Bitcoin (BTC) felt more bullish than ever June 9 after another 24 hours of upside propelled markets close to $13,000.

Market visualization courtesy of Coin360

Data from Coin360 painted a rosy picture for cryptocurrency traders, with bitcoin still leading the way in terms of daily gains.

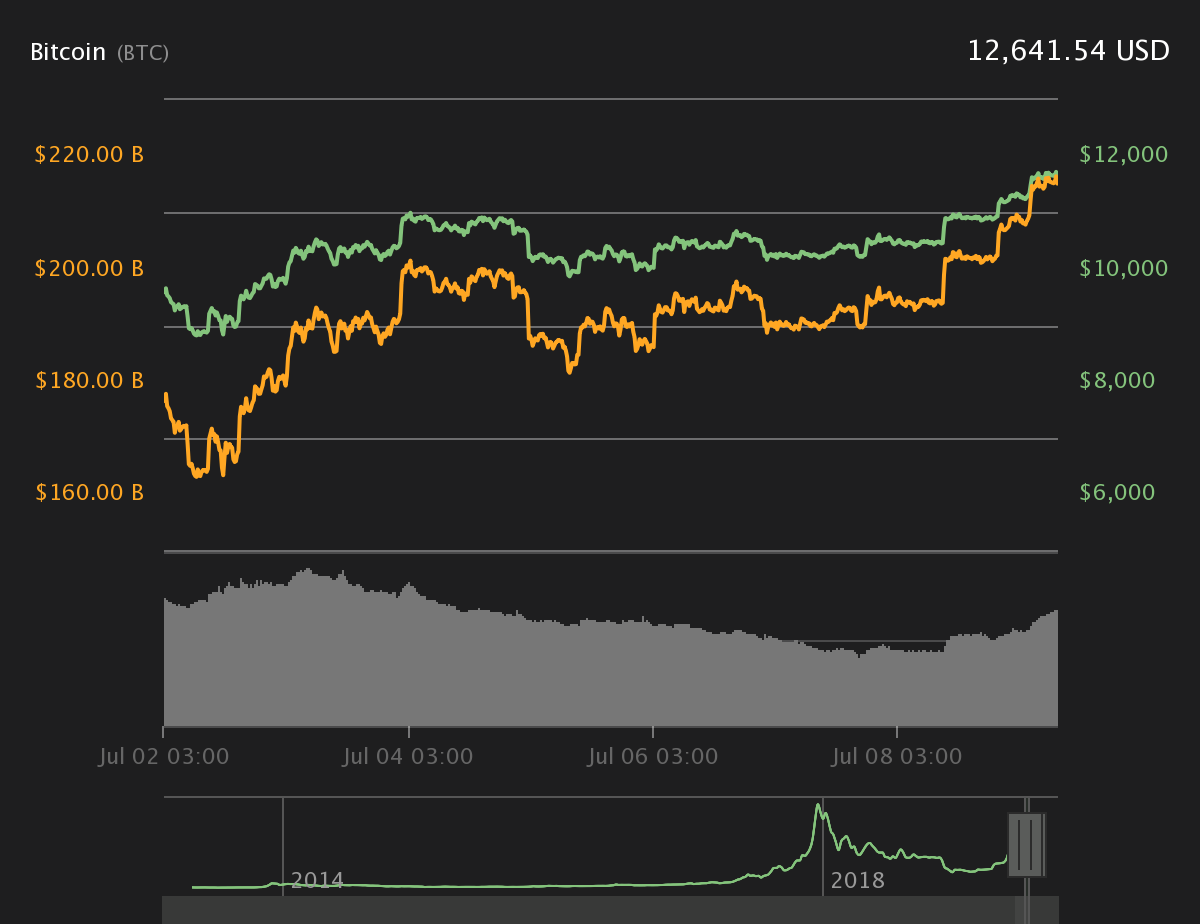

At press time, BTC/USD was up 11% versus Monday on $12,666. The pair had reached as high as $12,707 before a slight pullback below the $12,700 barrier.

Bitcoin 7-day price chart. Source: Coin360

The fresh moves further challenge theories bitcoin was due a downward correction which appeared earlier in the week. As Cointelegraph reported, veteran trader Peter Brandt led the warnings, arguing BTC could shed up to 80% of its bullrun gains.

Since then, bitcoin has shot up around $1,200, as other sources prepare for an extension of its parabolic activity before a ‘real’ reversal sets in.

“I think we’re in the next parabolic move,” Mark Yusko, founder, CEO and CIO of Morgan Creek Capital Management, told CNBC as bitcoin hit $12,250.

“That will probably take us into the $30,000 level before we get another little correction… the path to $100,000 by 2021 is really quite easy to draw out.”

Bitcoin’s weekly gains now sit at 30%, while monthly performance has topped 60%.

The enthusiasm around bitcoin was even starting to spread into long-deflated altcoin markets Tuesday, with some tokens in the top twenty cryptocurrencies by market cap rising around 5%.

Ethereum (ETH) hit $317 to seal support above $300 after languishing lower while bitcoin soared.

Ether 7-day price chart. Source: Coin360

Others fared less well, with chainlink (LINK) dropping 7.4% and exchange Bitfinex’s unus sed leo (LEO) shedding 6.2% in the same period.

Tron (TRX) was down almost 3% after news broke of a police presence at the company’s Beijing offices, with users implicating CEO Justin Sun as an accessory in a multimillion-dollar scam.