Bitcoin’s value jumped by almost 9% at one point on Monday, as investors fled the so-called stablecoin Tether.

Tether tokens are supposed to be tied to the U.S. dollar, with the eponymous company behind them claiming that it has a dollar in its accounts for each token it issues. There is no conclusive evidence to support this claim, but the token is still often used as a dollar substitute for trading purposes, as they are more easily transferred between exchanges than dollars are.

Some have long suspected that the Tether operation is being used to buy a load of Bitcoins for nothing, effectively propping up the value of Bitcoin. It so happens that Tether and a major cryptocurrency exchange called Bitfinex share the same CEO, and Tether sends all its freshly minted tokens to Bitfinex. When they get there, the price of Bitcoin tends to go up, suggesting Tether tokens are being used to buy Bitcoins.

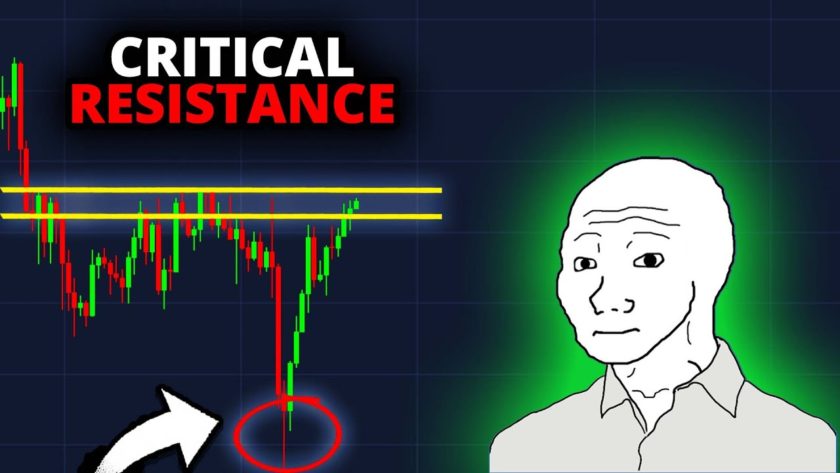

On Monday, the value of the Tether token, which had been worth around 99 cents, suddenly plunged as low as 93 cents before recovering to around 97 cents. At the same time, Bitcoin’s price shot up by 8.9% to $6,769 before settling down to around $6,640 at the time of writing—still up 5.2% over the preceding day.

According to Bloomberg, the reason for Tether’s pull away from the $1 mark lay in renewed rumors around Bitfinex’s financial health.

Bitfinex said in a Monday Medium post that its customers were still able to withdraw cryptocurrencies and fiat-currency holdings “without the slightest interference,” although “fiat deposits have been temporarily paused for certain user groups” pending the implementation of a new deposit system Tuesday. This missive appears to have been what staunched the selloff.

Bitcoin wasn’t the only winner from the Tether upset. Alternative “stablecoins” such as Gemini Dollar and TrueUSD are also up, as traders pulled back from Tether.

If You Liked This Article Click To Share