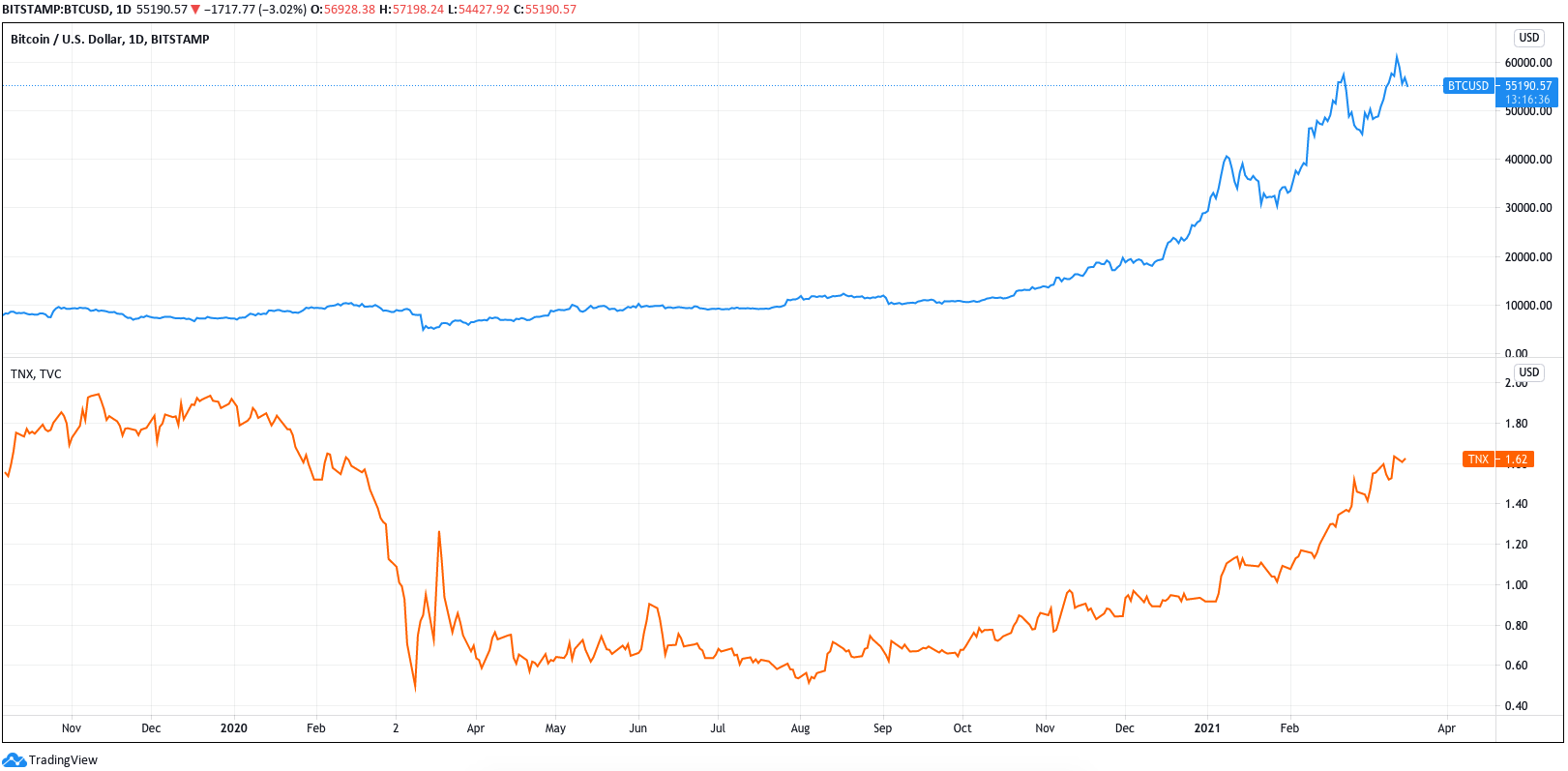

Bitcoin (BTC) slid under $55,000 on March 17 as United States treasury yields built on a comeback, which took them to their highest in over a year.

BTC price stays firmly rangebound

Data from Cointelegraph Markets Pro and TradingView showed further downward pressure for BTC/USD on Wednesday, compounding a comedown that began late on Sunday.

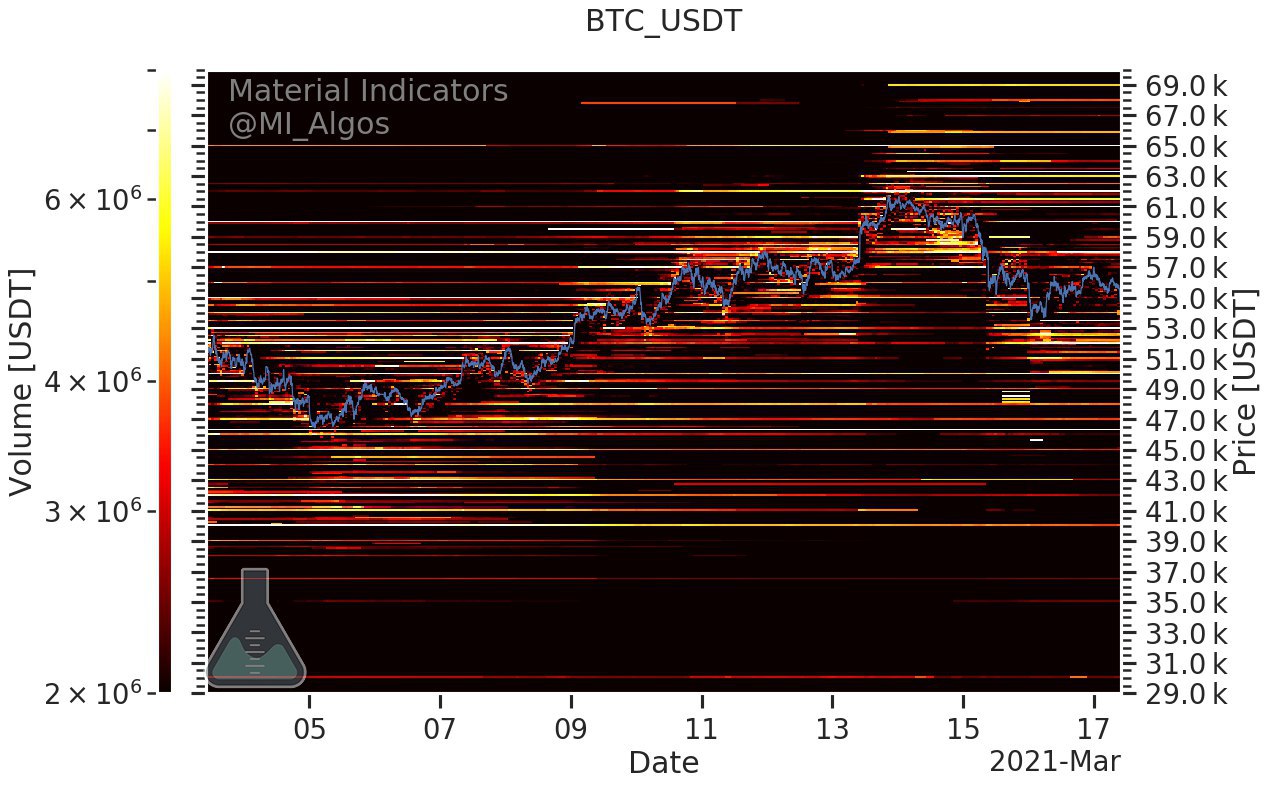

While not plugging the week’s lows at near $53,000, the latest dip to $54,425 on Bitstamp underscores Bitcoin’s correction after hitting all-time highs of $61,700.

The weakness came in tandem with the strength of U.S. bond yields, a classic drain on BTC performance. On-chain metrics showed broad strength, however, while derivatives funding rates also cooled, fueling bullish sentiment beyond spot price action.

“Bitcoin will continue to rise and rise in the foreseeable future — we don’t need charts or technical analysis to tell us what is painfully obvious,” trader Scott Melker forecast in a fresh YouTube update.

“People are increasingly interested in buying Bitcoin as a hedge against central bank behavior and infinite money-printing, while at the same time, supply is rapidly exiting the market.”

“I bought more BTC at 56,500. Just in case anyone was wondering if I’m still bullish,” Galaxy Digital CEO Mike Novogratz added, in another example of investor optimism.

At the time of writing, BTC/USD was circling $55,000 as a slight return to form kept the pair from testing deeper lows.

“We’ll only see further downside once $BTC loses ~$55,000,” popular Twitter account Rekt Capital argued, adding to recent Cointelegraph analysis.

Long-term bond warnings compound

On the topic of institutional involvement, meanwhile, this week was tipped by Bitcoin investment firm NYDIG to bring significant announcements from prospective large-volume corporate investors.

In an episode of the On The Brink podcast recorded on March 10, NYDIG CEO and co-founder Robby Gutmann removed any doubt that the institutional scene was about to transform.

“I think — I don’t think, I know — starting more or less next week, you’re going to see an absolute drumbeat of pretty game-changing milestones from some of these firms that are really going to mark each progressively new point in Bitcoin adoption, Bitcoin availability, Bitcoin products and services within the existing traditional financial landscapes,” he said.

As Cointelegraph reported, meanwhile, the topic of bonds has gained attention from several high-profile sources. This week, it was billionaire Ray Dalio who warned investors to stay away from dollar-denominated targets, with MicroStrategy CEO Michael Saylor championing Bitcoin as the answer.