Bitcoin’s (BTC) price dropped to a new yearly low of $78,258 on Feb. 27, leading some analysts to suggest that the cryptocurrency is now in an optimal purchasing zone.

Bitcoin 1-day chart. Source: Cointelegraph/TradingView

Bitcoin’s 60-day RCV hints at low-risk accumulation

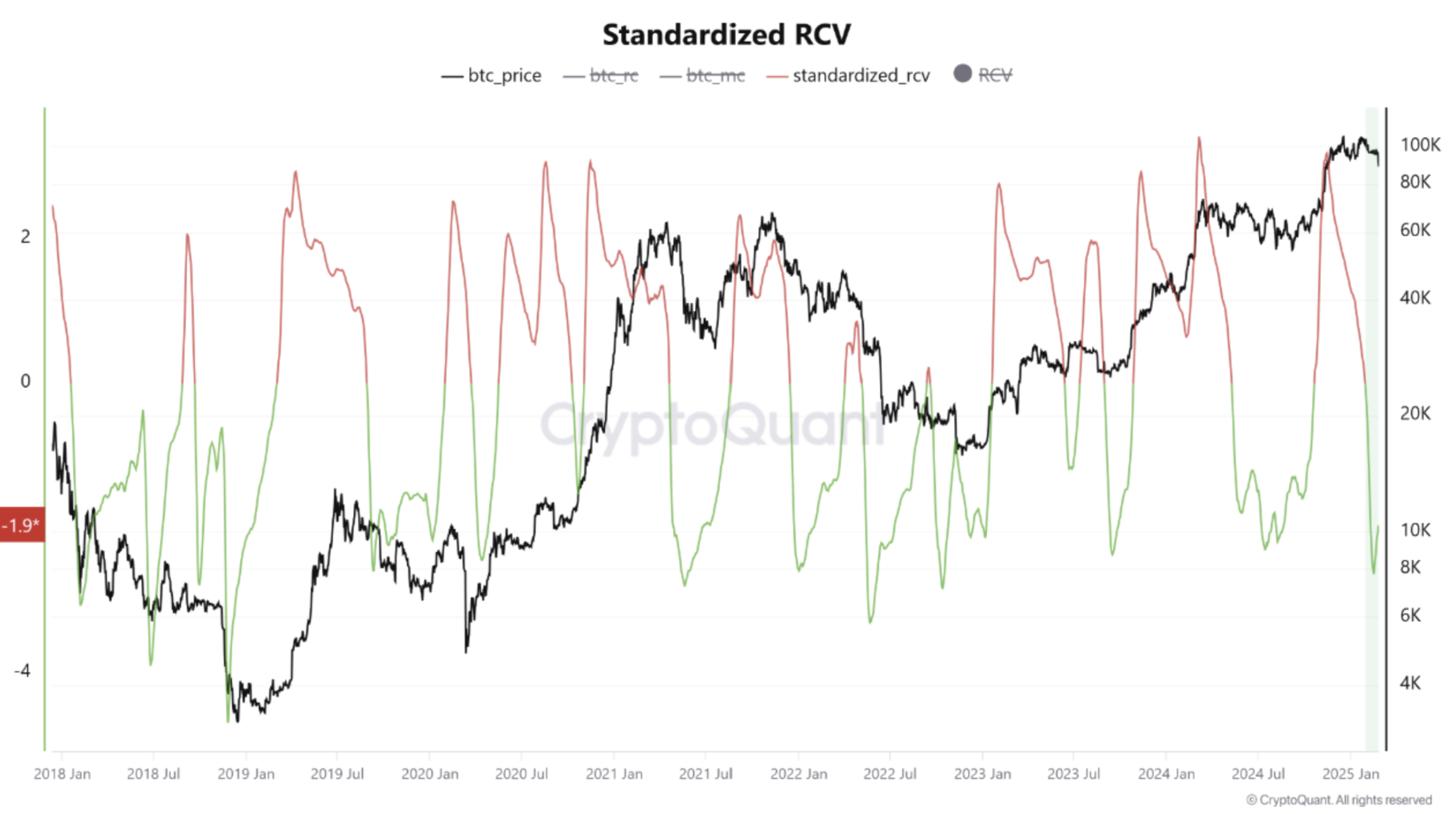

Crazzyblock, a Bitcoin trader and verified analyst on CryptoQuant said that Bitcoin’s 60-day RCV reached its lowest level of -1.9 in the chart, signaling an ‘optimal DCA opportunity’ for the first time since July 2024.

Bitcoin 60-day RCV chart. Source: CryptoQuant

The 60-day realized value to market capitalization variance (RCV) is a metric that calculates the 60-day rolling average and standard deviation of BTC price. According to the metric, whenever the RCV value is below 0.30, it indicates a low-risk investment in the asset. A value between 0.30-0.50 implies a neutral environment, and above 0.5 means a high sell-off risk.

The analyst pointed out that the metric has been historically accurate in identifying undervaluation and overvaluation trends for BTC, and the current normalized RCV value presents a favorable buying opportunity based on “historical risk-reward dynamics.” The BTC proponent added,

“Long-term investors should consider scaling into BTC positions via a DCA strategy as risk-adjusted conditions remain optimal.”

In 2024, the RCV value flashed a DCA signal between May and July, where Bitcoin fluctuated between $70,000 and $50,000. Thus, it is essential to note that the RCV does not signal a bottom but highlights the low-risk, high probability of making gains in the long term.

Crypto analyst Yonsei Dent pointed out that Bitcoin’s short-term holder SOPR (Spent Output Profit Ratio), which monitors realized profit or losses, had reached a sharp deviation below the lower Bolling Band.

Bitcoin SOPR range deviation data. Source: CryptoQuant

Based on such deviations, BTC has registered a short-term rebound between 8%-42%, with recoveries also evident during the 2022 bear market.

Related: How low can the Bitcoin price go?

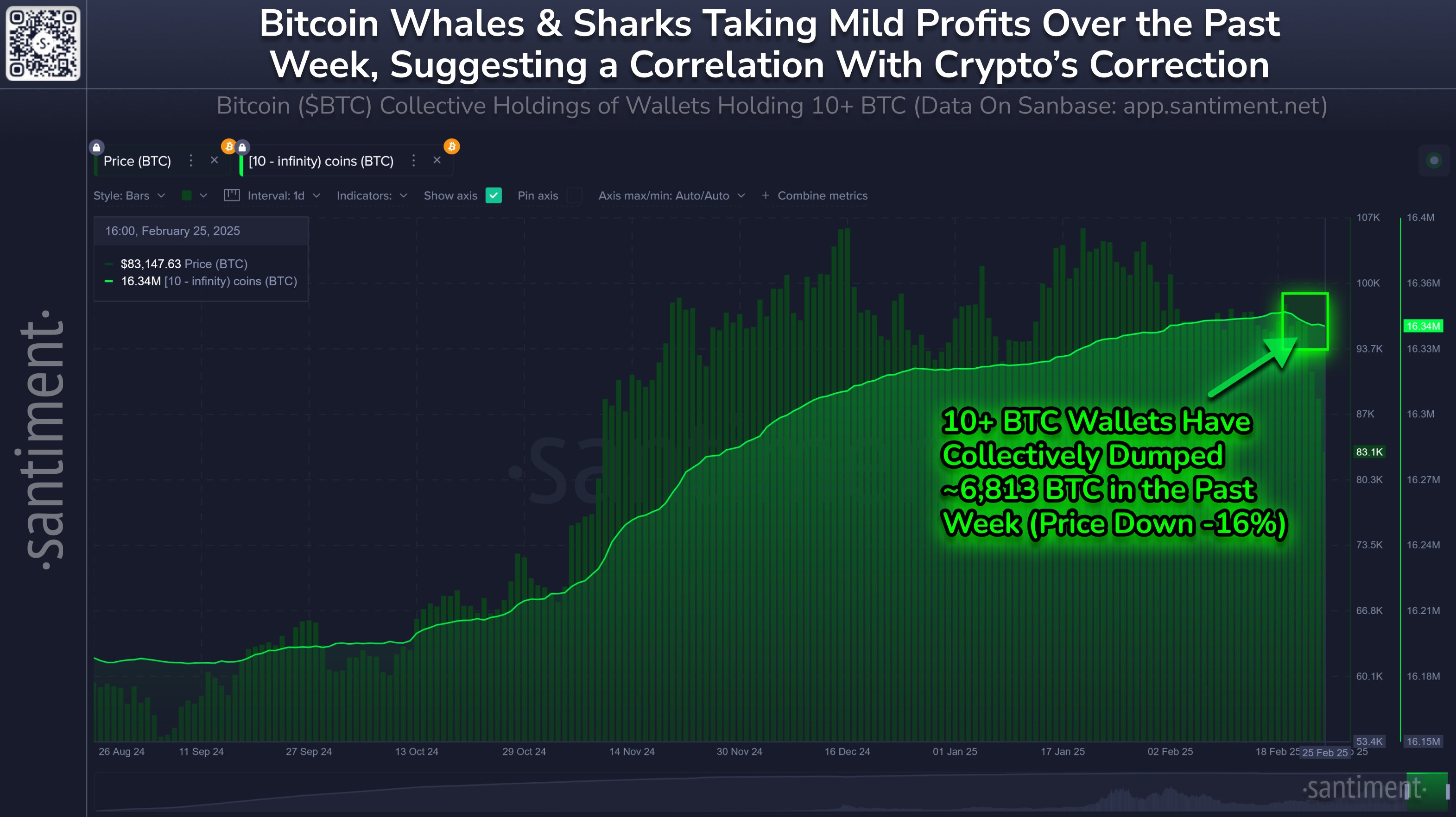

Bitcoin wallets with 10+ BTC dump 6,813 coins

Data from Santiment suggests that BTC’s price has been correlated with the accumulation and distribution behavior of wallets holding 10+ BTC. Whenever these addresses accumulate, Bitcoin progressively increases in value.

Bitcoin whales and sharks accumulation chart by Santiment. Source: X.com

Santiment also highlighted that the “key stakeholders” have dumped roughly 6,813 BTC over the past week, its most extensive distribution since July 2024.

Similarly, Ki-Young Ju pointed out that Bitcoin’s spot ETF demand is weak, suggesting that a “price recovery could take some time.”

Related: Is BTC price about to fill a $78K Bitcoin futures gap?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.