Technical Analysis: Bitcoin Price ‘Shows Muscle’

August 12, 2019 by Ramiro Burgos

Here’s some welcome news: the bitcoin price is showing some muscle while it goes sideways. This means it’s challenging a wide distribution zone and indicating it could prevail in a bullish trend. What are the long, mid and short-term outlooks? Read our weekly technical analysis to find out more.

Also read: Bitcoin Price Is Creeping Slowly Back Up. Is It a New Hope Phase?

Subscribe to the Bitsonline YouTube channel for great videos featuring industry insiders & experts

Bitcoin Price Technical Analysis

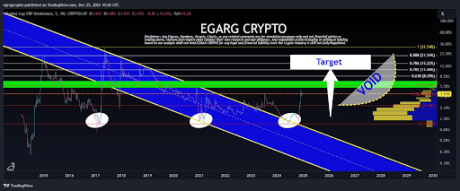

Long-Term Analysis

The bitcoin price is actually showing increased volatility, while recognizing a resistance at the $12,000 level, and a support near $9,000. If action keeps moving between this 3,000 basis point stage, the Hope phase from Mass Psychology Analysis would be safe, giving way to Optimism. If and when values overcome $12,000, the bullish consensus should favor the transferring of the mentioned 3,000 points up to $15,000.

On the other hand, an effective distribution pattern seems to be taking place on the chart, melting down the trend to $6,000 in case the $9,000 support level gets broken. This could re-activate the former Disbelief phase — depending on fundamentals, news and political factors.

Mid-Term Analysis

Mathematical Indicators flipped down again, reinforcing the lateral development action between $9,000 and $12,000 — while volatility increases to swing the quotes up and down dangerously.

A strong resistance remains at the $14,000 level, and an intermediate one at $12,000 could work as a psychological trigger for the general will, favoring the action to follow the uptrend in the background frame.

On the other hand, if prices brake down to $10,000 the sideways movement could shift down to re-enter the former lateral market between $9,000 and $7,000, canceling temporarily the upper targets.

Short-Term Analysis

Mixing Elliott Wave Theory with Bollinger Bands Analysis and Japanese Candlestick Analysis’ Fairy images, demand’s Soldiers seem to be strong enough to balance offer’s Crows’ distribution power into an imaginary battlefield that settles between $10,000 and $12,000.

Prices, if crossed to the upper band, could take control of the action to show muscle while sustaining the lateral market for the first of the two months necessary to defend the background bullish trend. If Crows prevail in the distribution action, the activity could get locked in for two months between $9,000 and $7,000.

What do you think will happen to the bitcoin price? Share your predictions in the comments below.

If you find Ramiro’s analyses interesting or helpful, you can find out more about how he comes to his conclusions by checking out his primer book, the Manual de Análisis Técnico Aplicado a los Mercados Bursátiles. The text covers the whole range of technical analysis concepts, from introductory to advanced and everything in between. To order, send an email to [email protected]

Image via Pixabay

This technical analysis is meant for informational purposes only. Bitsonline is not responsible for any gains or losses incurred while trading bitcoin.