Bitcoin (BTC) hit fresh lows on Sep. 7 as renewed selling pressure saw the largest cryptocurrency return to the $9,800 range.

Cryptocurrency market daily snapshot, Sep. 7. Source: Coin360

Analyst eyes BTC price bottom at futures gap

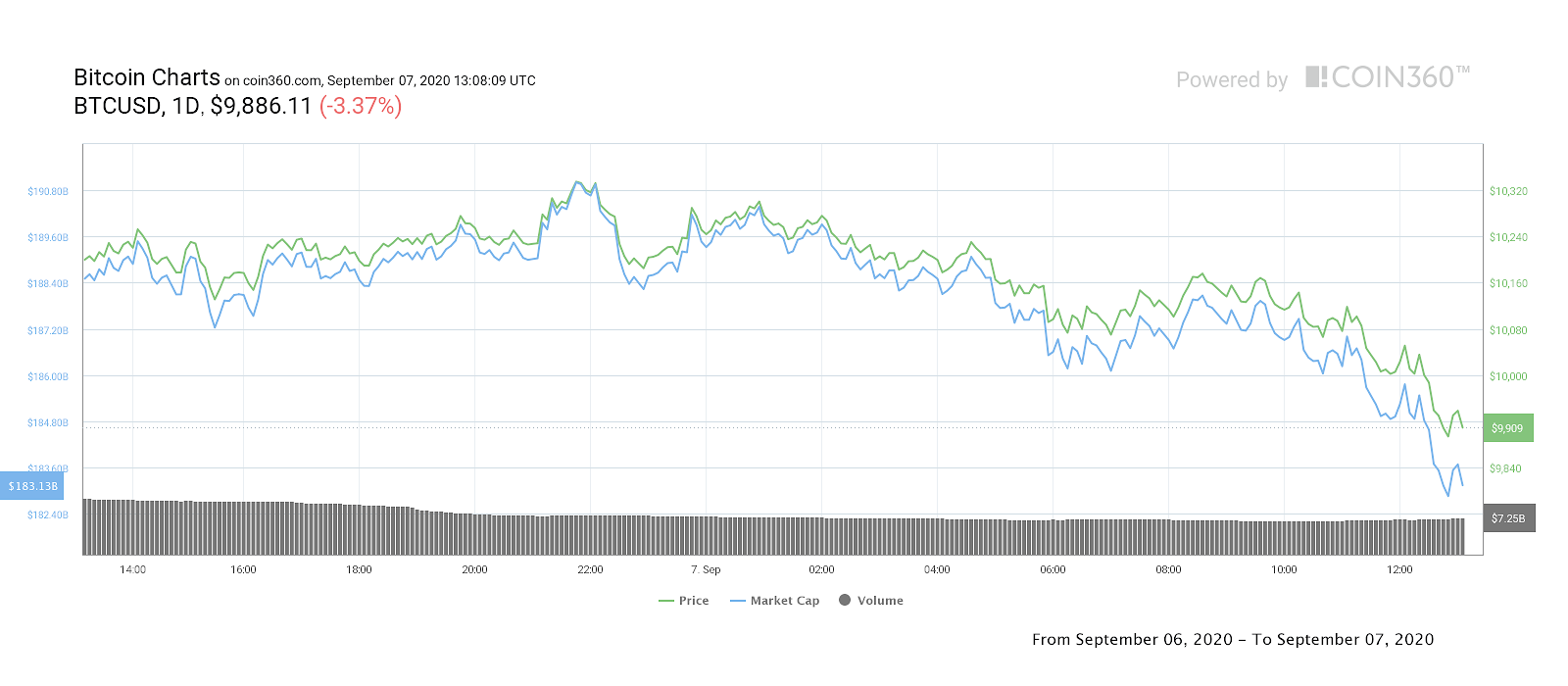

Data from Coin360 and Cointelegraph Markets showed more trouble for BTC/USD on Monday, the pair hitting $9,880 — its lowest since July 26.

BTC/USD 1-day price chart. Source: Coin360

After mixed performance over the weekend, $10,000 looked increasingly shaky support, something that analysts warn could be pivotal in the short-term.

Discussing the current market, Cointelegraph Markets analyst Michaël van de Poppe said that the outlook hinged on two gaps in CME Group’s Bitcoin futures markets.

As Cointelegraph reported, the two gaps are at $9,700 and $10,600 — Van de Poppe has outlined two likely scenarios for price action, and the question is which gap Bitcoin will fill first. Press-time levels were at $9,950.

“Couldn’t really hold the $10,000 level (or it’s dipping beneath). The second scenario would be a closing of the CME gap, after which closing of the upper CME gap is next,” he tweeted.

“$9,600-9,800 could be bottom level for now.”

The second scenario involves a break upwards towards $11,000, followed by a retest of levels around the lower CME gap.

DXY keeps climbing in blow to BTC

Bears had gained the upper hand through last week, with $12,000 swiftly giving way to 15% losses as macro changes took their toll.

Strength in the U.S. dollar currency index (DXY), which began as the week progressed, continued on Monday, hitting 93.1.

U.S. dollar currency index 10-day chart. Source: TradingView

Any influence from Wall Street stock markets will only be felt on Tuesday, as Labor Day sees a break in trading.