Bitcoin (BTC) was riding high on fresh gains on April 28 as little got in the way of bulls controlling the market.

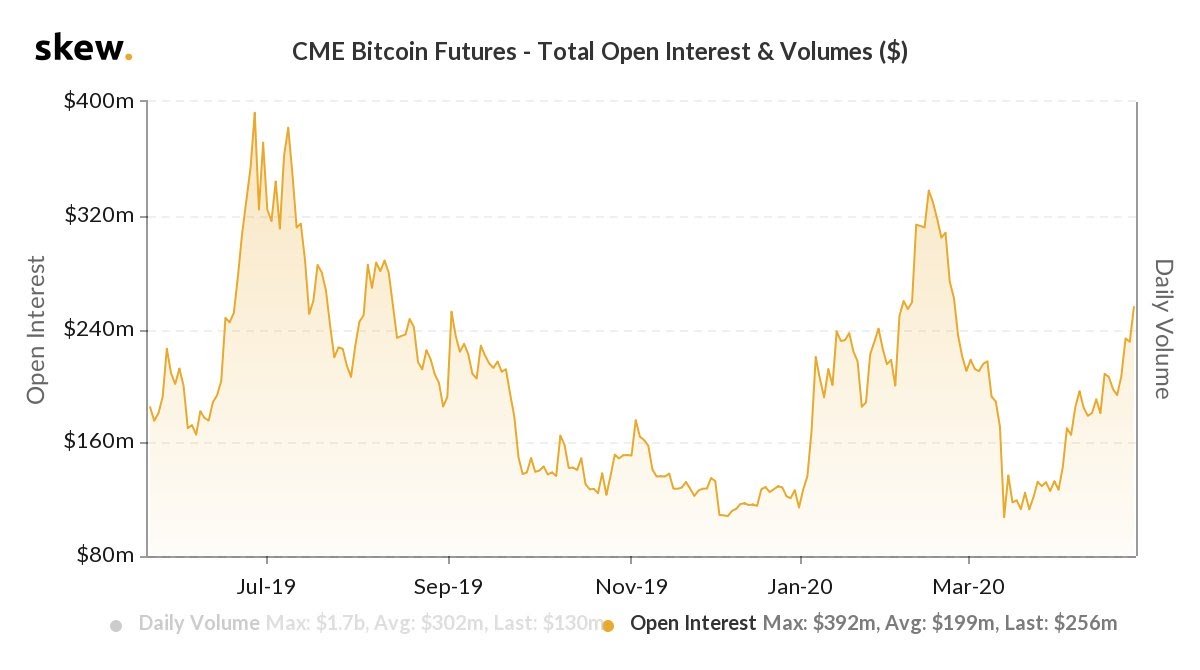

Cryptocurrency market daily overview. Source: Coin360

BTC price closes in on $8K barrier

Data from Coin360 and Cointelegraph Markets reflected the buoyant mood among traders as BTC/USD lingered near seven-week highs of $7,800.

Since gaining 10% in hours late last week, resistance has so far remained flipped as support — 24-hours lows at press time were a comparatively impressive $7,650.

Bitcoin has yet to challenge major resistance posed by its 200-day moving average price, something which at $8,000 represents a key next hurdle. At the same time, the incoming block reward halving is a topic of huge interest for market participants.

“As long as the price of $BTC remains above $7,600, it’s okay,” a still cautious Cointelegraph analyst, Michaël van de Poppe, summarized on Twitter on Monday.

Holding above $7,600 grants further momentum upwards and possibly a breaker above resistance.

A slow grind upwards for stock markets reflected the sustained performance for Bitcoin on Tuesday. Oil was weaker once more, that sector nonetheless having an overall weaker impact on BTC.

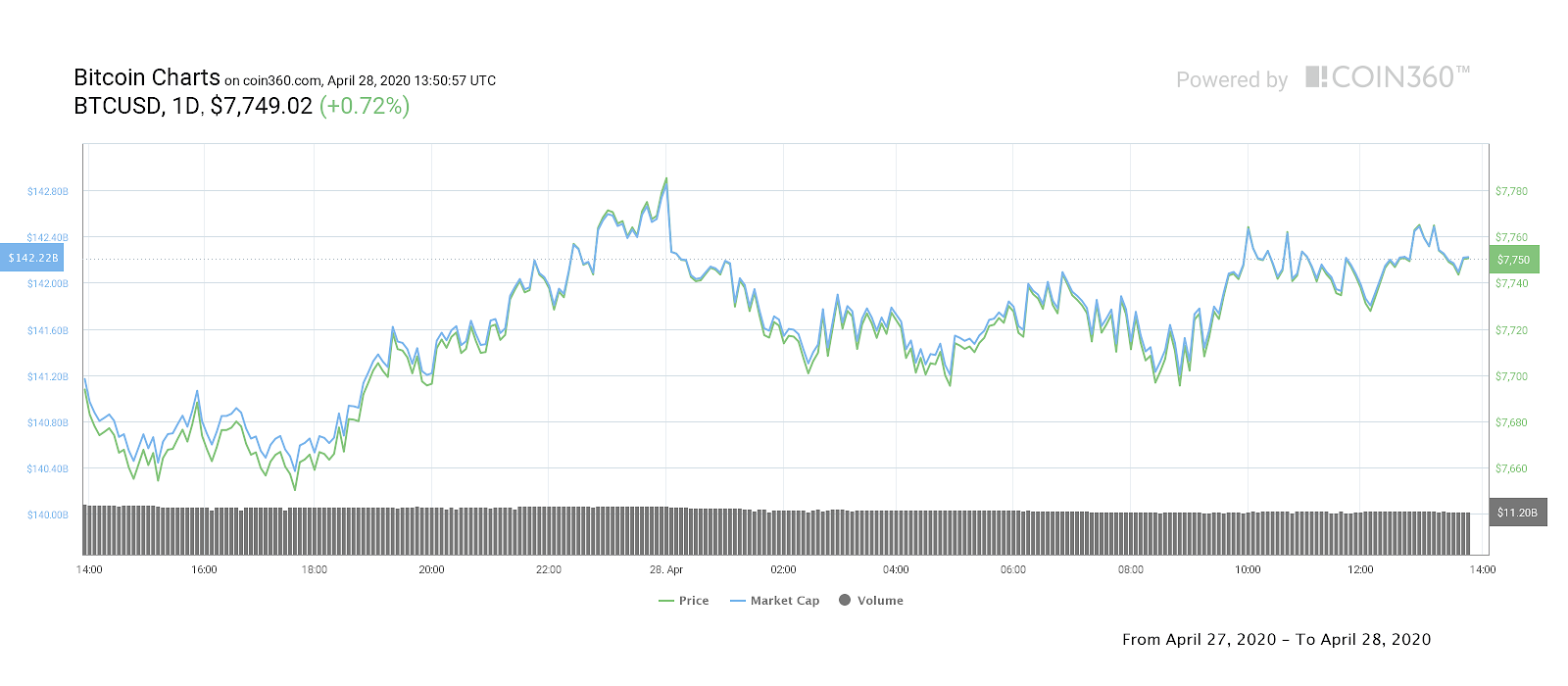

CME futures see fresh recovery

In terms of volume, meanwhile, figures continued to impress. As noted by analytics resource Arcane Research, stability is returning after last month’s crash, volume resetting by returning to roughly its position at the start of the year.

So too was open interest on Bitcoin futures. According to data from Skew, volume and open interest put in another consecutive week of growth since mid-March.

CME Bitcoin futures open interest and volume 1-year chart. Source: Skew

Arcane also pointed to market sentiment exiting its period of “extreme fear.” As Cointelegraph reported on Monday referencing the Crypto Fear & Greed Index, the seven-week hyper-bearish spell was the longest in the indicator’s history.