Bitcoin cratered on Friday, confirming that its interim downtrend sentiment is far from over.

The world’s largest cryptocurrency by market cap established an intraday low of $10,761.80, down 3.38 percent from the Thursday Asian session open. The move downhill brought bitcoin’s downside correction from 2019 top to 22.40 percent. At the same time, the cryptocurrency’s market capitalization dipped to approx $193.84 billion.

On the volume front, the bitcoin-enabled pairs across all the cryptocurrency exchanges posted more than $25 billion worth of trading activity in the past 24 hours. Nevertheless, the Real 10 Volume, which allegedly removes the fraudulent data off the volume statistics, reported just $1.98 billion worth of trades.

Interim Downtrend Confirmed

Bitcoin had rallied to a peak level of $13,868.44 on June 27 afternoon, its highest price since January 2018. It then dropped to $9,651 in the next five days, which brought its net downside correction to 30.41 percent on July 2 morning. In the sessions that came later, bitcoin attempted a brief upside recovery of circa 25 percent to close above the $12,000 level on June 4 yesterday.

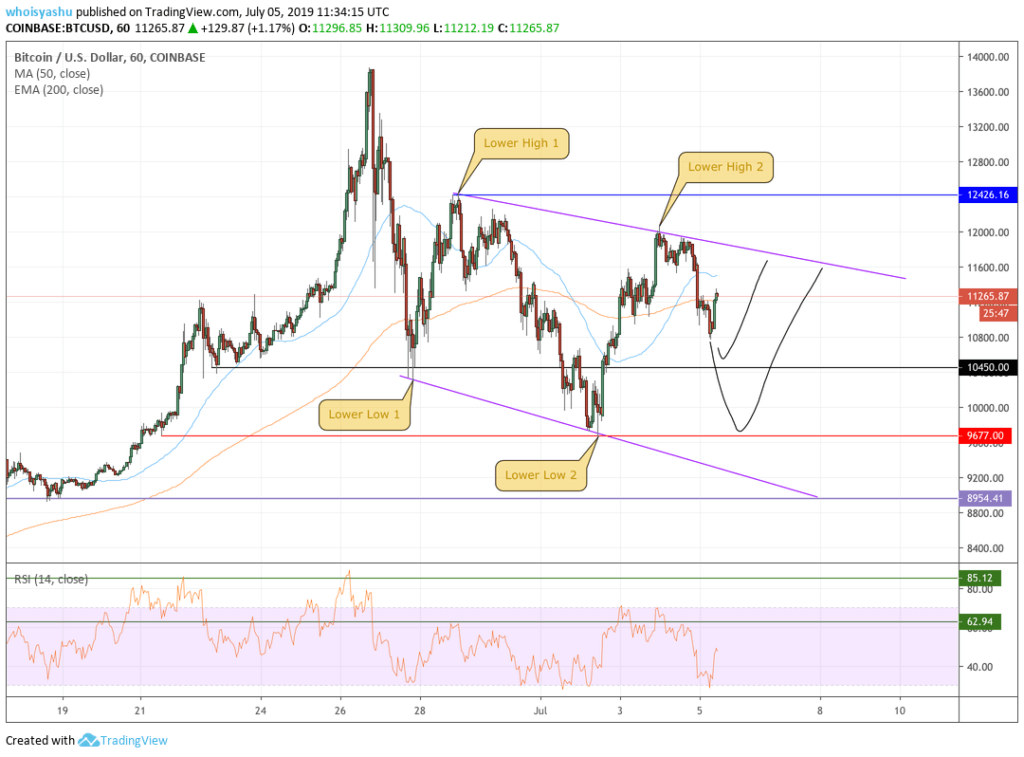

The price action throughout left imprints that indicated a downtrend action. As shown in the Coinbase chart above, the cryptocurrency formed more than two lower lows and lower highs, eventually making a constellation of a downward channel (indicated via purple).

That said, one could expect bitcoin to test the $10,450 level for a potential pullback. If that level fails, then the same pressure falls on the next near the $9,677 area. But the most crucial pullback level, as I believe, is the one near $8,954. This area has a history of accumulation, with the latest being between June 16 and 20. The same has served as a decent resistance level during the upside action in May.

The Bull Case

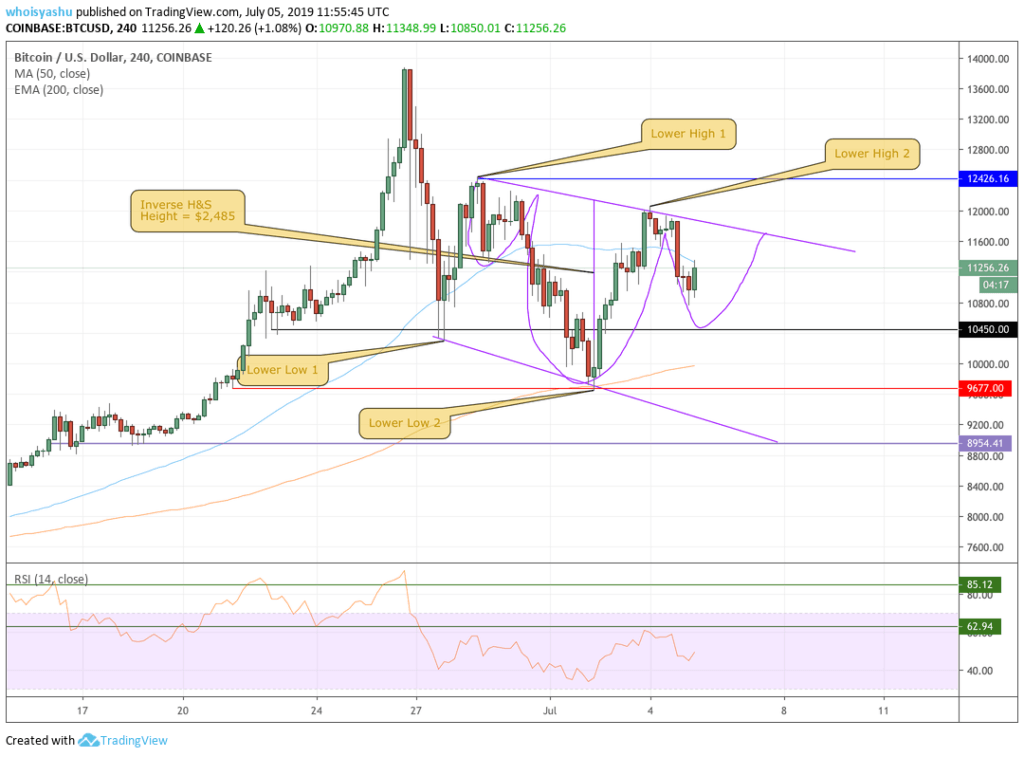

The Coinbase 4H chart above shows bitcoin also hinting to complete an inverse head and shoulder pattern, which is typically bullish. In the best case scenario, traders could start accumulating the cryptocurrency at any given support targets. The move would prompt bitcoin to retest the neckline for a breakout. If that happens, the bitcoin price would likely rise by as much as $2,485 — the height of the head and shoulder — from the point of breakout.

That would take the bitcoin price, at least, back to the local top of $13,868.44.

Click here for a real-time bitcoin price chart.

Live Crypto News Show