Today Bitcoin bulls found their resolve and are attempting to reverse the digital asset’s course even as equities markets across the globe continue to drop on the realization that Coronavirus is a real threat that will stay with us for some time.

The Dow Jones Industrial Average closed with a decline of 1,100 points (4.4%) and is down more than 10% for the week. The Nasdaq Composite also fell 4.6% to 8,566.48 and the S&P 500 endured a similar blow, dropping 4.4% to close at 2,987.76. According to market analysts, today’s drop represents the largest daily decline in recent history.

Crypto market daily price chart. Source: Coin360

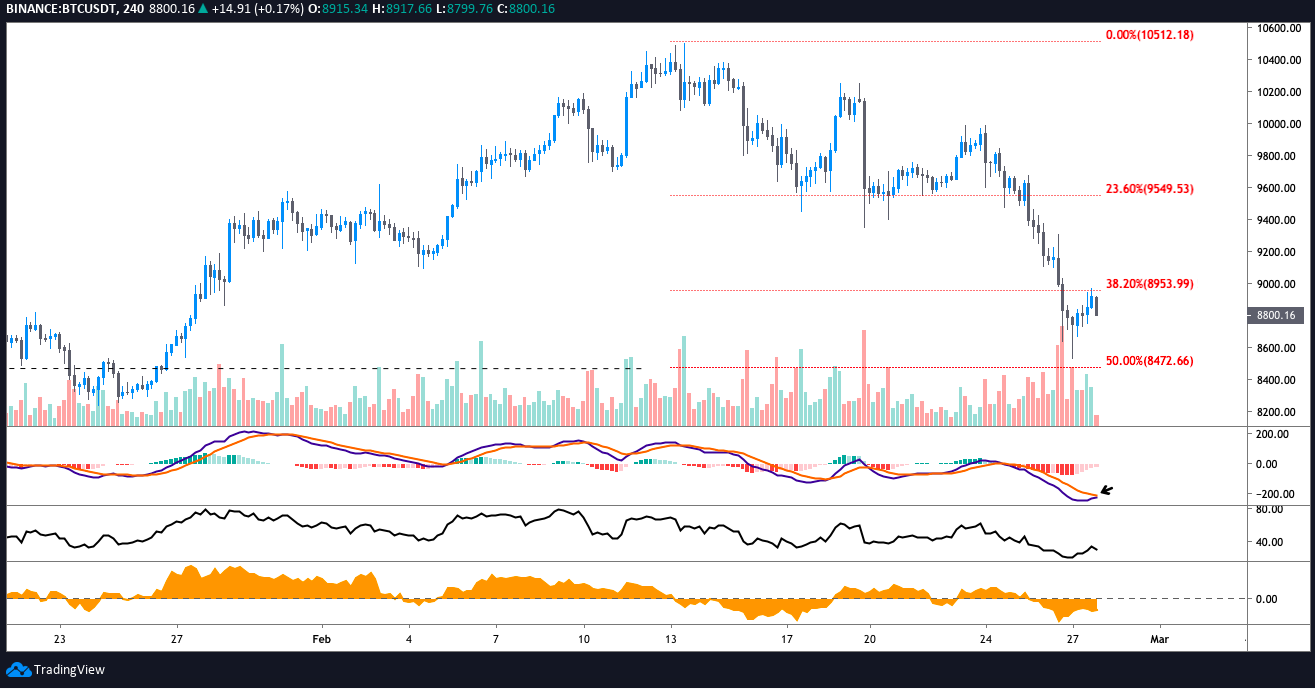

Currently, Bitcoin price is chasing after the 200-day moving average after dropping to an intra-day low at $8,509. The recovery from $8,509 is encouraging as it shows the support at $8,500 is holding and the shorter-time frame shows the moving average convergence divergence (MACD) attempting to pull out from oversold territory.

Earlier in the day the relative strength index (RSI) bounced from 23, a low not seen since December 20 when the indicator read 20.83 and the MACD line on the 4-hour timeframe has also curved upward but is still some distance from the signal line.

BTC USDT 4-hour chart. Source: TradingView

Traders will also notice that the MACD histogram bars have shortened in length and turned light pink as purchasing volume for Bitcoin increased.

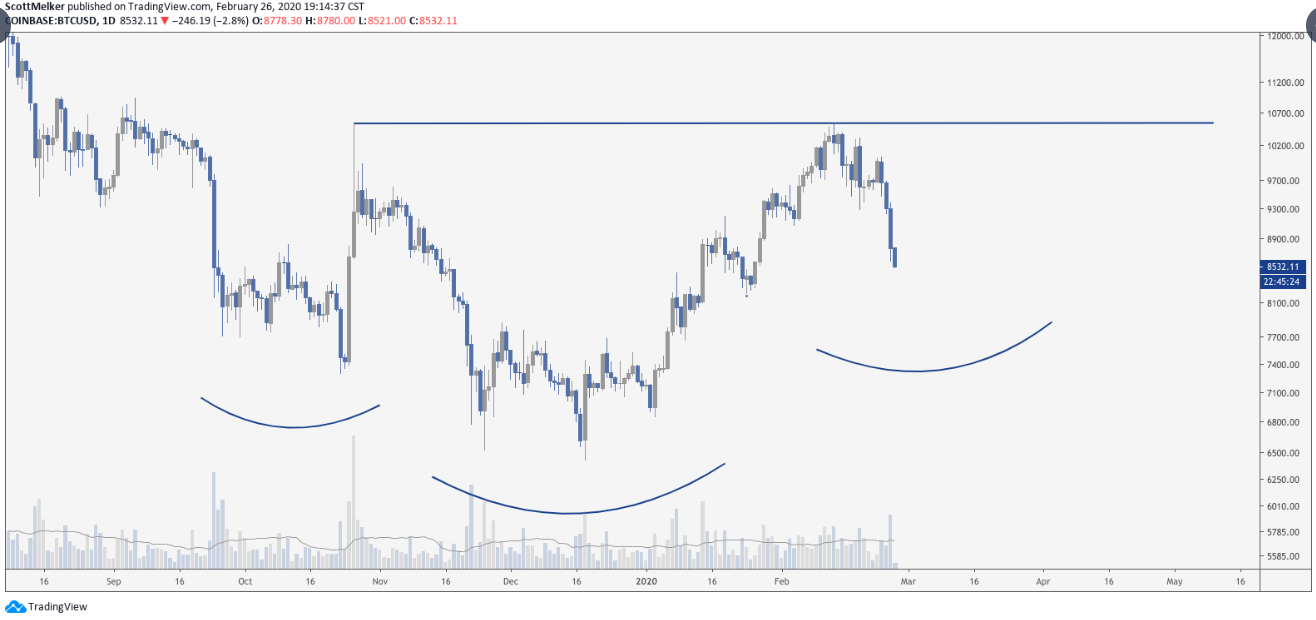

BTC USDT daily chart. Source: TradingView

Another positive is that earlier in the day traders managed to retake the 200-day moving average but at the time of writing Bitcoin price has dropped below it again. It is important that the price finds support at the 200-DMA but the volume profile visible range (VPVR) also suggests that the 50-day moving average ($9,230) and the high volume node at $9,254-$9,428 will push back as a point of resistance.

This is not too surprising, given that $9,500 was a difficult resistance to flip to support just on Feb. 5.

On the 4-hour timeframe, one can see that a pattern of higher lows was forming but the long upper wicks of each candle show that traders are taking profits rather than long positions.

It seems that the current pullback below the 200-DMA is mirroring traditional markets which closed with another day of massive losses.

In the current situation, trading volume is going to be the ultimate tell on whether Bitcoin price will maintain the current attempt to reverse the course.

BTC USD daily chart. Source: TradingView

On Feb. 26 Cointelegraph contributor Scott Melker tweeted the above chart and said:

“Is everyone talking about this yet?”

If the inverse head and shoulders pattern Melker mentions were the complete the right shoulder, Bitcoin price could drop as low as $7,400. Hence the desire by bulls that Bitcoin price holds above the 200-DMA.

If the price breaks below the moving average and falls below the support at $8,500, traders will look for a bounce at the 61.8 Fibonacci retracement level ($7,991). Failure to bounce in the golden pocket would increase the likelihood of the inverse head and shoulders pattern completing.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.