On Nov. 4, the open interest on Bitcoin options reached a new all-time high. As this occurred, an even more curious case emerged. On Nov. 6, a total of $470 million in open interest is set to expire. This is rather unusual, as usually, monthly and quarterly concentrate the liquidity.

At the moment, Deribit holds 75% of the open interest, followed by Bit.com with 13%. Oddly enough, on both exchanges, put options represent 65% of the outstanding notional. This ratio is the exact opposite of the Bitcoin (BTC) options aggregate market for the remaining dates, which favors call options by a wide margin.

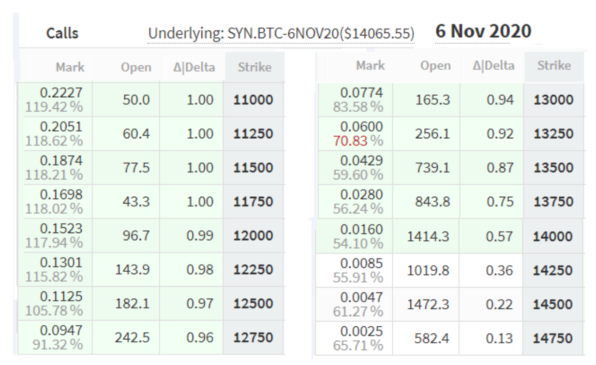

On a more granular view, 6,050 BTC call options are ranging from $13,500 to $14,750. Bit.com adds 1,130 BTC, and OKEx adds another 430 BTC. Therefore, there’s an immediate $114 million open interest supporting current levels.

Meanwhile, the put options from $13,250 to $14,750 amount to 4,700 BTC at Deribit, followed by 1,320 BTC at Bit.com and OKEx with 480 BTC. Thus, the immediate sell-side pressure amounts to $98 million open interest from put options.

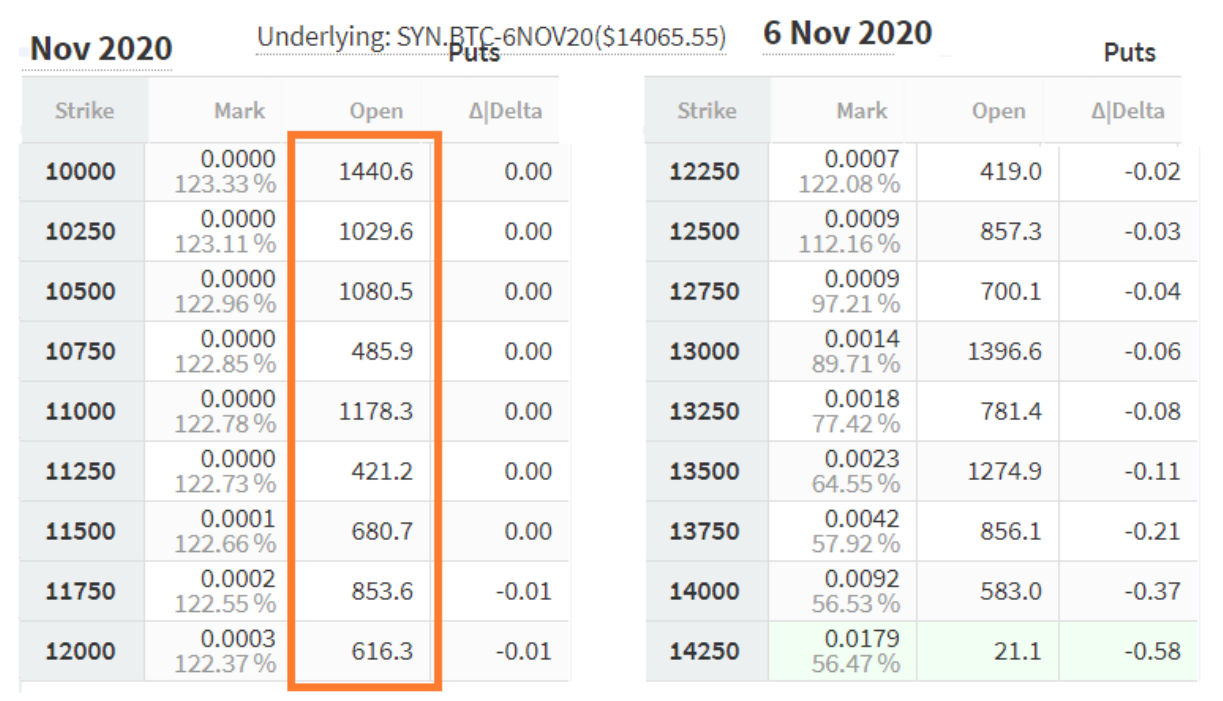

In reality, most of the put options have been depreciated, with no market value. With less than 16 hours till expiry, a right to sell BTC at $12,500 and lower is worthless. This excludes 60% out of the $300 million put options open interest.

Therefore, when analyzing just the option strikes closer to market levels, there is a slight $16 million imbalance favoring the buy-side. It seems like there had been some large bearish trades meticulously prepared for the U.S. elections, negatively impacting the price.

Fortunately for the buyers, the opposite movement appears to be taking place, causing bearish short-term options to get wasted.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.